Business Cash Flow Solutions That Work in Real Life

Nov 26, 2025

Smarter Cash Flow Starts with How You PayThe way you fund your business payments can either tighten or unlock...

Smarter Cash Flow Starts with How You Pay

The way you fund your business payments can either tighten or unlock your cash flow. For too long, the default options have been limited to bank transfers, overdrafts, or loans each carrying its own set of restrictions, costs, or delays. Lessn provides a smarter alternative.

Instead of tying up your working capital with every payment, Lessn helps you stretch funds further by giving you the flexibility to pay by card, access built-in float, and time payments around your business cycle—not the bank’s. It’s a modern approach to managing cash flow that’s designed for agility, not complexity.

Lessn puts the power back in your hands. Whether you’re funding a large tax bill, paying overseas suppliers, or smoothing out seasonal fluctuations, Lessn helps you pay in a way that preserves your cash and rewards you for it.

The Problem: Capital Is Tied Up in Payments

In most businesses, cash flow challenges stem from the timing of money moving in and out, rather than the ability to generate revenue. The gap between paying your bills and collecting from customers creates constant tension.

You’re expected to:

Pay suppliers before you’ve received payment from your clients.

Cover VAT, PAYE, and compliance costs in full and on time.

Pre-pay for stock or project expenses well before you see a return.

This creates a cash crunch that’s often solved with short-term borrowing or dipping into reserves both of which can drain the business or slow growth.

Paying early locks up valuable capital that could be used for operations, marketing, or hiring.

Paying late might protect your cash, but it can strain relationships, cause missed deliveries, or damage your credibility.

Turning to traditional finance adds interest, fees, paperwork, and the risk of rejection especially for growing businesses without a large asset base.

When every payment decision feels like a compromise between operational flexibility and financial pressure, it’s clear the system needs an upgrade. Lessn is that upgrade, built for real-world businesses that want more control, more time, and more from every dollar they spend.

Let me know if you’d like this broken out further for visual blocks or adapted for a different section.

Why Businesses Need Smarter Cash Flow Tools

How Lessn Helps Unlock Cash Flow

Lessn is designed to help businesses control when and how money leaves their accounts. Instead of tying up cash in supplier payments or scrambling for short-term funding, Lessn lets you use your existing credit infrastructure to buy time, optimise spend, and maintain liquidity without needing to change how your suppliers get paid.

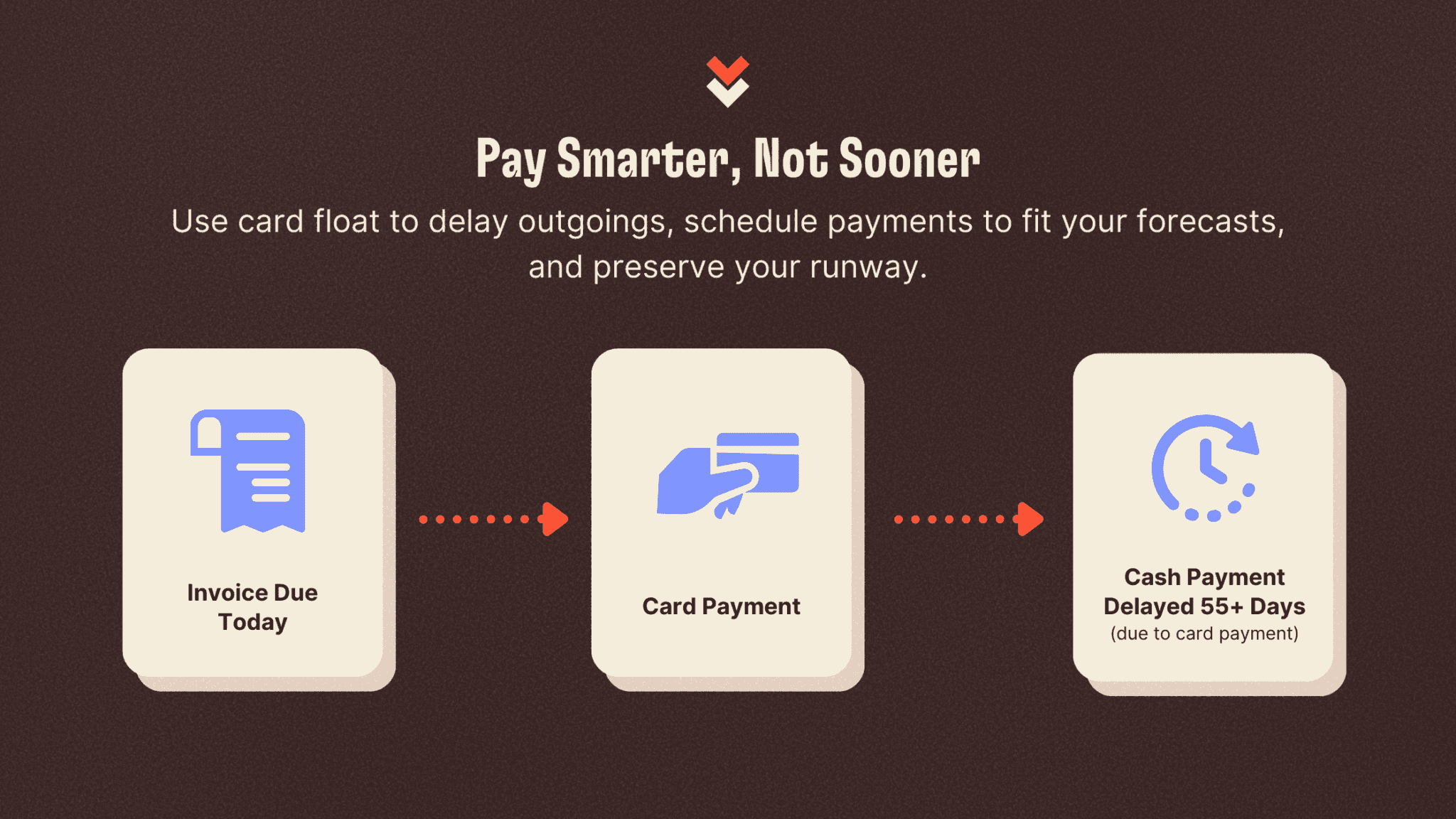

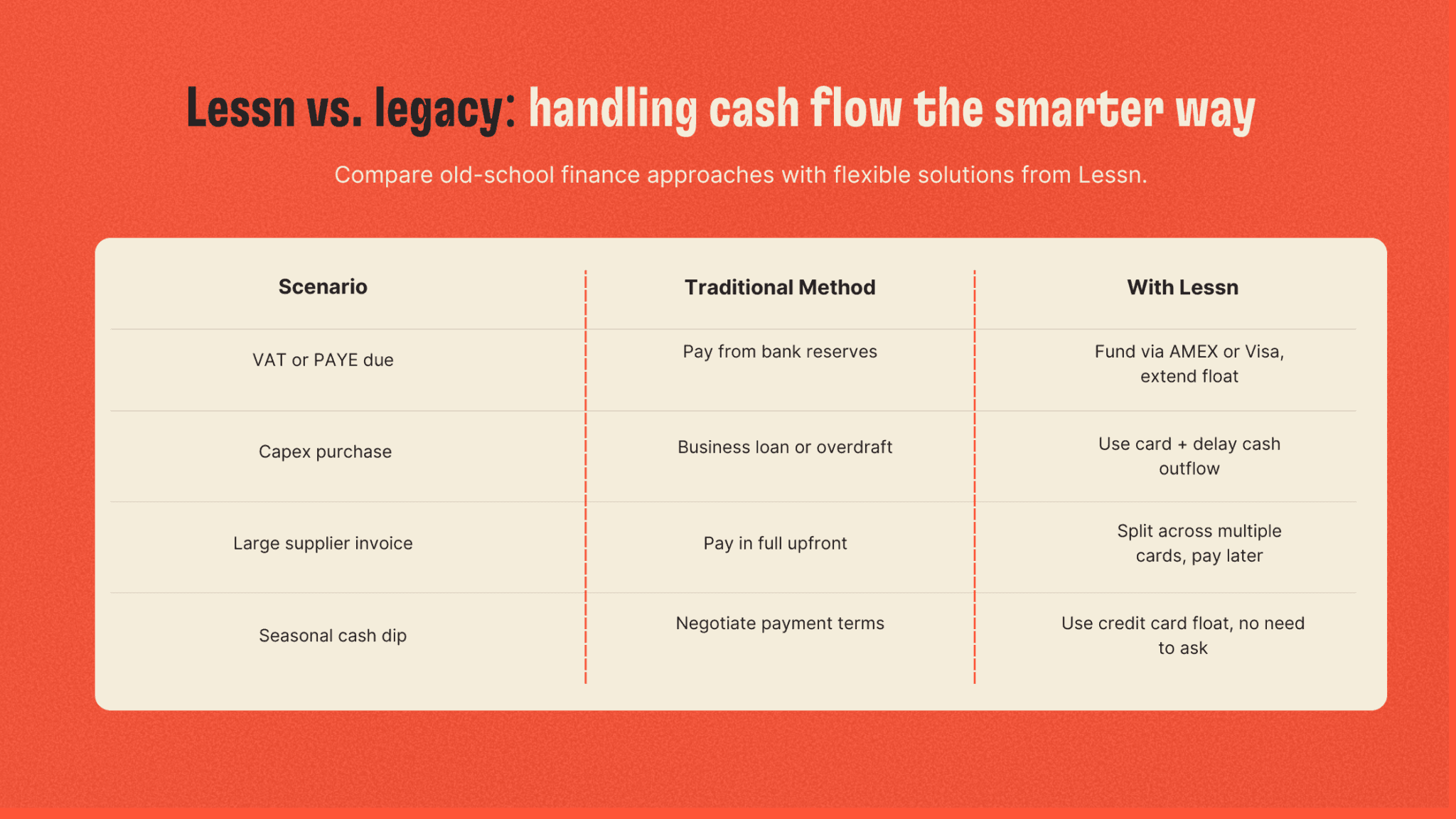

Use Card Float to Delay Cash Outflows

With Lessn, you can pay any supplier invoice using your credit card, even if the supplier doesn’t accept card payments. Your supplier receives a standard bank transfer, while you unlock up to 55+ days of float through your card’s interest-free period. That means your cash stays in your account longer, helping you manage outgoings more strategically.

Split Payments Across Multiple Cards

Large invoices don’t need to create short-term cash flow pain. Lessn allows you to split a payment across multiple cards, helping you manage card limits, spread repayments across billing cycles, and take advantage of multiple rewards programmes. This is especially useful for managing tax payments, capex, or seasonal spikes in supplier costs.

Schedule Payments Based on Capital Requirements

Not all payments need to happen today. Lessn lets you schedule payments in advance, aligning your outflows with your receivables or financial forecasts. Whether you need to delay until a large customer invoice lands or align with an upcoming billing cycle, Lessn gives you control over timing, without friction, delays, or needing to renegotiate terms.

Common Scenarios Solved with Lessn

Controls That Finance Teams Need

Lessn is a cash flow management platform designed for finance professionals who need transparency, accountability, and structure in how their businesses spend money.

It gives finance teams more than just flexibility. It gives them control.

Approval Workflows

Set multi-step authorisation processes for payments based on thresholds, departments, or supplier categories. You can define who initiates, who reviews, and who approves, ensuring high-value or sensitive transactions are never processed without oversight.Real-Time Spend Visibility

Track outgoing payments across teams, business units, and payment types from one central dashboard. Whether you’re managing spend across multiple entities or just want clearer reporting, Lessn gives you a live view of where your cash is going and when.Audit-Ready Records

Every transaction is logged with rich metadata including who created it, what card was used, invoice reference numbers, and payment status. This simplifies end-of-month reconciliation, streamlines audits, and gives you a defensible record of activity.Role-Based Permissions

Set granular controls to manage who can access what. Whether you want to delegate access to bookkeepers, set view-only roles for department heads, or limit who can approve payments over a certain threshold, Lessn gives you the structure to support internal policy.

Customer Stories: Capital Freed, Growth Unlocked

Real businesses are already using Lessn to unlock working capital, improve payment flexibility, and redirect resources toward growth.

“We used Lessn to fund our quarterly BAS via credit card instead of draining our reserves. That float gave us time to collect on receivables, and the points paid for our next flight to Melbourne.”

— Operations Director, Construction Business

This construction firm was able to smooth out its quarterly cash cycle by shifting a major tax payment onto a business credit card. Rather than dipping into operating reserves or cutting costs elsewhere, the business preserved its liquidity—while earning travel rewards that reduced out-of-pocket costs for future work trips.

“Instead of applying for a short-term facility, we paid our overseas supplier via Lessn using two cards. It took five minutes and saved us thousands in interest.”

— Founder, Consumer Goods Company

Facing a high-value international supplier invoice, this founder avoided taking out a costly short-term loan by funding the payment through two business credit cards. It was processed instantly, incurred no new debt obligations, and saved time and interest fees compared to traditional finance options.

These aren’t one-off wins. They’re proof that rethinking payment workflows can unlock tangible results. Businesses across sectors are using Lessn to turn cash flow from a constraint into a lever—stretching capital, improving operational flexibility, and reducing reliance on short-term borrowing.

If your business is dealing with tight payment windows, unpredictable receivables, or high-value outgoings, these stories show there’s a smarter way to manage it. Lessn helps you take action before it becomes a problem.

Frequently Asked Questions

Will this impact my supplier relationships?

Not at all. Your supplier continues to receive payments as they always have via a standard bank transfer in their local currency. From their perspective, nothing changes. They don’t need to sign up, integrate with a new system, or even know you’ve used a credit card to fund the payment. This means you can take advantage of card float and rewards without disrupting your existing vendor relationships, processes, or trust.

Is this risky for my business?

Using Lessn carries no more risk than paying with your business credit card. In fact, by adding structured approval workflows, real-time visibility over transactions, and audit-ready records, Lessn can actually enhance your financial controls. The platform gives you greater oversight across payment timing, team roles, and funding methods, minimising the chance of errors or unauthorised spending. It also improves compliance and reduces reliance on ad hoc workarounds like manual card payments or last-minute transfers.

Is this better than invoice finance?

Invoice finance relies on using your receivables to access funding and that means waiting for your customers to pay. It can also involve high fees, complex onboarding, and lender risk assessments. Lessn is different. It lets you fund payments on your own terms, using your existing credit card facilities. That means no need to tie payments to specific invoices, no new debt instruments, and no external approval required. You stay in control of timing, terms, and transaction flow, without needing to involve your debtors or take on additional financing obligations.

Can I really use a credit card for any business payment?

Yes. Lessn allows you to fund virtually any business payment using your credit card—even if the recipient doesn’t accept cards. The supplier receives a standard bank transfer, while you benefit from card rewards and float.

What kinds of expenses can I use Lessn for?

Lessn can be used for supplier invoices, tax payments (like PAYG, BAS, VAT), rent, overseas contractors, inventory, capex purchases, and more. If it’s a business expense that requires a bank transfer, you can likely fund it through Lessn.

What cards can I use with Lessn?

You can use major credit cards including AMEX, Visa, and Mastercard. Lessn works across multiple issuers, and you can even split larger payments across multiple cards to manage limits.

Do I need to onboard my suppliers to use Lessn?

No. Suppliers don’t need to sign up or change how they receive payments. They’ll get paid as usual via a bank transfer, so there’s zero friction or extra admin on their side.

Will this change my reconciliation process?

It’ll simplify it. Lessn integrates with Xero, MYOB, and QuickBooks. Payments sync automatically with your accounting software, and each transaction is matched to its invoice, saving hours of manual reconciliation.

How secure is Lessn?

Very. All card and payment data is encrypted, and every transaction includes audit trails, user history, and permissions. Lessn is built with finance teams and compliance in mind.

Can I use Lessn across multiple businesses or ABNs?

Yes. Lessn supports multi-entity management, allowing you to manage payments, cards, and users across multiple business entities from one platform.

How Lessn helps when it matters most

Cash flow pressure is rarely about profitability. It’s about timing. Even strong, growing businesses can feel cash-strapped if outgoings are mistimed, like paying suppliers or tax obligations before income lands in the bank. In these moments, most businesses don’t need another loan. What they need is more control over when money leaves the account.

That’s where Lessn steps in.

Lessn is designed for real-world finance teams and operators who want to manage cash flow proactively. It gives you the flexibility to fund supplier payments using your business credit card, even if the recipient doesn’t accept cards. This allows you to unlock your card’s float period, preserve cash in the bank, and take advantage of any rewards or points offered by your card provider.

Float and points are valuable, but the real advantage is gaining control. Lessn lets you align payments with your financial rhythm. You can delay settlement without delaying suppliers. You can spread large costs across multiple cards. You can plan ahead without waiting on loan approvals or renegotiating terms.

Behind the scenes, Lessn also keeps everything tidy. Payments are logged, approved, and reconciled automatically with your accounting software. There’s no change required for your vendors, no manual paperwork, and no compromise on visibility or compliance.

So if your goal is to operate with less financial stress, stronger cash control, and more strategic decision-making—Lessn gives you the foundation to do just that.

Ready to Make Your Payments Work Harder for Your Business?

If every dollar that leaves your business could deliver more time, more control, more rewards why settle for the old way of paying?

Lessn helps you unlock the full potential of every payment.

Instead of draining your cash reserves or juggling funding gaps, you can:

Fund supplier payments using your business credit card

Extend your float period by up to 55+ days

Earn AMEX, Visa, or Mastercard rewards on everyday outgoings

Schedule payments in line with your cash flow forecasts

Streamline reconciliation in your accounting platform

All without disrupting your supplier relationships or adding debt to your balance sheet.

Whether you’re navigating seasonal slowdowns, planning a big investment, or simply trying to hold onto more working capital, Lessn gives you a smarter way to manage your outgoings.

Start optimising your capital and gaining control over how and when you pay.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.