Business Payments

Apr 28, 2024

Business payments are hard. They are just one small part of an interdependent series of back office processes and exchange of information between...

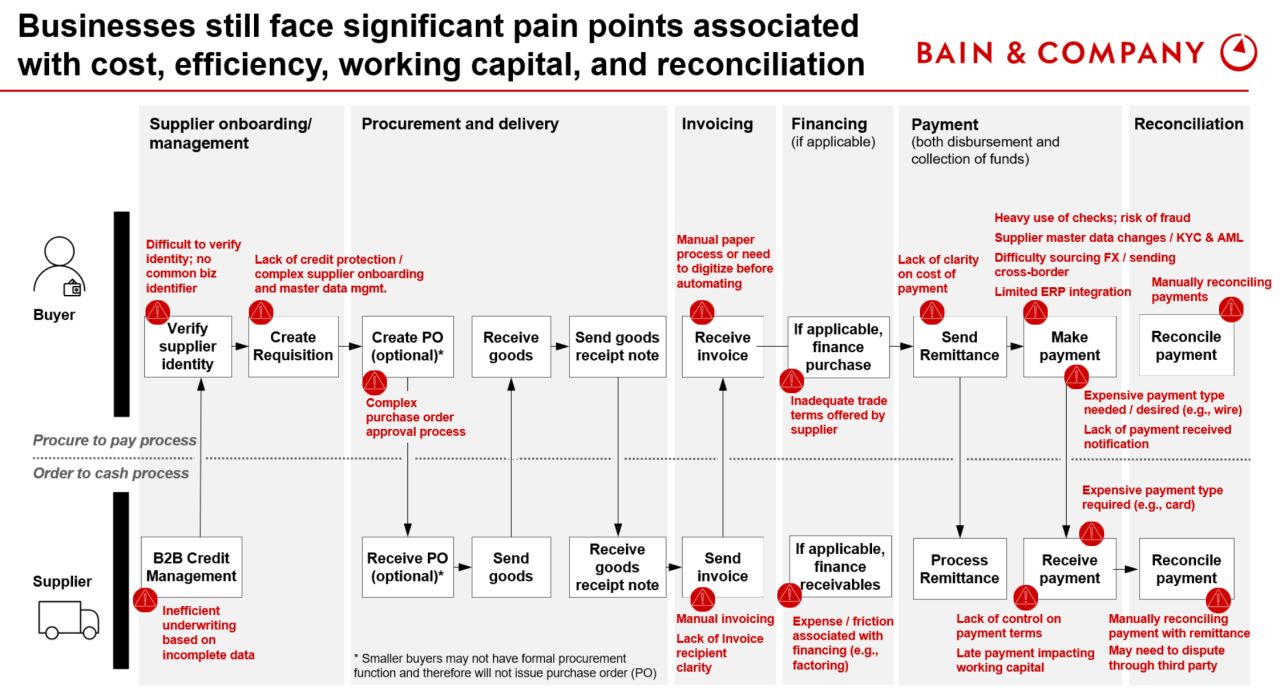

Business payments are hard. They are just one small part of an interdependent series of back office processes and exchange of information between business buyers and suppliers.

Some solutions span specific business processes, some attempt to address all of them, whilst others seek to support either buyers or suppliers, with a lot of overlap as solutions expand into adjacent processes or build B2B networks that serve the needs of both buyers and suppliers.

As we digitise payments and payment choices and demands to improve efficiency and effectiveness increase, we inadvertently exacerbate some of the challenges. Once upon a time a payment was was delivered in an envelope with a cheque. Now remittance data is disassociated from the funds and delivered in a variety of formats (PDF, excel, a URL , an einvoice) via a variety of different ways (email, messaging apps such as Whatsapp and WeChat )

The enduring challenges related to inefficiency and working capital are opportunities for value add services that augment increasingly commoditized transaction revenue.

Bain & Company use the diagram below to summarize buyer<>supplier interactions and associated pain points.

In an increasingly interconnected world, businesses operate across technology and geographic borders, necessitating a robust yet flexible and easy to use payment infrastructure. Often systems in this space only cater for the enterprise level organisations which are too costly and unwieldy for small and medium businesses to contemplate, nor do they have the features small business owners require. Lessn, bridges the gap between disparate business systems (such as accounting, HR, and ERP platforms) and diverse payment methods (including bank transfers and card payments).

By providing seamless integration of these multiple systems whilst enabling flexibility of payment mechanism, to the user, choice, efficiency, transparency and compliance are all improved.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.