Exploring B2B Payment Solutions for Smoother, More Efficient Transactions

Mar 26, 2025

B2B transactions form the backbone of business operations, ensuring payments between companies for goods, services, and supply chain management. Unlike consumer...

B2B transactions form the backbone of business operations, ensuring payments between companies for goods, services, and supply chain management. Unlike consumer payments, which focus on convenience, business-to-business payments must be secure, scalable, and adaptable to high-value transactions, recurring invoices, and global commerce. As the landscape of B2B payments Australia and worldwide continues to evolve, businesses are seeking innovative solutions to streamline their financial processes.

As businesses seek ways to improve cash flow and reduce administrative overhead, selecting the right B2B payment method becomes critical. The ideal payment solution not only enhances efficiency but also minimises costs, strengthens vendor relationships, and ensures secure, timely transactions. This is where B2B payment automation comes into play, offering a range of benefits for modern businesses.

Why Payment Types Matter in B2B Transactions

The method a business chooses to process payments has a direct impact on financial stability, operational efficiency, and business relationships. Here are key factors that businesses should consider when selecting a payment solution:

Cash Flow Management

Aligning payment methods with revenue cycles ensures businesses maintain working capital for operational needs. Some payment methods, such as business credit cards, offer extended payment cycles, helping businesses optimise liquidity.Processing Costs

Each payment method comes with transaction fees, such as credit card processing charges or bank wire fees. Businesses should select cost-effective payment solutions to reduce expenses while maintaining seamless supplier transactions.Payment Security & Compliance

B2B transactions often involve high-value payments and regulatory requirements. Businesses must ensure that payment solutions comply with industry regulations and include fraud prevention features to safeguard financial transactions.Efficiency & Automation

Manual payment processes consume time and increase the risk of errors. Automated B2B payment solutions streamline workflows, reduce administrative workload, and ensure accuracy in financial reporting and reconciliation.

The most effective B2B payment systems integrate with accounting software, allowing businesses to simplify payment tracking and financial management. This integration is crucial for electronic B2B transactions and overall business efficiency.

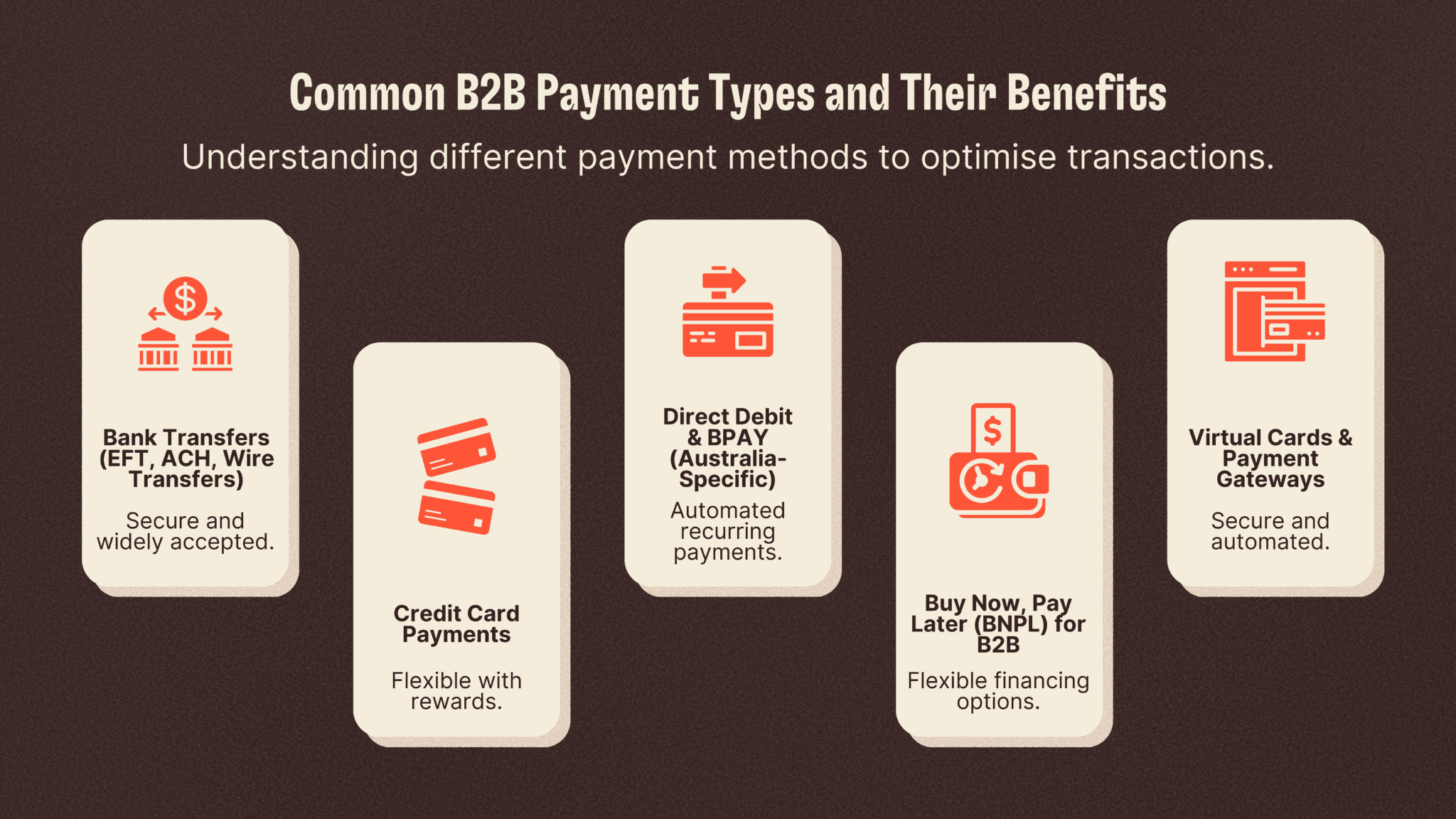

Common B2B Payment Types and Their Benefits

Businesses have multiple payment options, each with distinct advantages and considerations. Below is an overview of the most common B2B payment types.

1. Bank Transfers (EFT, ACH, Wire Transfers)

How It Works

Bank transfers involve direct transactions between business accounts. Methods include Electronic Funds Transfer (EFT), Automated Clearing House (ACH) payments in the U.S., and wire transfers for international transactions.

Best For

Recurring payments such as supplier invoices and payroll

High-value transactions that require secure processing

International transactions needing direct bank-to-bank transfers

Benefits

Secure and widely accepted by vendors

Reduces reliance on intermediaries, improving transaction speed

Provides a direct link between business accounts for easier reconciliation

Considerations

Wire transfers can be costly, particularly for international payments

Processing times vary: EFT and wire transfers may be same-day, while ACH takes 2–3 business days

2. Credit Card Payments

How It Works

Businesses use credit cards to pay suppliers and manage operational expenses. Some platforms convert credit card transactions into bank transfers, allowing businesses to use credit even when suppliers do not accept card payments.

Best For

Extending payment cycles using credit card float periods

Earning cashback, travel rewards, or points on business expenses

International and online transactions requiring immediate payment processing

Benefits

Immediate transaction processing improves cash flow

Credit card rewards can help offset business costs

Allows businesses to defer payments and maintain working capital

Considerations

Not all suppliers accept credit cards

Processing fees (typically 1.5%–3%) can be expensive for large transactions

How Lessn.io Solves This

Lessn.io enables businesses to pay suppliers with credit cards—even those that do not accept them. This allows businesses to earn credit card rewards, extend cash flow, and automate payments while ensuring suppliers receive payments in their preferred format.

3. Direct Debit & BPAY (Australia-Specific)

How It Works

Direct debit allows businesses to set up automated withdrawals from their bank accounts for recurring payments. BPAY is an Australian bill payment system used for secure transactions between businesses and government entities.

Best For

Subscription-based services, utilities, and rent payments

Businesses making government or regulatory payments

Companies with recurring invoices needing automated processing

Benefits

Automated transactions reduce manual payment tasks

Scheduled payments help prevent late fees

Secure and compliant with financial regulations

Considerations

Requires payer authorisation before processing

Processing times typically range from 1–3 business days

4. Buy Now, Pay Later (BNPL) for B2B

How It Works

BNPL providers allow businesses to spread payments over multiple months while suppliers receive full payment upfront. This enhances financial flexibility without requiring traditional loans.

Best For

Small-to-mid-sized businesses with cash flow constraints

Businesses making large one-off purchases needing flexible repayment terms

Benefits

Immediate supplier payments while buyers manage working capital

No need for traditional bank loans

Flexible repayment schedules

Considerations

Some BNPL providers charge interest or late fees

Not all suppliers offer BNPL as a payment option

5. Virtual Cards & Payment Gateways

How It Works

Virtual cards generate unique digital credit card numbers for secure transactions, while payment gateways facilitate online B2B payments.

Best For

Businesses prioritising secure supplier payments

E-commerce transactions requiring fast digital payment processing

Benefits

Reduces fraud risks compared to traditional credit cards

Easier reconciliation, improving financial tracking

Works with automated accounts payable (AP) solutions like Lessn.io

Considerations

Some suppliers may not accept virtual cards

Transaction fees can be similar to credit card processing fees

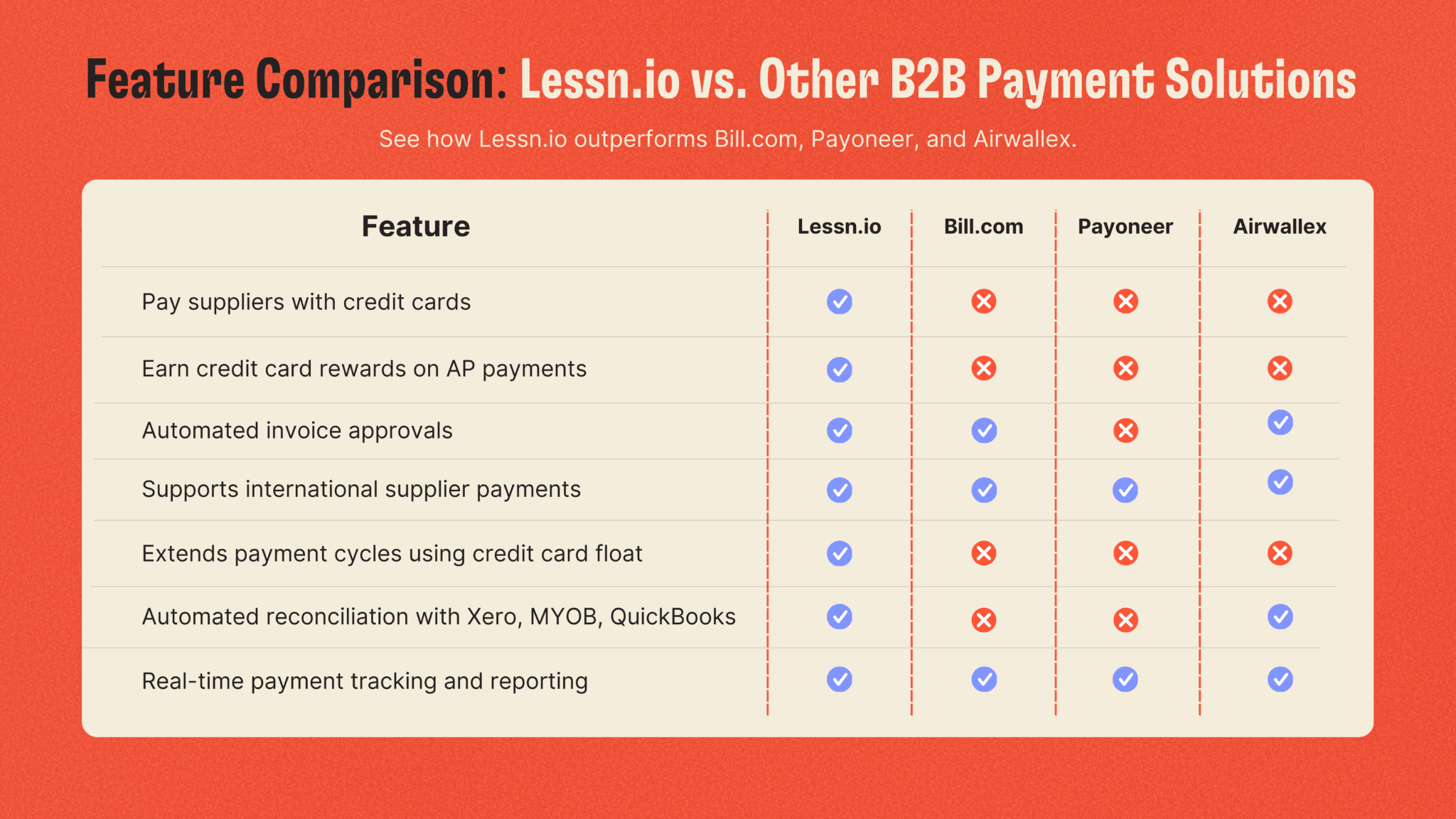

How Lessn.io Outperforms Other B2B Payment Solutions

While platforms like Bill.com, Payoneer, and Airwallex offer B2B payment services, they lack flexibility in payment options and rewards. Lessn.io is designed to optimise cash flow, automate payments, and maximise financial benefits.

Feature Comparison: Lessn.io vs. Other B2B Payment Solutions

Why Businesses Choose Lessn.io Over Competitors

While many B2B payment platforms offer automation and invoice management, Lessn.iostands out by giving businesses greater flexibility, control, and financial benefits. Unlike traditional payment solutions that limit how businesses manage supplier payments, Lessn.io removes restrictions, enhances cash flow, and turns accounts payable into a strategic advantage.

Here’s how Lessn.io outperforms competitors like Bill.com, Payoneer, and Airwallex in key areas:

1. Pay Any Supplier with a Credit Card

Many B2B payment platforms only allow bank transfers or require suppliers to sign up for their network before they can receive payments. This creates friction and limits flexibility.

Lessn.io enables businesses to pay any supplier with a credit card—even if they don’t accept them directly.

Payments are converted into bank transfers, ensuring suppliers receive funds as usual while businesses gain the ability to earn rewards and extend cash flow cycles.

Unlike Bill.com, which requires suppliers to accept payments through their platform, Lessn.io works with any supplier—no account setup required.

2. Maximise Credit Card Rewards

Most B2B payment platforms do not support credit card reward accumulation on supplier payments. Traditional payment methods like EFT, wire transfers, and direct debits do not generate cashback, points, or travel perks.

Lessn.io is designed to help businesses earn rewards on payments they were already making.

Whether using American Express, Visa, or Mastercard, businesses can accumulate points on supplier payments—turning a standard expense into a financial benefit.

Instead of paying suppliers without any return, businesses can redeem points for cashback, flights, hotels, or business expenses—reducing overall costs.

3. Extend Payment Cycles & Improve Cash Flow

One of the biggest challenges businesses face is managing cash flow when supplier invoices are due before revenue comes in. Traditional payment platforms offer no flexibility, requiring immediate payment through bank transfers.

Lessn.io extends payment cycles by allowing businesses to leverage credit card float periods—offering up to 50+ days of working capital before payment is due.

This reduces reliance on business loans, overdrafts, or external financing, helping companies maintain liquidity without added interest costs.

Businesses can strategically time supplier payments to align with their revenue cycles, ensuring better financial control.

Example:

A business with $100,000 in monthly supplier invoices that switches to Lessn.io and pays via credit card instead of bank transfer can:

Delay cash outflow for up to 50 days while suppliers receive funds immediately.

Use available cash for business growth, inventory purchases, or marketing.

Avoid short-term financing costs or overdraft fees.

No other B2B payment solution provides this level of cash flow flexibility.

4. Automate Invoice Approvals & Payment Reconciliation

Manual invoice approvals and reconciliation can slow down financial operations, leading to errors, delays, and missed payments. Many B2B platforms lack deep accounting integrations, requiring businesses to manually input transactions into their software.

Lessn.io automates invoice approvals, ensuring payments are processed on time and eliminating manual bottlenecks.

It seamlessly integrates with Xero, MYOB, and QuickBooks, syncing transactions in real-time to reduce manual reconciliation.

Businesses gain a single dashboard for all payments, approvals, and financial tracking, improving visibility and efficiency.

By streamlining payment approvals and reconciliation, Lessn.io helps finance teams:

Reduce administrative workload and eliminate manual errors.

Speed up month-end closing, ensuring accurate financial reporting.

Improve compliance and audit readiness with a clear transaction history.

Optimise Your B2B Payments with Lessn.io

Selecting the right B2B payment solution is about more than just convenience—it has a direct impact on cash flow, operational efficiency, and business relationships. Businesses that rely on outdated payment methods often struggle with slow approvals, high processing fees, and limited flexibility. These inefficiencies create financial strain, reduce working capital, and increase the risk of late payments that can damage supplier relationships.

With Lessn.io, businesses no longer need to compromise on speed, flexibility, or financial rewards. Instead of treating payments as a routine expense, Lessn.io helps businesses turn accounts payable into a strategic financial advantage.

Key Benefits of Using Lessn.io for B2B Payments

Extend Payment Cycles Without Disrupting Supplier Relationships

Many businesses face cash flow challenges when large supplier invoices are due at the same time. Lessn.io allows businesses to extend their payment cycles by using credit cards, leveraging up to 50+ days of additional working capital without relying on loans or overdrafts.Maximise Credit Card Rewards on Business Expenses

Unlike traditional payment solutions that require immediate bank transfers, Lessn.io enables businesses to pay suppliers using credit cards—even when suppliers do not accept them directly. This allows businesses to earn cashback, points, or travel rewards on everyday supplier payments, effectively turning expenses into financial benefits.Automate Invoice Approvals and Payment Reconciliation

Manual invoice processing is time-consuming and prone to errors. Lessn.io automates invoice approvals, ensuring that payments are processed faster, more accurately, and with complete visibility. Seamless integration with accounting platforms like Xero, MYOB, and QuickBooks further simplifies reconciliation, reducing administrative overhead and financial reporting errors.Reduce Administrative Costs and Eliminate Payment Delays

Many businesses lose time and money chasing invoices, waiting for approvals, or dealing with manual reconciliation. Lessn.io eliminates these inefficiencies by automating workflows, reducing processing times by up to 75% and ensuring that invoices are paid on time.Enhance Financial Visibility and Planning

Businesses need real-time insights into their cash flow to make informed financial decisions. Lessn.io’s dashboard provides real-time tracking of payments, upcoming liabilities, and financial performance, allowing businesses to forecast expenses with greater accuracy.

Why Lessn.io is the Future of B2B Payments

Lessn.io isn’t just another payment platform—it’s a complete financial optimisation tool that helps businesses gain control over their payment processes. By replacing inefficient manual methods with automation, flexibility, and financial incentives, businesses can transform their accounts payable into a source of cash flow stability and financial growth.

With traditional payment methods, businesses face high fees, slow processing times, and limited flexibility in managing working capital. Lessn.io removes these obstacles by allowing businesses to control how and when they pay suppliers, ensuring they can:

Maintain financial flexibility without disrupting operations

Turn supplier payments into a revenue-generating strategy

Reduce financial risk by automating workflows and improving compliance

Gain competitive advantages through cost savings and cash flow optimisation

Take Control of Your Payments Today

In a competitive business environment, every financial decision matters. How your business handles payments can impact your profitability, cash flow, and ability to grow. Instead of letting accounts payable be a financial burden, Lessn.io turns it into an opportunity to increase liquidity, earn rewards, and improve financial efficiency.

With Lessn.io, businesses can:

Save time by automating invoice approvals and payments

Save money by optimising payment methods and earning credit card rewards

Improve cash flow by strategically managing supplier payments

Strengthen supplier relationships by ensuring timely and secure transactions

If your business is ready to move beyond slow, inefficient, and costly payment processes, Lessn.io provides the automation and flexibility needed to optimise financial operations.

Start streamlining your B2B payments today.

Book a Demo to see how Lessn.io can transform your accounts payable process and help your business take control of its financial future.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.