How to Integrate Payment Automation with Your Accounting Software

Apr 23, 2025

Managing supplier payments, reconciling invoices, and keeping your books up to date can be time-consuming and prone to errors,...

Managing supplier payments, reconciling invoices, and keeping your books up to date can be time-consuming and prone to errors, especially if you’re still relying on manual processes. That’s where payment automation comes in.

By integrating payment automation tools with your accounting software, you can streamline accounts payable (AP), improve visibility, and free up time to focus on higher-value work.

In this guide, we’ll walk you through what payment automation is, why it matters, and how to connect it to your accounting system for maximum efficiency.

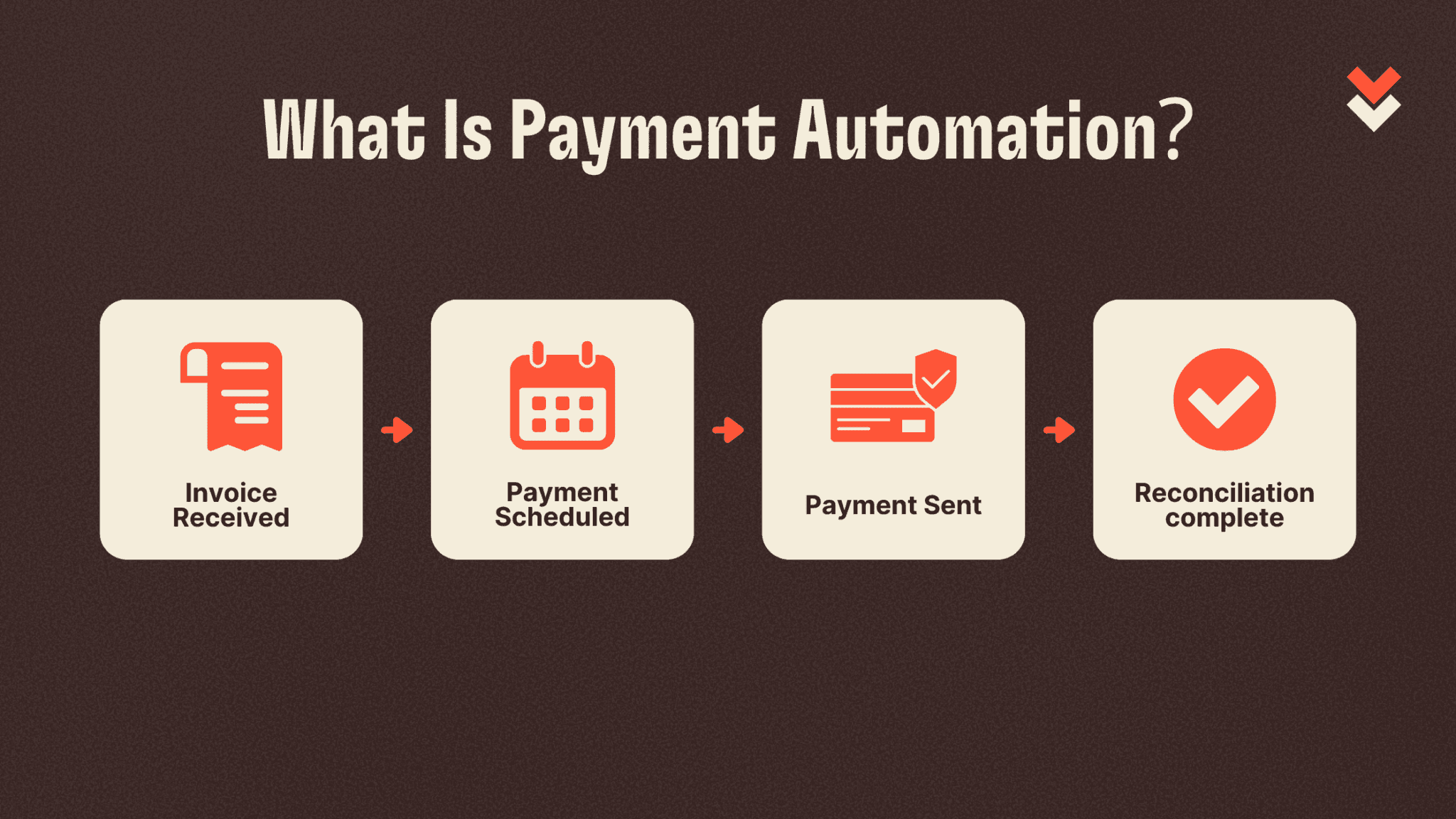

What Is Payment Automation?

Payment automation refers to the use of software tools to manage, schedule, and execute business payments without manual input. Instead of manually creating payments, uploading ABA files, or chasing approvals, automation handles the heavy lifting—from invoice matching to payment execution and reconciliation.

A payment automation platform typically allows you to:

Schedule and approve supplier payments

Fund payments via bank account or credit card

Automatically sync paid invoices back to your accounting software

Earn rewards or improve cash flow if payments are made via credit card

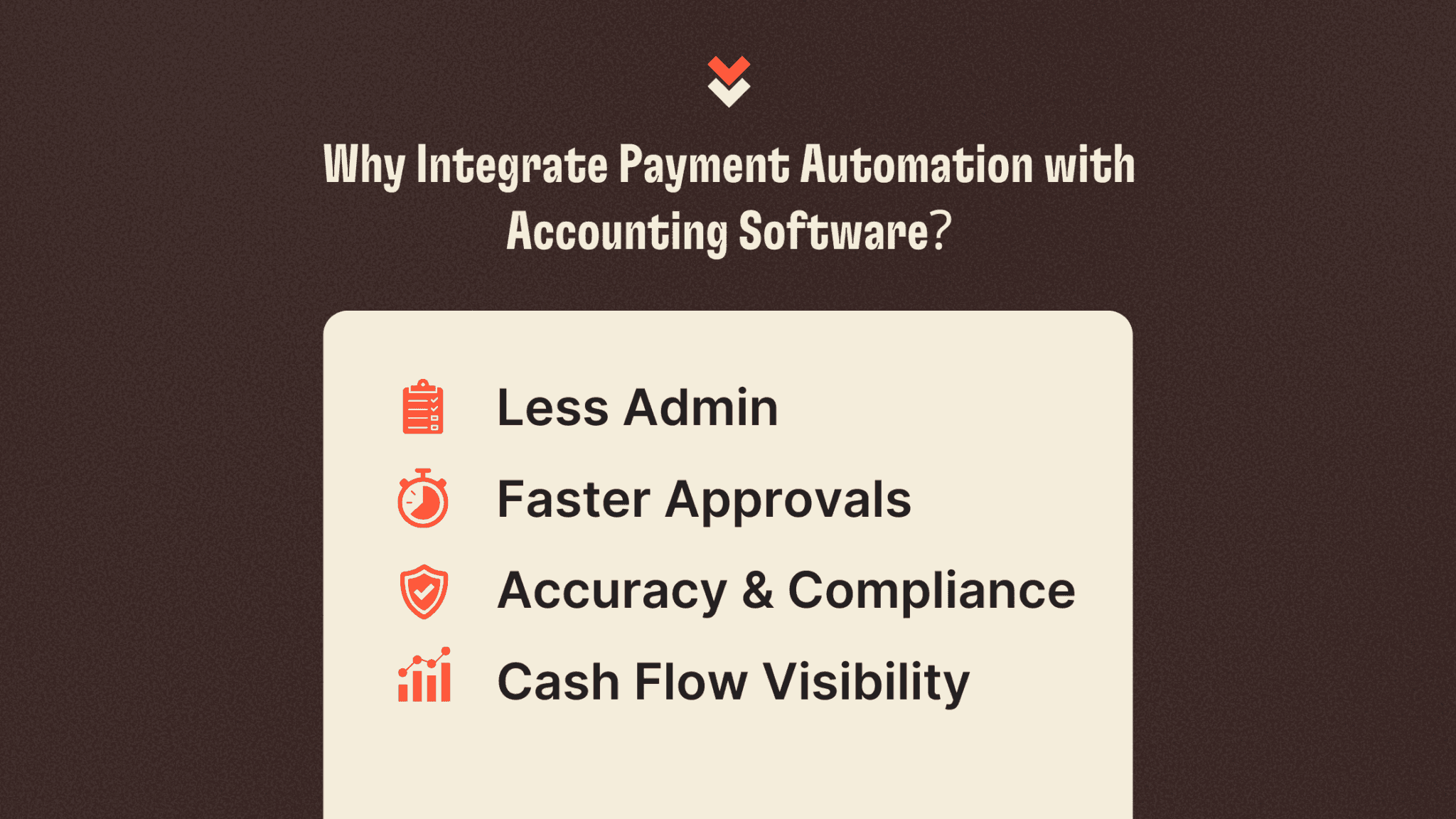

Why Integrate Payment Automation with Accounting Software?

When your payment tool talks directly to your accounting system (like Xero or MYOB), you remove friction across your finance function. Here’s what you gain:

1. Less Admin

Manually keying in invoice data, exporting spreadsheets, and cross-checking payments are tasks that eat into your team’s time. With payment automation integrated into your accounting software, invoices flow in automatically and are matched with their respective payments. Once a bill is paid, it’s marked off in your ledger—no need for manual updates or duplicated effort. This not only reduces admin but also helps your team stay focused on more strategic finance work.

2. Faster Approval Workflows

Approval delays are one of the biggest bottlenecks in accounts payable. Payment automation tools allow you to define approval rules based on value, department, or supplier. You can route payments to the right team member, send reminders automatically, and track progress in one dashboard. This means payments go out on time, and your team doesn’t have to chase down internal stakeholders to get things moving.

3. Improved Accuracy

Mistakes in data entry can result in overpayments, missed invoices, or reconciliation headaches. With automation, those risks are significantly reduced. Your accounting software remains the single source of truth, and data flows seamlessly between systems. Duplicate payments and errors in GL coding become far less common, ensuring that your records are accurate and audit-ready.

4. Stronger Cash Flow Visibility

Real-time syncing between your payment system and accounting ledger means you always know what’s due, when, and how much you’ve already committed. You can plan ahead with confidence, spot upcoming cash crunches early, and make informed decisions about when and how to pay—whether that’s choosing to fund by card to extend float, or taking advantage of early payment discounts.

5. Built-in Compliance

Good payment automation tools come with built-in governance. That includes audit trails, approval hierarchies, and access controls that help you stay compliant with internal policies and external standards. During audits or financial reviews, you’ll have clear records of who approved what, when, and how each payment was processed—making reporting faster and less stressful.

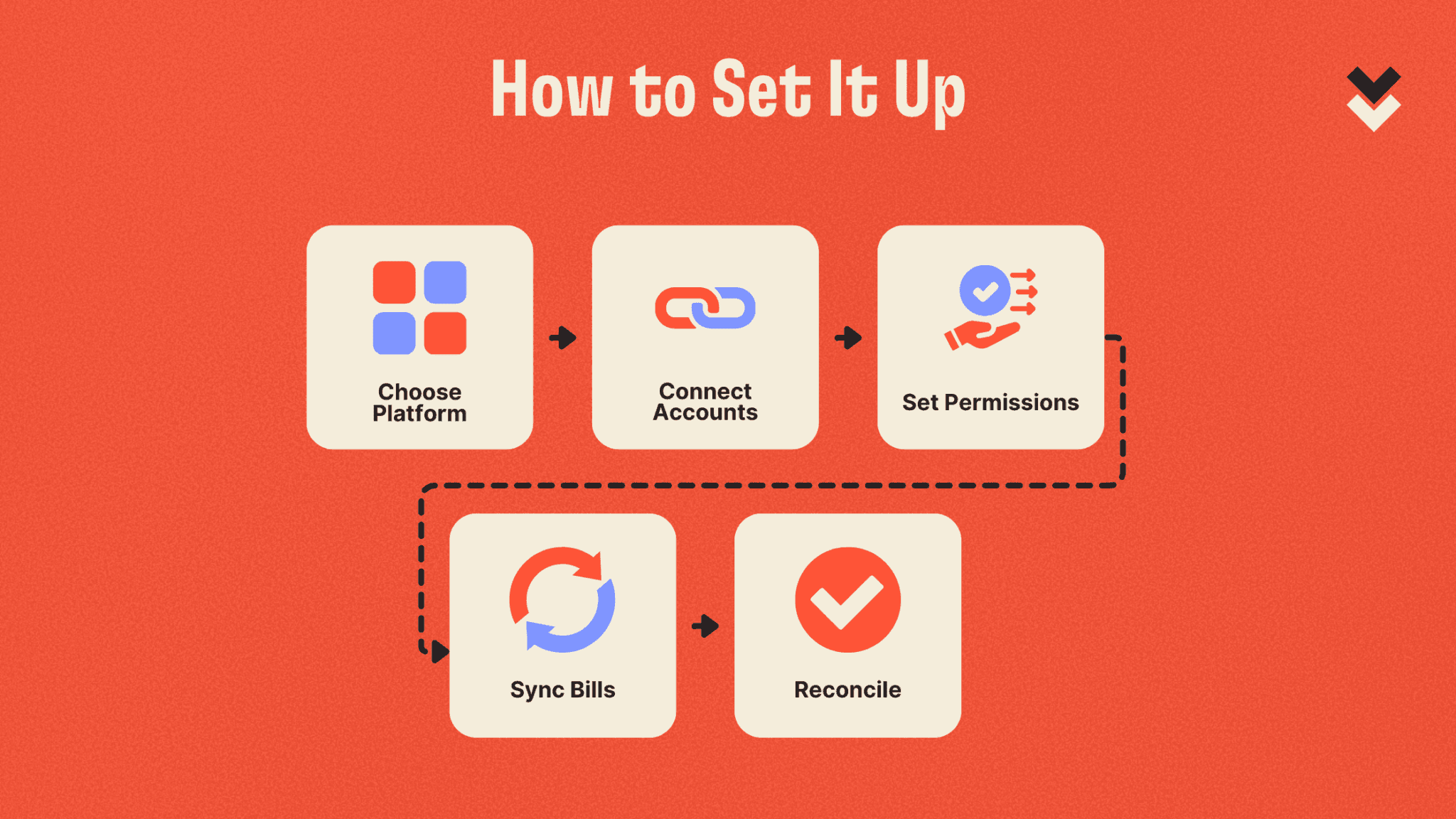

Step-by-Step: How to Set It Up

Ready to link your payment platform with your accounting software? Here’s how the process typically works:

Step 1: Choose the Right Payment Automation Platform

Look for a tool that integrates with your existing accounting software (e.g., Xero or MYOB) and supports your preferred payment methods (e.g., card, bank transfer).

Platforms like Lessn specialise in this, offering AP automation that plugs into your systems seamlessly.

Step 2: Connect Your Accounts

Most platforms offer a simple login-based integration. Log in to your accounting software from within the payment platform to sync your chart of accounts, contacts, and invoices.

Step 3: Review Your Settings

Set up user roles, approval workflows, and payment rules. You can define who can initiate, approve, and finalise payments—giving you control without bottlenecks.

Step 4: Sync and Review Outstanding Bills

Once connected, your accounts payable list will appear in the payment tool. Review due dates, choose funding methods (e.g., card for points), and prepare batches for approval.

Step 5: Pay and Reconcile Automatically

Payments are executed directly from the platform. Once a payment clears, it’s automatically marked as paid in your accounting software and matched with the original invoice. Reconciliation? Done.

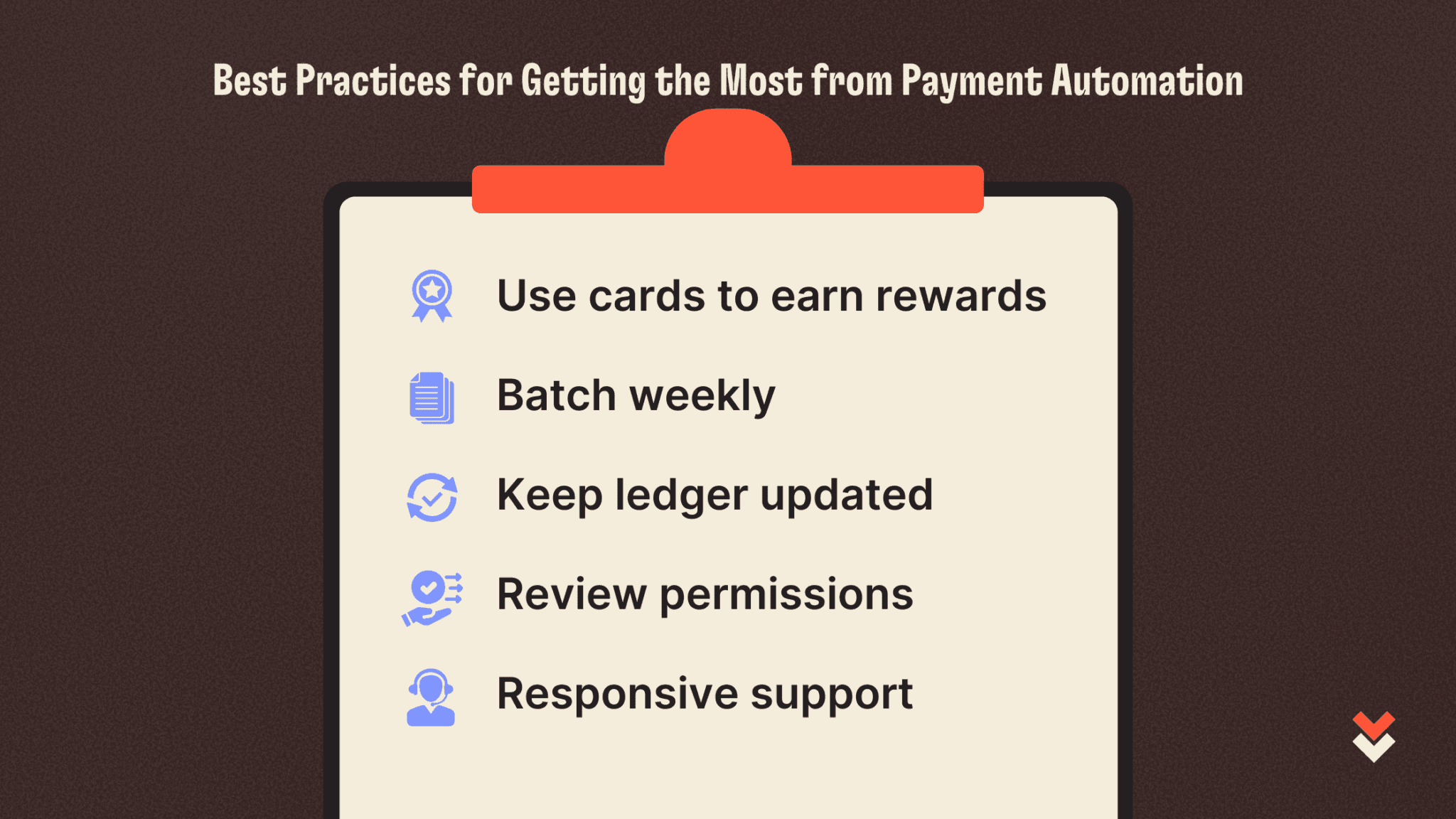

Best Practices for Getting the Most from Payment Automation

Setting up payment automation is just the first step. To truly maximise its value, businesses need to embed it into their workflows with intention. Here’s how to get the most out of your platform:

1. Use your business credit card strategically

Where possible, fund payments using your business credit card—especially for large or recurring expenses like software subscriptions, supplier invoices, or tax payments. This helps you take advantage of rewards programs (like AMEX points), extend your cash flow with interest-free days, and avoid dipping into working capital unnecessarily. Just make sure your card settings and approval workflows are aligned.

2. Batch payments weekly

Rather than processing invoices one at a time, group your payments into a weekly cycle. This keeps your books tidy, reduces the admin burden, and creates consistency for both your internal approvers and external suppliers. It also improves cash forecasting, as you’ll have a clearer picture of your outgoings at regular intervals.

3. Keep your accounting software up to date

Automation only works as well as the data it’s pulling from. Ensure that your accounting software reflects the most current information—whether that’s invoice uploads, supplier details, or chart of account updates. If your ledger is outdated, your payment automation will be too.

4. Review roles and permissions regularly

As your team grows or changes, so should your access controls. Review who can initiate, approve, and finalise payments on a quarterly basis. This not only protects you from fraud or accidental errors but also ensures your workflows remain efficient and aligned with your organisational structure.

5. Choose a platform with responsive support

Even the best systems occasionally need human intervention. Select a payment automation provider that offers responsive, knowledgeable customer support—especially when dealing with payment issues, integrations, or urgent reconciliations. Having help on hand ensures continuity even when something goes off-script.

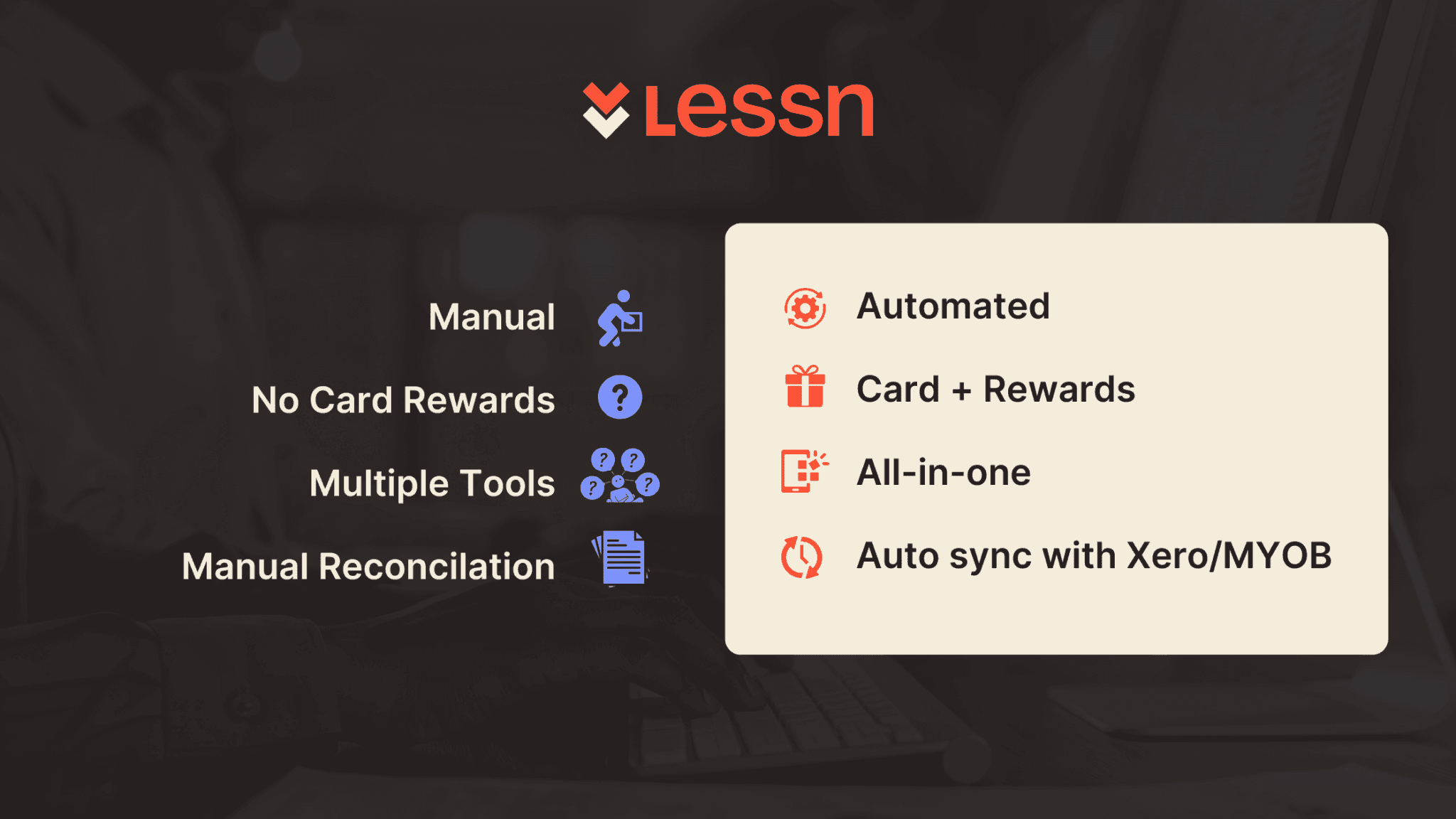

Why Lessn Makes It Easy

Lessn is designed specifically for businesses that want to streamline accounts payable without adding more tools, steps, or complexity. It brings together automation, control, and flexibility, turning what used to be a manual process into something seamless and strategic.

Out-of-the-box integration with Xero and MYOBmeans you can sync invoices, suppliers, and chart of accounts instantly. There’s no need for spreadsheets or data transfers. Lessn pulls in your payables and keeps everything aligned in real time.

But what really sets Lessn apart is the ability to fund any payment via credit card, even if the supplier doesn’t accept cards. That means you can unlock rewards, preserve cash flow using your card’s interest-free period, and extend working capital, all without changing the way your supplier gets paid. They receive a normal bank transfer, while you get the financial flexibility and benefits.

Here’s what you can do with Lessn:

Pay directly from your AP list: No more jumping between systems. Manage approvals and payments from one dashboard.

Choose card or bank transfer per invoice: Optimise each payment based on your cash flow strategy.

Automate your approval workflows: Set clear rules and roles so payments flow smoothly through your team.

Earn credit card rewards on business expenses: Turn every outgoing into points or cashback.

Reconcile payments automatically: Completed payments sync back to your ledger with matching invoice data, saving hours of admin.

Whether you’re a small team paying a handful of suppliers or managing multi-entity payments across regions, Lessn provides a simple and smart foundation for payment automation. It is built to scale with you as your business grows.

It’s time to leave manual processes behind

Integrating payment automation with your accounting software does more than just cut down admin time. It creates a more efficient, predictable, and scalable finance operation that grows with your business.

If your team is still juggling spreadsheets, manually uploading ABA files, or chasing directors for last-minute approvals, you’re spending valuable time on tasks that can be easily automated. These outdated processes not only slow you down but also increase the risk of error, payment delays, and missed opportunities for rewards or early payment discounts.

With a well-integrated payment automation platform in place, your business can gain full visibility over outgoings, speed up internal workflows, and free your finance team to focus on more strategic tasks like cash flow planning and forecasting.

Whether you’re a sole trader or managing multiple entities, the right system will give you better control, stronger compliance, and improved accuracy across your accounts payable.

Lessn makes this process simple. From syncing your invoices to funding supplier payments via credit card and reconciling transactions automatically, it gives you all the tools you need to modernise your AP process.

Now’s the time to move beyond manual admin and take advantage of smarter systems.

Explore how Lessn can help your business adopt payment automation and spend less time managing bills and more time driving growth.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.