How to Speed Up Your Payments & Improve Cash Flow

Mar 26, 2025

Managing cash flow efficiently is critical for business success. Slow payments and manual processes create bottlenecks that impact operations, limit growth,...

Managing cash flow efficiently is critical for business success. Slow payments and manual processes create bottlenecks that impact operations, limit growth, and strain vendor relationships. Without optimized cash flow management solutions, businesses struggle to maintain financial stability, leading to unnecessary costs and inefficiencies.

When businesses experience late payments or approval delays, they lose control over their financial position. Payment bottlenecks not only disrupt operations but also limit access to early payment discounts and create cash flow shortfalls.

Accounts payable automation offers a structured way to accelerate payments, optimize working capital, and improve financial visibility. By eliminating manual data entry, reducing approval delays, and ensuring timely payments, businesses can stabilize cash flow and focus on strategic growth.

With the right electronic payment solutions, companies can streamline invoice approvals, schedule payments efficiently, and integrate seamlessly with accounting platforms. These improvements minimize errors, reduce administrative workload, and ensure consistent, predictable cash flow.

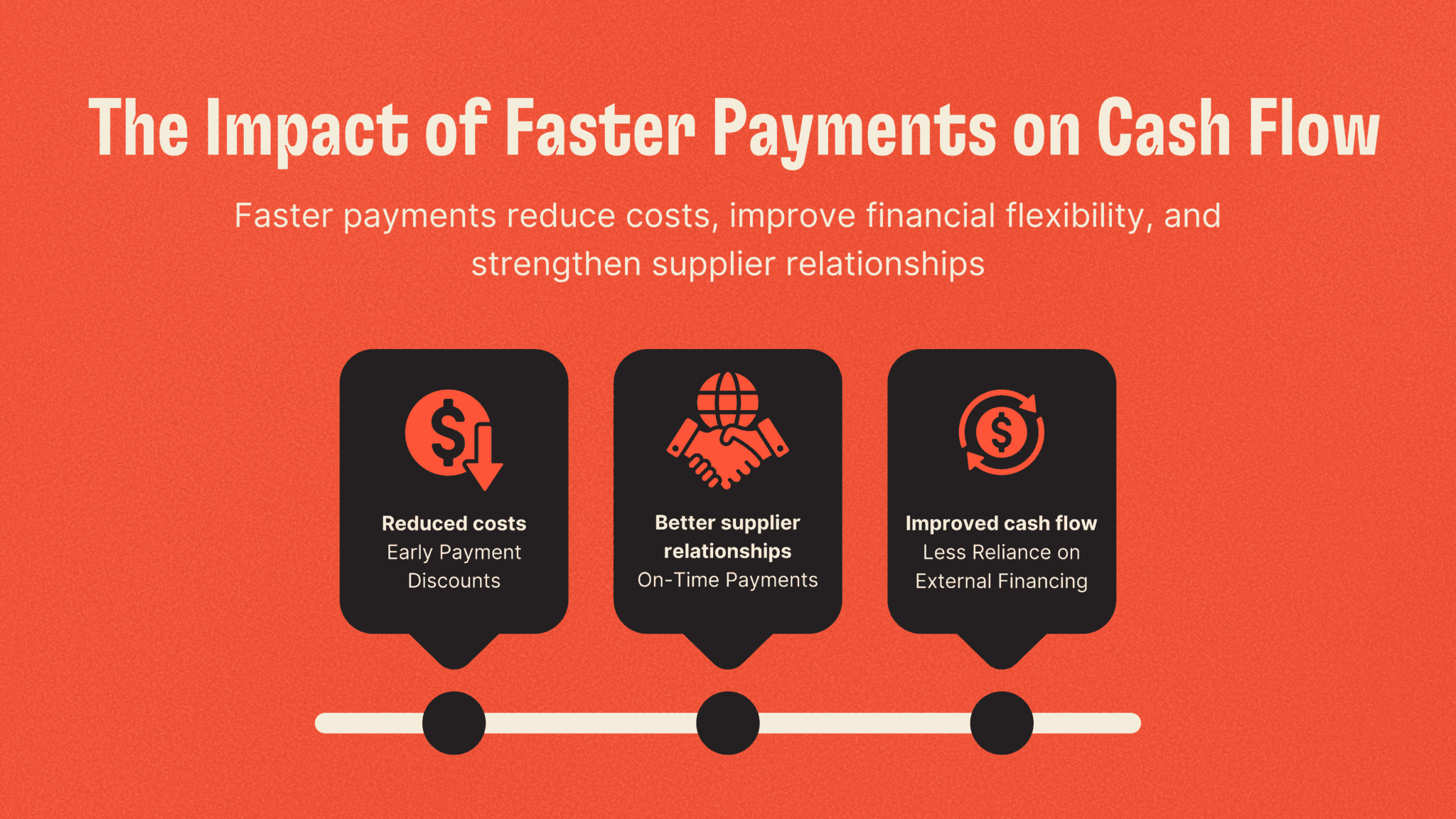

The Impact of Faster Payments on Cash Flow

Cash flow management isn’t just about increasing revenue—it depends on how efficiently payments move in and out of the business. Poor payment processes, long approval times, and reliance on manual methods create unnecessary financial strain.

Delayed outgoing payments increase operational expenses, reduce financial flexibility, and force businesses to rely on external financing. When payments are slow, businesses struggle to maintain cash reserves, which can impact their ability to invest in growth and implement effective cash flow optimization strategies.

How Payment Delays Impact Businesses

Higher Costs from Missed Discounts

Many suppliers offer early payment discounts to incentivize prompt payments. For example, a supplier may offer a 2% discount if payment is made within 10 days instead of the standard 30-day term. However, businesses relying on manual invoice processing often miss out on these savings, leading to higher costs per transaction and missed opportunities for expense reduction strategies.

Strained Supplier Relationships

Consistently late payments damage vendor relationships, leading to worse contract terms, supply disruptions, or even revoked credit lines. Vendors prioritize businesses with reliable payment histories, and a lack of consistency in payment schedules can impact access to discounts or flexible payment terms.

Increased Administrative Overhead

Without digital invoice processing, finance teams must chase approvals, verify details, and manually reconcile transactions. This increases labor costs, slows down payment cycles, and diverts resources from more strategic financial tasks such as financial planning and analysis.

Greater Reliance on External Financing

Businesses that don’t manage payments strategically often experience short-term cash shortages, forcing them to rely on loans, credit lines, or emergency funding to cover operating expenses. Borrowing money to cover everyday expenses adds interest costs and financial risk, highlighting the need for effective financial risk management strategies.

Why Faster Payments Matter

A slow and inefficient payment process doesn’t just cause delays—it impacts overall business performance, supplier relationships, and financial stability. Businesses that rely on manual payment processes often miss opportunities to save money, negotiate better terms with vendors, and optimize their working capital. Automating payments is more than just about speed—it’s about taking control of your finances and making every transaction work in your favor.

1. Take Advantage of Supplier Discounts, Reducing Costs Per Transaction

Many suppliers offer early payment discounts to encourage prompt payments, allowing businesses to reduce costs significantly. For example, a supplier might offer a 2% discount for payments made within 10 days instead of the usual 30-day term. While this may seem like a small percentage, it quickly adds up over time, resulting in thousands of dollars in savingsannually for companies with high invoice volumes.

However, manual invoice approval processes often cause delays, making it difficult for businesses to capitalize on these discounts. A single invoice stuck in an approval queue can mean missing out on cost-saving opportunities.

By implementing accounts payable automation, businesses can schedule payments strategically, ensuring that invoices are approved and paid within the discount window. This approach improves cost efficiency, helping businesses reinvest savings into operations or growth initiatives.

2. Strengthen Vendor Relationships, Securing Better Contract Terms and Avoiding Supply Disruptions

A business’s relationship with its suppliers directly impacts supply chain stability, pricing, and long-term success. Vendors value customers who pay on time and reliably, often rewarding them with better contract terms, volume discounts, or priority service. On the other hand, businesses with a history of late payments may experience:

Stricter credit terms, limiting flexibility in ordering stock or services.

Higher prices, as suppliers factor in the risk of delayed payments.

Delayed deliveries, as priority is given to clients with better payment histories.

When payments are automated through electronic payment solutions, suppliers receive payments on time, every time, reducing disputes and strengthening partnerships. Reliable payment histories can even put businesses in a stronger position to negotiate better terms, such as extended credit lines or exclusive discounts.

Additionally, ensuring payments are processed correctly eliminates the risk of supply disruptions due to overdue invoices. Businesses that depend on key suppliers for materials, inventory, or services can avoid potential production delays or service interruptions caused by unpaid invoices.

3. Reduce Unnecessary Administrative Costs by Eliminating Manual Processing

A business’s relationship with its suppliers directly impacts supply chain stability, pricing, and long-term success. Vendors value customers who pay on time and reliably, often rewarding them with better contract terms, volume discounts, or priority service. On the other hand, businesses with a history of late payments may experience:

Stricter credit terms, limiting flexibility in ordering stock or services.

Higher prices, as suppliers factor in the risk of delayed payments.

Delayed deliveries, as priority is given to clients with better payment histories.

When payments are automated through electronic payment solutions, suppliers receive payments on time, every time, reducing disputes and strengthening partnerships. Reliable payment histories can even put businesses in a stronger position to negotiate better terms, such as extended credit lines or exclusive discounts.

Additionally, ensuring payments are processed correctly eliminates the risk of supply disruptions due to overdue invoices. Businesses that depend on key suppliers for materials, inventory, or services can avoid potential production delays or service interruptions caused by unpaid invoices.

3. Reduce Unnecessary Administrative Costs by Eliminating Manual Processing

Processing payments manually requires a significant investment in labor, time, and resources. Finance teams spend hours tracking invoices, verifying payment details, and manually reconciling transactions. The hidden costs of manual processing include:

Labor costs associated with invoice handling, approval routing, and data entry.

Error correction costs from duplicated payments, incorrect entries, or missed invoices.

Delayed approvals, which lead to late fees and missed discounts.

By implementing digital invoice processing, businesses can reduce processing time by up to 75%, eliminating the need for manual data entry and approval follow-ups. Automated systems ensure invoices move through the approval process seamlessly, reducing human intervention and cutting administrative overhead.

Additionally, fewer errors mean fewer payment disputes with suppliers, reducing the time spent on issue resolution. Businesses can redirect their finance teams’ efforts to more strategic financial tasks, such as forecasting, budgeting, and cost analysis, leading to significant operational efficiency improvements.

4. Maintain Better Financial Predictability with Real-Time Cash Flow Tracking

Cash flow is the lifeblood of any business, and having real-time visibility into outgoing payments is crucial for maintaining financial stability. Businesses without automated payment systems often struggle with:

Unexpected cash shortages, as invoices are paid inconsistently, creating unpredictability.

Limited forecasting accuracy, making it harder to plan for upcoming expenses.

Overdrawn accounts, as payments are made without clear oversight of available cash balances.

With cash flow forecasting software and spend management platforms, businesses can track payments in real-time, ensuring they always know how much money is going out and when. Features like scheduled payments and automated reconciliation provide a clearer financial picture, helping businesses plan more effectively.

Real-time cash flow tracking enables companies to:

Ensure sufficient cash reserves before making payments.

Align payments with revenue inflows, preventing cash shortages.

Improve financial forecasting, allowing for better budgeting and planning.

By automating payments and gaining full visibility over outgoing cash flow, businesses can reduce financial risks, improve liquidity, and make more informed financial decisions.

How Lessn.io Transforms Invoice Payments

Lessn.io is a leading invoice payment automation platform that helps businesses speed up payments, optimize cash flow, and earn financial rewards. Unlike traditional AP software, Lessn.io provides:

Invoice payments via credit cards, even when suppliers don’t accept them.

A 50+ day payment float period, allowing businesses to extend cash flow cycles.

Automated reconciliation with Xero, MYOB, and QuickBooks, reducing manual tracking.

Financial rewards, enabling businesses to earn AMEX, Visa, and Mastercard points on business expenses.

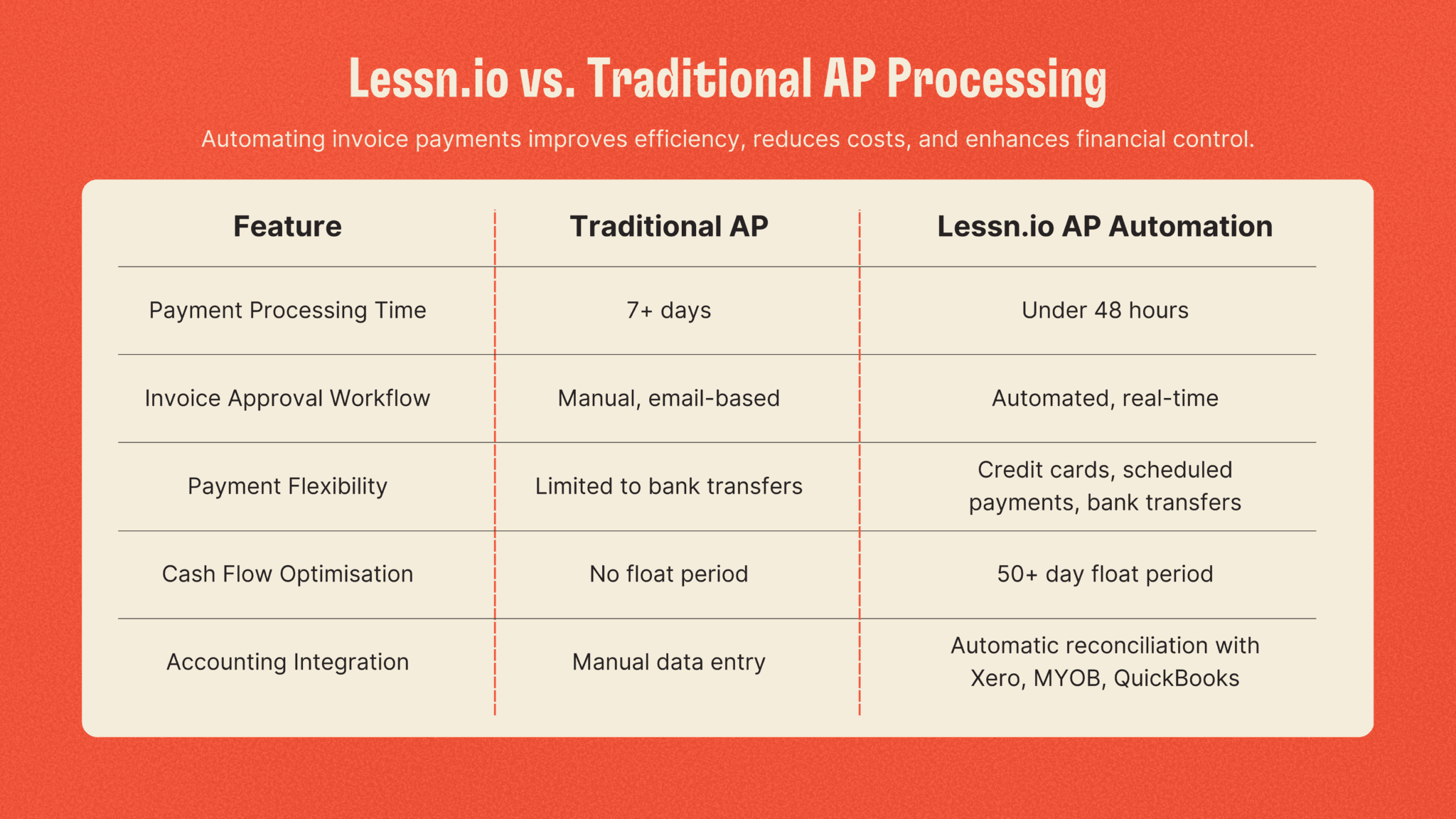

Lessn.io vs. Traditional AP Processing

Switching to Lessn.io’s invoice payment automation is a game-changer for businesses looking to streamline their accounts payable process and improve cash flow management. With traditional AP systems, businesses often struggle with slow approvals, manual errors, and cash flow unpredictability. Lessn.io eliminates these bottlenecks, allowing businesses to process invoices faster, gain financial flexibility, and maintain accurate financial records.

Why Businesses Choose Lessn.io

1. Up to 75% Faster Invoice Processing

Manual invoice processing involves multiple steps—data entry, approval routing, verification, and payment execution—all of which can take days or even weeks. Lessn.io automates these steps, significantly reducing processing times and ensuring invoices are approved without unnecessary delays. Faster approvals mean on-time payments, better supplier relationships, and access to early payment discounts that businesses might otherwise miss.

2. Increased Cash Flow Flexibility

Many businesses struggle with cash flow gaps due to fixed supplier payment schedules and unpredictable revenue inflows. With Lessn.io, companies can extend payment terms using credit card float periods while ensuring suppliers are paid on time. This added financial flexibility allows businesses to preserve working capital, avoid unnecessary loans, and strategically manage outgoing payments without disrupting supplier relationships.

3. Improved Financial Accuracy and Control

Accounting errors—such as duplicate payments, incorrect invoice amounts, or misallocated expenses—can lead to significant financial discrepancies. Lessn.io integrates seamlessly with accounting software like Xero, MYOB, and QuickBooks, ensuring that every payment is automatically reconciled with financial records. By eliminating manual data entry, businesses reduce the risk of errors and maintain precise, up-to-date financial reports for better decision-making.

Switching to Lessn.io’s invoice payment automation is a game-changer for businesses looking to streamline their accounts payable process and improve cash flow management. With traditional AP systems, businesses often struggle with slow approvals, manual errors, and cash flow unpredictability. Lessn.io eliminates these bottlenecks, allowing businesses to process invoices faster, gain financial flexibility, and maintain accurate financial records.

Why Businesses Choose Lessn.io

1. Up to 75% Faster Invoice Processing

Manual invoice processing involves multiple steps—data entry, approval routing, verification, and payment execution—all of which can take days or even weeks. Lessn.io automates these steps, significantly reducing processing times and ensuring invoices are approved without unnecessary delays. Faster approvals mean on-time payments, better supplier relationships, and access to early payment discounts that businesses might otherwise miss.

2. Increased Cash Flow Flexibility

Many businesses struggle with cash flow gaps due to fixed supplier payment schedules and unpredictable revenue inflows. With Lessn.io, companies can extend payment terms using credit card float periods while ensuring suppliers are paid on time. This added financial flexibility allows businesses to preserve working capital, avoid unnecessary loans, and strategically manage outgoing payments without disrupting supplier relationships.

3. Improved Financial Accuracy and Control

Accounting errors—such as duplicate payments, incorrect invoice amounts, or misallocated expenses—can lead to significant financial discrepancies. Lessn.io integrates seamlessly with accounting software like Xero, MYOB, and QuickBooks, ensuring that every payment is automatically reconciled with financial records. By eliminating manual data entry, businesses reduce the risk of errors and maintain precise, up-to-date financial reports for better decision-making.

Take Control of Your AP Process with Lessn.io

Lessn.io empowers businesses to turn their accounts payable process into a strategic advantage, rather than a time-consuming burden. By automating payments, optimizing cash flow, and reducing manual errors, businesses gain full control over their finances. Whether you want to speed up invoice processing, maximize cash flow flexibility, or streamline reconciliation, Lessn.io provides the tools to simplify and improve your AP workflow.

Are You Ready to Transform Your Accounts Payable Process?

Book a demo today to see how Lessn.io can help your business eliminate payment delays, improve financial efficiency, and unlock new growth opportunities.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.