Maximise Amex points with Lessn: a guide for Australian businesses

Jun 18, 2025

Using an American Express card for business payments is already a clever move. But what if you could go...

Using an American Express card for business payments is already a clever move. But what if you could go further and make every dollar stretch that little bit more?

That’s where pairing your Amex spend with a smart platform like Lessn can make a big impact. From marketing and contractor invoices to insurance and travel, every transaction has the potential to earn points. With the right setup, you can maximise Amex points with Lessn and turn your regular business expenses into serious rewards.

This guide will show you exactly how Australian businesses can get more value from Amex by aligning their spend with automated invoice workflows using Lessn.

How Amex points work for business owners

American Express business cards allow companies to earn points for everyday spend across a wide range of categories. Depending on the card you choose, you’ll either earn Membership Rewards points or Qantas Points, both offering great value if used wisely.

Membership Rewards vs Qantas Points

Most Amex business cards fall into one of these two categories:

Membership Rewards: These points are highly flexible. You can transfer them to various frequent flyer and hotel loyalty programs, such as Velocity, Emirates Skywards, Singapore Airlines KrisFlyer and Marriott Bonvoy. You can also redeem them for gift cards, statement credits or products.

Qantas Points: These go directly into your Qantas Business Rewards or personal Frequent Flyer account. They’re ideal for companies that fly often with Qantas and want to earn status credits and rewards through a single airline ecosystem.

Whichever points system you choose, the real benefit comes from putting as much eligible spend through your Amex card as possible — and that’s where Lessn’s automation features come in.

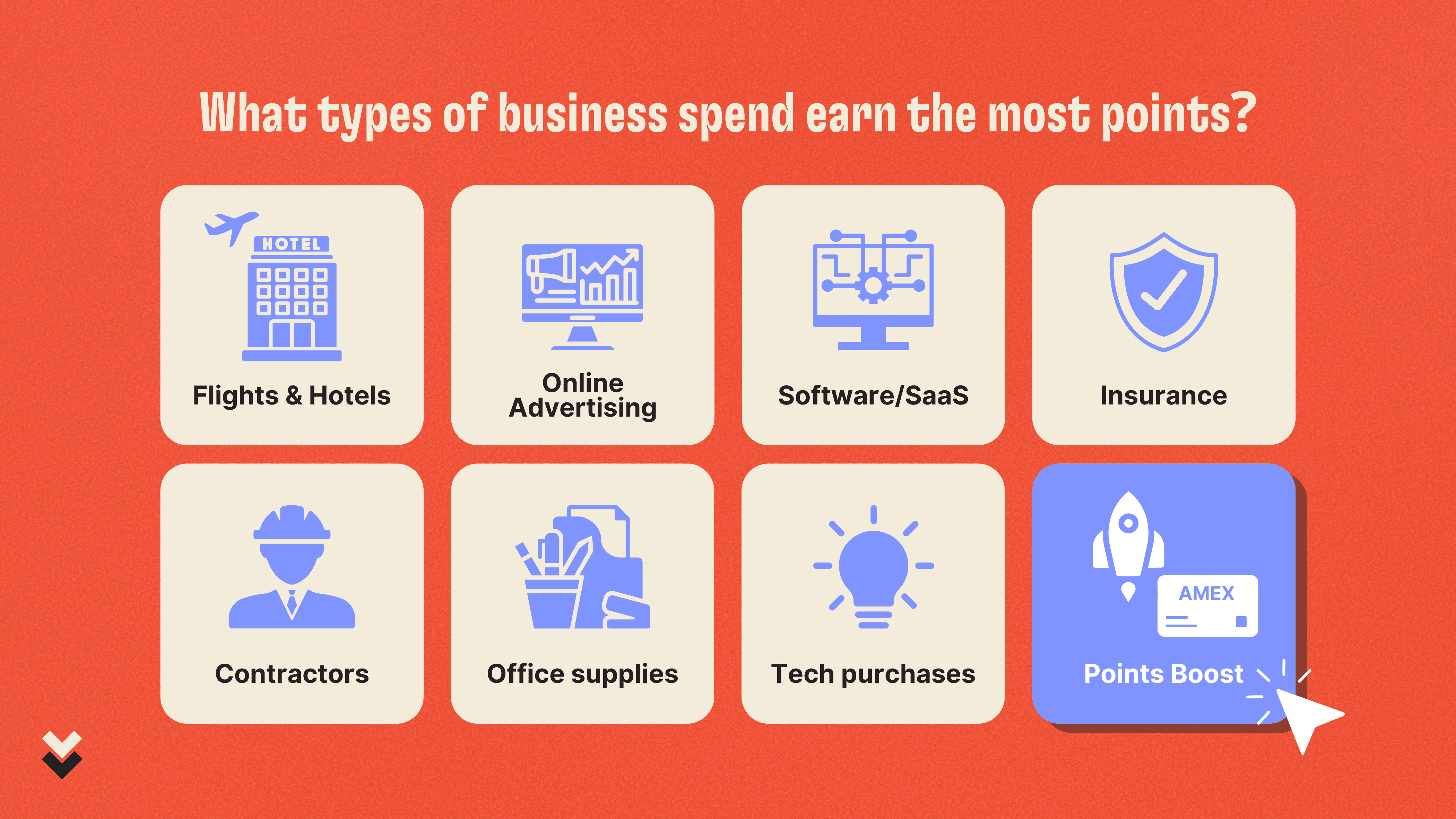

What types of business spend earn the most Amex points?

Not all business spend is created equal when it comes to points. To maximise your return, focus on the categories that offer the highest earn rates. These usually include:

Flights and accommodation (domestic and international)

Online advertising via Google Ads, Meta, LinkedIn and others

Software and SaaS subscriptions such as Xero, Canva, project tools and email platforms

Insurance premiums

Freelancer or contractor invoices

Office supplies and technology purchases

If you’re not already using your Amex for these types of expenses, you could be missing out. Even worse, if you’re still using BPAY or bank transfers for routine payments, you’re leaving a significant amount of points on the table.

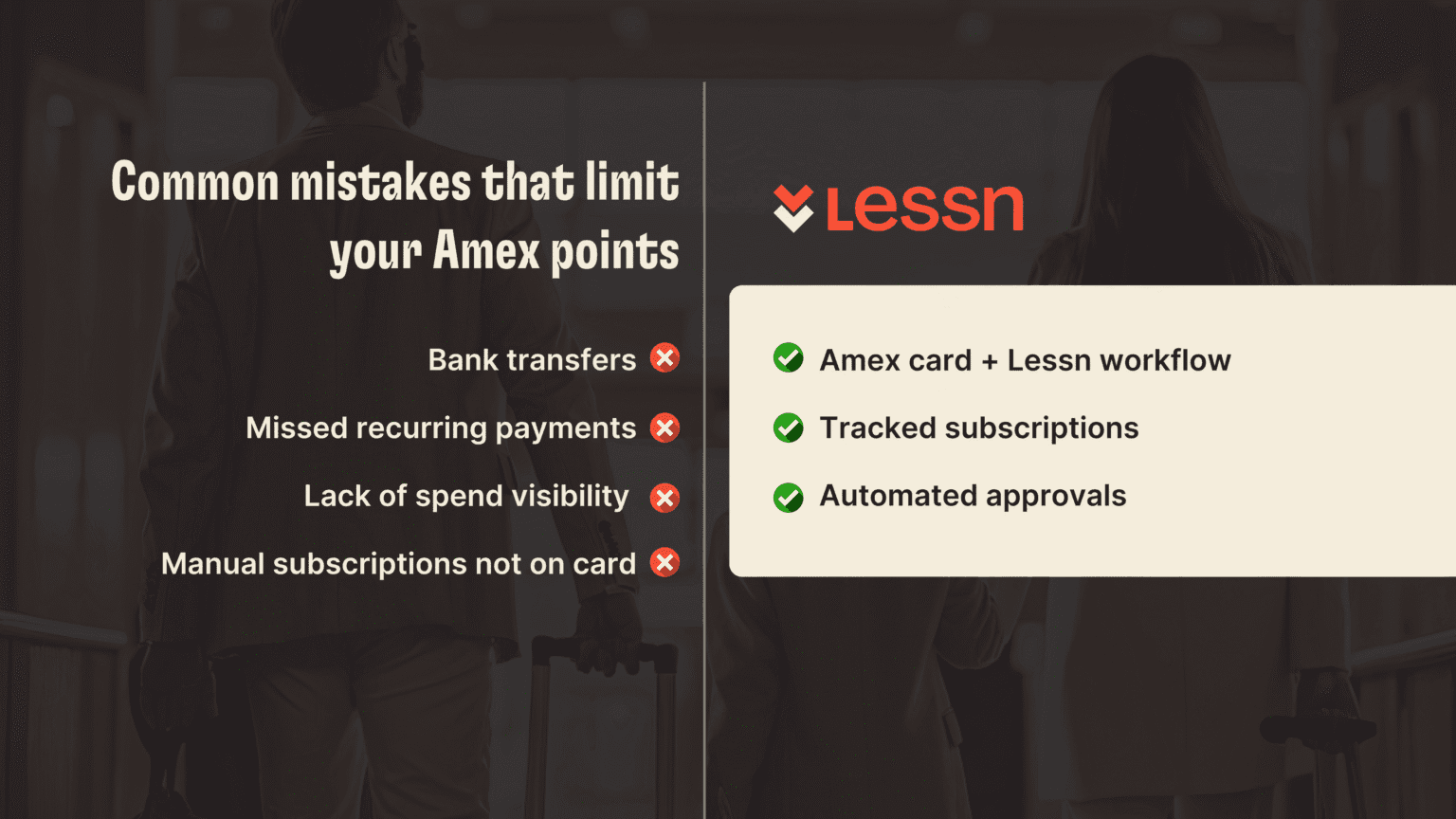

Common mistakes that limit points potential

Many Australian businesses are unintentionally reducing their points earning by:

Using bank transfers when card payment is possible

Some suppliers may not accept Amex directly. But there are workarounds, like paying through Lessn that let you use your card regardless of a supplier’s payment preferences.

Failing to use the card for subscriptions and software

Monthly charges for cloud tools, web hosting, team collaboration software or creative platforms can all be routed through your Amex. If these are being debited from a bank account instead, you’re missing out on high-value points.

Forgetting recurring bills

Some recurring payments are simply “set and forget,” often left to run through traditional accounts payable processes. But with Lessn, those recurring invoices can be linked to Amex and tracked properly.

Lack of visibility over which expenses earn points

Without integrated spend tracking, finance teams often lose sight of which payments went on the card and whether they were optimised. Lessn helps solve this by making it easy to categorise and reconcile every transaction.

How Lessn helps businesses earn more Amex points

Lessn is more than just a tool for paying invoices. It’s an intelligent invoice softwareplatform that helps businesses take full advantage of their card rewards.

Here’s how Lessn makes a measurable difference to your points balance:

Use your Amex card for more expenses

Many suppliers may not accept Amex directly. Lessn allows you to pay by card while the platform settles the invoice via bank transfer on your behalf. This means you still earn points, without changing how your suppliers receive their money.

Gain control over payment timing

With Lessn, you can schedule invoice payments to match your cash flow needs and your Amex statement cycle. That gives you the chance to extend your cash float while still paying on time.

Avoid missed opportunities

Every missed card payment is a missed chance to earn points. Lessn ensures you’re never caught off guard. It keeps your approvals flowing, reminds you of due dates and helps avoid last-minute manual payments that bypass the card.

What types of business expenses can be paid via Lessn and Amex?

You might be surprised at how many of your regular business costs can be paid with your Amex card through Lessn. Examples include:

Marketing spend (digital and traditional)

Supplier invoices (even those who don’t take Amex)

Contractor and freelancer fees

Insurance premiums

Travel expenses including flights and accommodation

Software tools (CRM, project management, accounting)

Training and event costs

IT equipment and supplies

With these categories accounting for a large percentage of business expenditure, even modest monthly spend can translate into thousands of extra points each year.

Real scenario: Jane’s digital agency in Sydney

Jane runs a boutique digital agency based in Sydney. Each month, she pays around $30,000 in supplier invoices, advertising spend and software tools.

Previously, Jane only used her Amex card for flights and hotel bookings. Everything else was paid via bank transfer. She was earning points, but nowhere near what she could.

After adopting Lessn’s invoice software, Jane set up her Amex Business Explorer card to route as many payments as possible through the platform. Contractors, tools like Canva and HubSpot, and even agency insurance premiums. All were now paid via Amex through Lessn’s card-friendly workflow.

Now Jane earns over 120,000 additional points each year. That’s enough for multiple return flights between Sydney and Brisbane or even a business-class upgrade for an overseas conference.

Plus, her bookkeeper has saved hours of manual reconciliation, thanks to Lessn’s Xero integration.

How Lessn simplifies invoice and payment management

Beyond points, Lessn helps businesses reduce admin, improve accuracy and gain better control over their accounts payable.

Track and categorise card payments automatically

Lessn links each Amex card transaction to its corresponding invoice and supplier. That means no more guessing, no manual data entry and a clear audit trail at tax time.

Batch payments for maximum efficiency

Instead of logging into multiple bank accounts or platforms, you can group payments together and manage them in one dashboard, even if they’re going to different suppliers.

Automate approval workflows

Lessn routes invoices to the right people based on rules you set. This keeps payments moving, reduces bottlenecks and ensures authorisations are completed on time.

Sync with Xero or MYOB

Lessn integrates with your accounting software to ensure data is consistent across platforms. This streamlines reconciliation, speeds up BAS reporting and supports clean EOFY books.

Why this matters for Australian businesses

Points aren’t just a perk. For many businesses, they’re a strategy.

You can use points to:

Book business travel at a lower cost

Upgrade to business class for client visits or conferences

Offer team incentives like hotel stays or gift cards

Offset cash expenses using statement credits

But earning points isn’t enough on its own. To get the most value, your business needs visibility, control and consistency.

All the things that Lessn’s invoice software is built to provide.

Turn everyday spend into serious points

If you’re already using an Amex card for business, that’s a great start. But to truly maximise the value of your rewards, you need to rethink how your payments are processed. With Lessn, you can make sure more of your spend earns points, your payments are never missed, and your finance team has a smoother, smarter workflow.

Want to get more out of your Amex card? Start using Lessn to turn everyday payments into serious points.

Try Lessn or book a demo today.

How many extra points could your business be earning just by changing how you pay?

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.