Maximise Credit Card Reward Points: Earn More on Every Payment

Apr 4, 2025

Lessn.io’s intelligent accounts payable (AP) system optimises business payments to maximise credit card reward points effortlessly. Instead of missing out on valuabl...

Lessn.io’s intelligent accounts payable (AP) system optimises business payments to maximise credit card reward points effortlessly.

Instead of missing out on valuable financial perks, businesses can turn everyday expenses into strategic advantages, earning cashback, travel rewards, and other incentives on payments they were already making.

Many businesses overlook the opportunity to earn significant rewards on their supplier payments, largely due to limitations in payment acceptance and inefficient tracking of spending categories.

Lessn.io eliminates these barriers by enabling businesses to use credit cards for all AP transactions—even with suppliers that don’t traditionally accept cards. This approach not only streamlines accounts payable processes but also improves cash flow management and ensures businesses make the most of available credit card rewards.

Why Businesses Miss Out on Reward Points

Most businesses don’t realise that their accounts payable process could be generating rewards. While corporate expenses are a necessary part of operations, failing to optimise payments means companies leave valuable money on the table.

Here’s why most businesses miss out on credit card rewards:

1. Missed Opportunities to Earn Rewards on AP Payments

Many suppliers prefer bank transfers, BPAY, or direct debits, which don’t generate points. Businesses assume they have no choice but to comply, losing out on thousands of reward points.

Solution: Lessn.io enables businesses to convert these payments into credit card transactions, ensuring that all business expenses contribute to valuable rewards.

2. Complexity in Managing Multiple Rewards Programs

Different credit card providers offer varying reward structures, and businesses often find it difficult to track which expenses should go on which card. This leads to suboptimal rewards accumulation.

Solution: Lessn.io’s AI-powered smart routing system ensures payments are automatically directed to the most rewarding card, removing the guesswork and maximising earnings.

3. Using the Wrong Credit Card for Certain Spending Categories

Not all expenses earn the same number of points. Some credit cards offer higher rewards on advertising spend, utilities, travel, or office supplies, while others provide general rewards. Without an optimised approach, businesses lose potential earnings.

Solution: Lessn.io identifies which credit card is best for each type of expense, ensuring that businesses always earn the highest possible points per dollar spent.

4. Manual Tracking of Rewards is Time-Consuming & Inefficient

Most businesses lack a real-time system to track their credit card rewards, making it difficult to manage spending across multiple cards. This leads to wasted points, expired rewards, and missed redemption opportunities.

Solution: Lessn.io’s real-time tracking dashboard allows businesses to monitor and manage their reward points in one place, providing insights into how to redeem them for maximum value.

📌 Want to make sure you’re earning the most on every transaction?

Did You Know?

Businesses That Don’t Optimise Credit Card Payments Miss Out on Thousands of Dollars Every Year

Most businesses focus on managing expenses efficiently, but few realise that supplier payments are an untapped source of financial benefits. Companies that fail to optimise their AP payments could be missing out on substantial rewards that could contribute to cost savings, employee perks, or even reinvestment into business growth.

For example, a business with an annual spend of $500,000 on supplier invoices could be missing out on up to $15,000 in rewards, whether in travel points, cashback, or statement credits. That’s money that could be used for business flights, office equipment, or reducing operational costs.

Instead of making traditional bank transfers that offer no return, businesses using Lessn.io can:

Convert supplier payments into point-generating transactions to ensure every dollar spent contributes to valuable rewards.

Optimise card usage to ensure the most rewarding credit card is used for every payment.

Gain better cash flow flexibility, allowing companies to pay invoices while maximising financial perks.

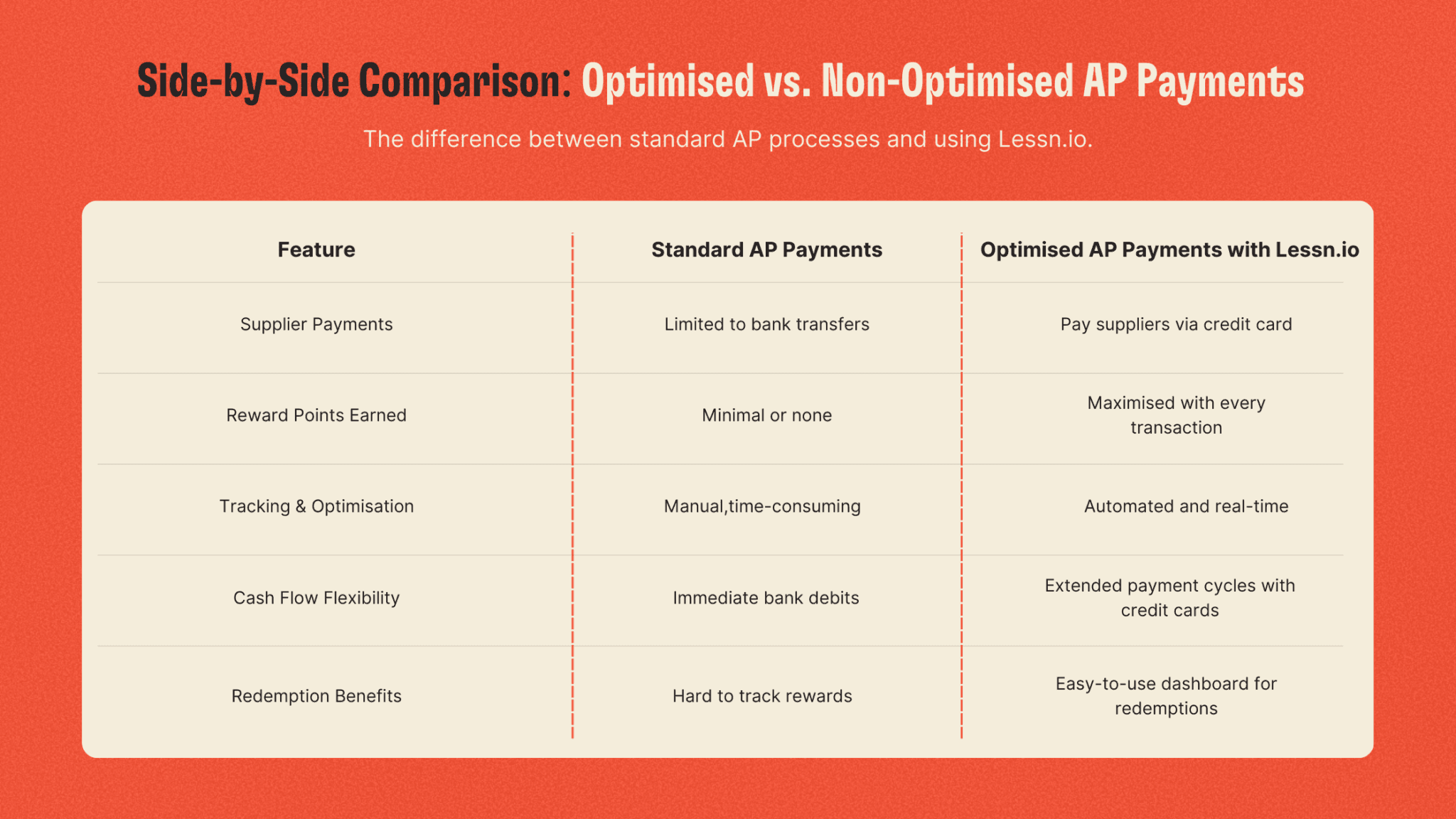

Side-by-Side Comparison: Optimised vs. Non-Optimised AP Payments

With Lessn.io, every business payment becomes a smarter financial move.

1. Can I use my credit card to pay suppliers who don’t accept card payments?

Yes. Lessn.io allows businesses to convert bank transfers into credit card transactions, ensuring that even suppliers who do not traditionally accept card payments can still be paid while businesses continue earning reward points. Lessn.io processes the payment on your behalf, so your supplier receives funds via their preferred method, while you benefit from points accumulation.

2. How does Lessn.io help businesses earn more credit card points?

Lessn.io’s smart payment routing ensures that every payment is assigned to the most rewarding credit card available. Instead of manually selecting which card to use, Lessn.io automates this process, optimising payments to earn the maximum possible points per transaction. This prevents missed opportunities and ensures businesses are always taking full advantage of their rewards programs.

3. Does Lessn.io integrate with accounting software?

Yes. Lessn.io seamlessly integrates with Xero, MYOB, QuickBooks, and major ERP systems, ensuring that all payments are automatically reconciled. Every transaction made through Lessn.io is recorded in your accounting system, eliminating manual data entry and reducing errors in financial reporting.

4. How does Lessn.io improve cash flow while earning rewards?

By allowing businesses to use credit card float periods, Lessn.io enables companies to extend payment cycles while maintaining financial flexibility. Instead of making immediate payments via bank transfers, businesses can use their credit card’s interest-free period to delay cash outflows while still ensuring suppliers are paid on time. This additional breathing room allows businesses to allocate funds more effectively, manage working capital, and take advantage of short-term investment opportunities—all while accumulating valuable credit card rewards.

5. What types of expenses can I pay using Lessn.io?

Lessn.io supports a wide range of business expenses, including supplier invoices, utilities, advertising spend, rent, insurance, and even payroll in some cases. Any payment that can be processed via a bank transfer can be converted into a credit card transaction, allowing businesses to maximise rewards on nearly every business expense.

6. Will my supplier know I am paying through Lessn.io?

No. Lessn.io processes payments in the background, ensuring that suppliers receive payments as usual, via bank transfer or their preferred method. There is no disruption to supplier relationships, and they are not required to change the way they receive payments.

7. Can I split payments across multiple credit cards?

Yes. Lessn.io enables businesses to split large payments across multiple credit cards. This allows companies to strategically spread spending across different rewards programs, ensuring they reach reward thresholds, maximise cashback offers, or qualify for bonus promotions across multiple cards.

8. How does Lessn.io track my reward points?

Lessn.io provides a real-time dashboard that tracks all payments and corresponding reward points. Instead of manually checking credit card statements and tracking different rewards programs separately, businesses can view their points earnings, transaction history, and redemption opportunities in one place.

9. Is Lessn.io secure?

Yes. Lessn.io uses bank-grade encryption and multi-layer security controls to protect all financial data and transactions. Built-in fraud detection, audit trails, and compliance tracking ensure every payment is processed securely and meets regulatory standards.

10. Can Lessn.io help me redeem my credit card rewards?

Lessn.io does not directly handle redemptions, but it provides detailed insights and tracking to help businesses understand how many points they have earned and which redemption options offer the most value. By automating expense categorisation, Lessn.io ensures businesses always know where their rewards stand and how to use them effectively.

Maximise Every Payment. Earn More Rewards

Many businesses treat supplier payments as a standard operating cost without realising the financial advantages that can come from optimising payment methods. With Lessn.io, every invoice becomes an opportunity to earn valuable credit card rewards, improve cash flow, and unlock financial benefits that can contribute to business growth.

Turn Invoices into Point-Generating Transactions and Earn Rewards Effortlessly

Most businesses pay invoices through bank transfers, BPAY, or direct debits—none of which generate credit card reward points. This means companies miss out on thousands of dollars’ worth of potential rewards every year simply by using inefficient payment methods.

With Lessn.io, businesses can convert supplier payments into credit card transactions, ensuring that every invoice processed contributes to cashback, travel rewards, or other financial incentives. Instead of missing out on points, businesses can make each transaction work for them, turning regular expenses into a strategic advantage.

By leveraging Lessn.io’s automated AP system, companies can:

Earn points on invoices, rent, utilities, and operational costs that typically don’t qualify for credit card rewards.

Ensure that payments are processed efficiently, with suppliers receiving funds via their preferred method, while businesses continue earning points.

Track reward accumulation in real time, eliminating the need for manual tracking and guesswork.

This seamless integration between invoice payments and credit card rewardsallows businesses to make the most of their spending, ensuring they never leave potential rewards behind.

Improve Cash Flow by Extending Payment Cycles Without Disrupting Supplier Relationships

Cash flow management is a major concern for businesses, especially those that handle high volumes of supplier payments. Traditional bank transfers require immediate payment, depleting working capital and putting financial strain on businesses that need flexibility.

Lessn.io enables businesses to extend their payment cycles by leveraging their credit card’s interest-free period, providing much-needed breathing room to manage cash flow more effectively. Instead of making an instant bank transfer, companies can schedule payments via Lessn.io, allowing them to:

Use their credit card float period to delay cash outflow while still ensuring suppliers receive funds on time.

Optimise working capital by maintaining cash reserves for other operational needs.

Improve financial predictability, ensuring they can cover expenses while earning rewards on every transaction.

By strategically timing payments through Lessn.io, businesses can maintain supplier trust and reliability while also improving internal cash flow. Suppliers receive payments through their preferred method, ensuring no disruption in service, while businesses gain more control over their financial outflows.

Unlock Exclusive Rewards and Travel Benefits That Contribute to Business Growth

Beyond improving cash flow and operational efficiency, Lessn.io helps businesses unlock valuable perks and rewards that can be reinvested into the company. Many credit card programs offer benefits such as:

Travel perks – Businesses can redeem accumulated points for flights, hotel stays, seat upgrades, and airport lounge access. This is particularly valuable for companies with frequent travel needs, allowing them to save on business trips.

Cashback rewards – Cashback cards allow companies to offset operational expenses directly, reducing the cost of utilities, office supplies, and advertising spend.

Employee incentives – Businesses can use credit card rewards to fund gift cards, team-building activities, or corporate events, turning expenses into opportunities to boost employee engagement and satisfaction.

Lessn.io makes it easier than ever to automate and maximise these benefits, ensuring that every payment contributes to a greater financial advantage. By leveraging smart payment routing and automated reconciliation, businesses gain complete visibility into their expenses, rewards earnings, and redemption opportunities, all within a centralised dashboard.

Take Control of Your AP Process and Start Earning More

With Lessn.io, businesses can stop treating supplier payments as just another cost and start using them as a strategic tool for financial growth. Instead of allowing payments to drain cash flow, companies can turn their invoices into a source of value, ensuring that every transaction contributes to reward accumulation, improved liquidity, and business expansion.

Are you ready to start maximising your payments?

Book a Demo today and discover how Lessn.io can help your business earn more on every transaction.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.