Pay Overseas Suppliers via Credit Card: Even If They Don’t Accept Cards

Apr 21, 2025

Use Lessn to fund global supplier payments with your credit card, preserve cash flow, and earn rewards, while Monoova...

Use Lessn to fund global supplier payments with your credit card, preserve cash flow, and earn rewards, while Monoova handles secure, fast FX settlement in your supplier’s local currency.

Managing international payments for business shouldn’t mean sacrificing flexibility or efficiency. Lessn empowers you to fund overseas supplier invoices using your credit card, whether it’s AMEX, Visa or Mastercard, unlocking rewards, extending cash flow, and simplifying accounting.

Behind the scenes, Monoova facilitates fast and compliant FX supplier payments, delivering funds in your vendor’s local currency with competitive exchange rates. Together, Lessn and Monoova give you a modern, end-to-end payment solution built for today’s finance teams.

International Payments, Less Hassle

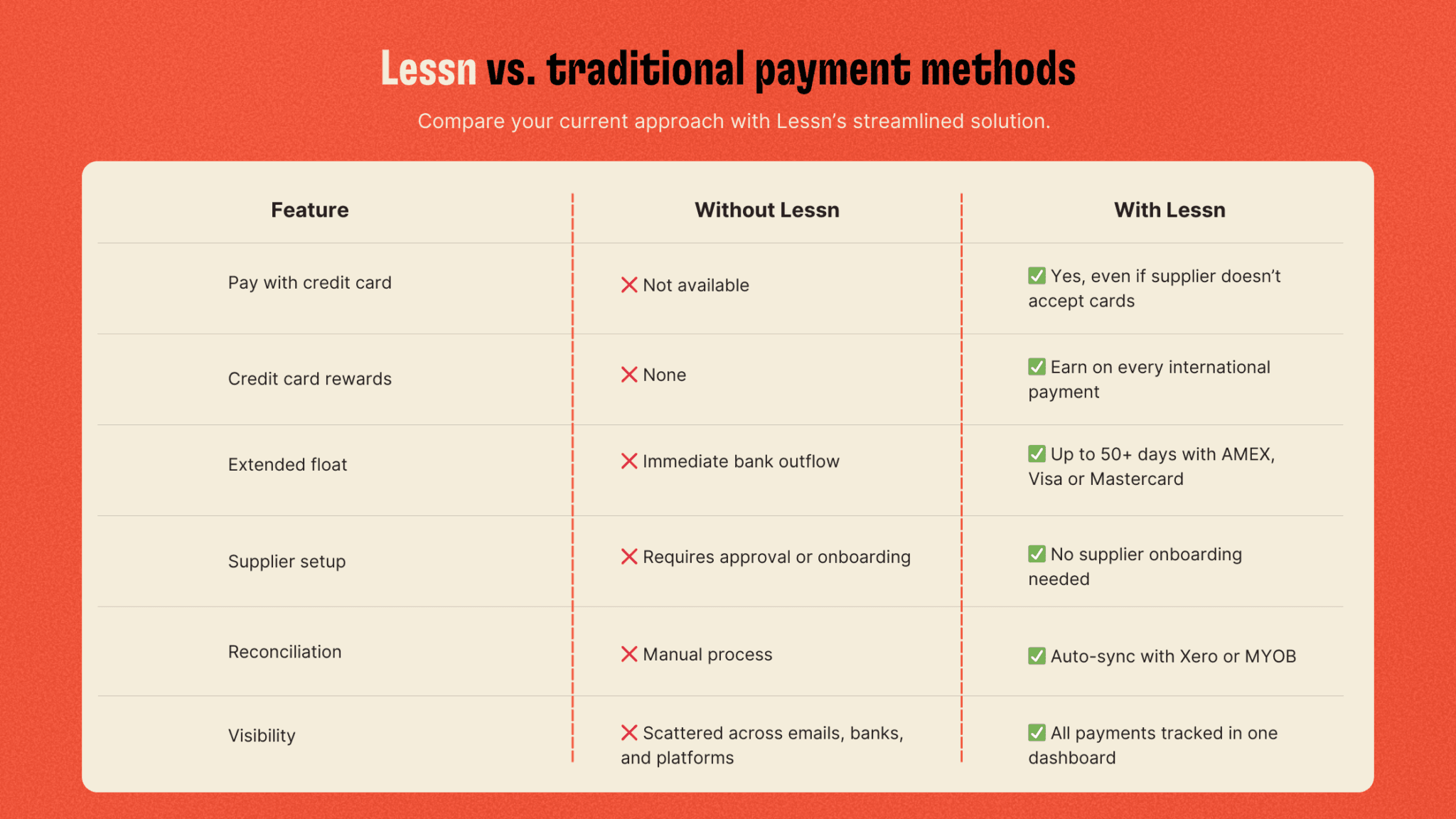

For many businesses, sending international supplier payments is one of the most frustrating parts of managing cash flow. Traditional methods like SWIFT bank transfers are slow, expensive, and inflexible. They lock up cash, offer poor foreign exchange (FX) rates, and provide limited visibility across teams.

You’re often forced to pay upfront using your business account, with no option to use your AMEX, Visa or Mastercard, even if that would suit your cash flow strategy better. That means no float, no rewards, and no flexibility.

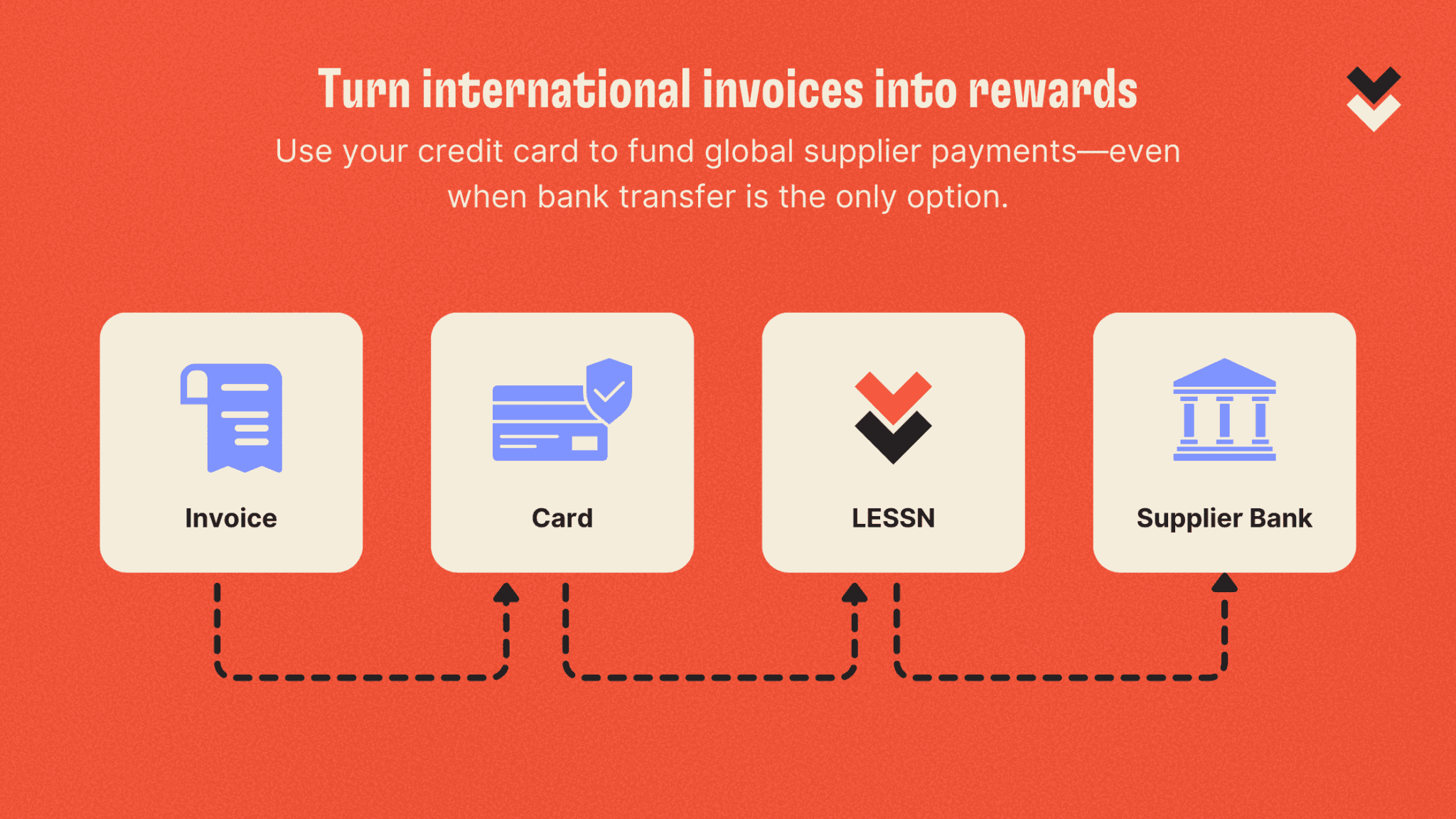

Lessn changes that. Now you can pay any international supplier using your credit card, even if they only accept bank transfers. Through a seamless integration with Monoova, Lessn allows you to fund cross-border payments by card, while Monoova handles settlement in your supplier’s local currency.

It’s faster, smarter, and built for finance teams who want more control.

What You Can Do with Lessn

Fund FX Payments by Credit Card

Lessn allows you to pay international suppliers with your business credit card, even if those suppliers only accept traditional bank transfers. This feature is a game-changer for businesses looking to earn points, extend working capital, or eliminate wire transfer friction. Your credit card becomes a smarter way to handle international payments for business transforming routine supplier settlements into strategic spending opportunities.

Extend Cash Flow

Using your card to fund FX supplier payments gives you access to your credit card’s full interest-free period up to 50+ days with many providers. This means you don’t need to part with your cash the moment an invoice is due. Instead, you can pay your supplier on time while retaining liquidity to support operations, take on new opportunities, or simply maintain a healthier buffer in your business account.

Earn Rewards on Every International Payment

When you fund global payments through Lessn using a rewards-earning credit card, those large supplier invoices can turn into valuable business benefits. Depending on your card provider, you could earn frequent flyer miles, cashback, or other perks on payments that previously offered no return. Whether it’s stock purchases, international contractors, or overseas marketing services, you can now convert essential spend into tangible business value.

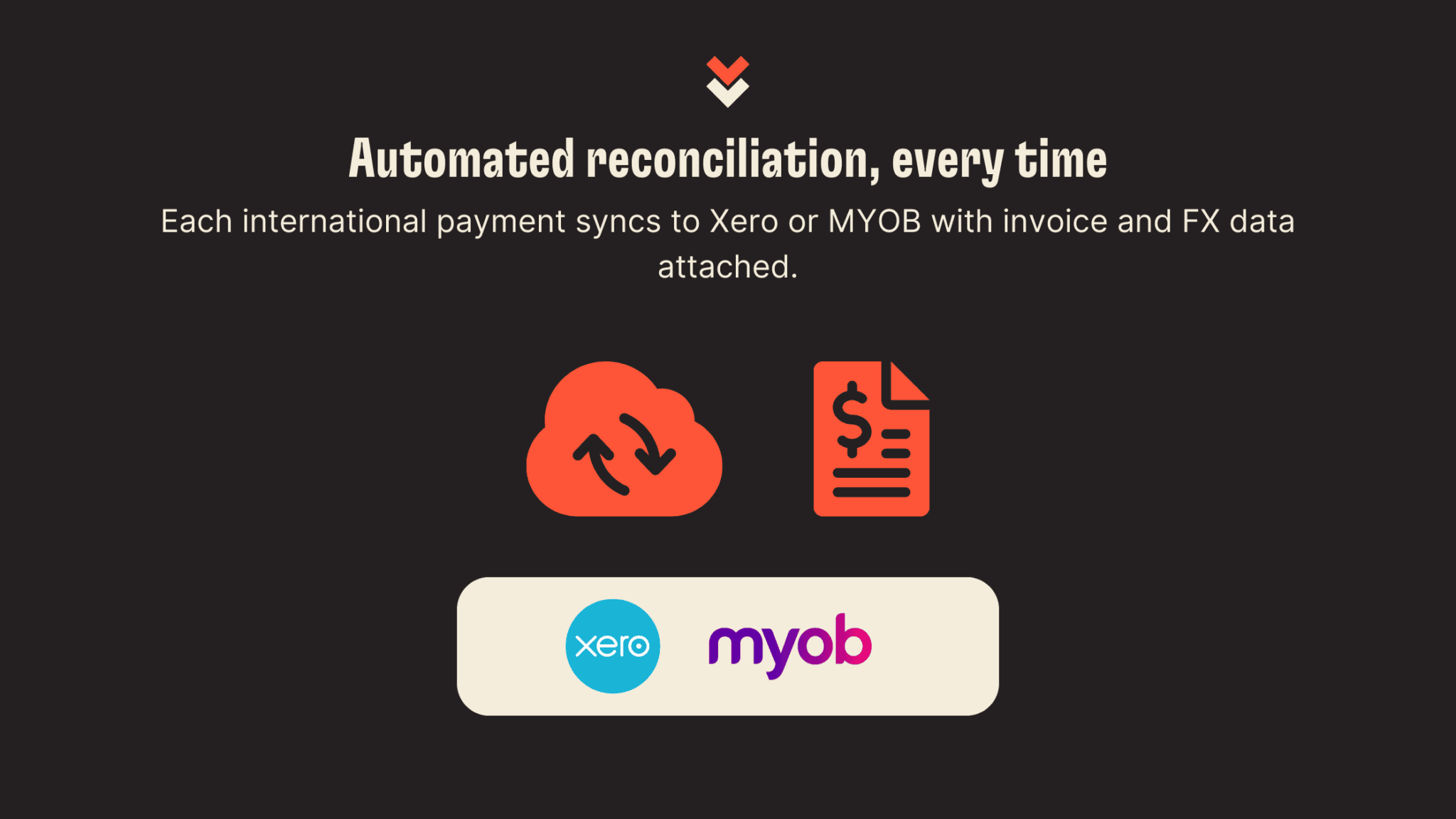

Automate Reconciliation

Manual reconciliation of FX supplier payments is tedious and error-prone. Lessneliminates the need for spreadsheets and double entry by syncing each transaction directly with your accounting platform like Xero or MYOB. Payment data is matched to the correct invoice, including FX conversion details and timestamps, so your books stay clean, accurate, and up to date.

Track and Manage in One Place

Forget toggling between banks, accounting tools, and card statements. Lessn gives you a unified dashboard where you can view every international supplier payment along with statuses, payment methods, approval steps, and reconciliation records. It’s a single source of truth designed for finance teams that want full control over international payments for business.

How It Works: Paying International Suppliers with Lessn

Here’s how Lessn and Monoova work together to simplify global payments:

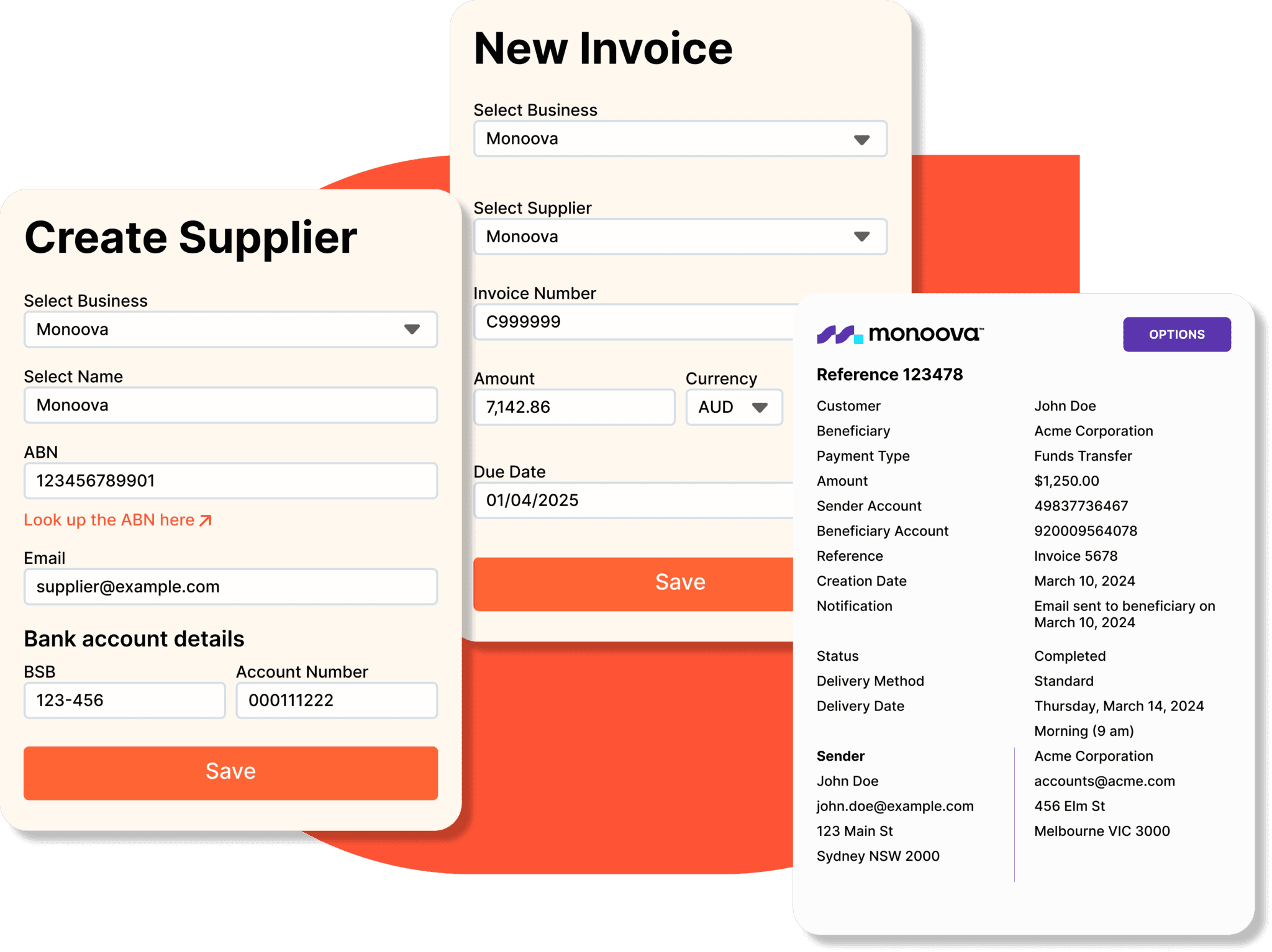

1. Create Your FX Payment in Monoova

Log into Monoova and set up the overseas transfer. Enter your supplier’s local bank details and choose the currency and amount.

2. Add Monoova as a Supplier in Lessn

Treat Monoova like any other supplier in Lessn. Use the bank details they provide for incoming funds.

3. Fund the Transaction Using Your Credit Card

Use Lessn’s one-time payment feature to fund the amount via credit card. Enter the invoice details and the reference ID from Monoova.

4. Lessn Pays Monoova -> Monoova Settles the FX Transfer

Lessn sends the funds to Monoova, and Monoova converts the amount and sends it to your supplier—quickly and securely.

5. Your Accounting Software is Automatically Updated

Lessn matches the payment to the correct invoice and syncs the data back into your accounting ledger, fully reconciled.

Your supplier receives a standard local bank deposit, with no need to change how they receive payments. You gain all the benefits of credit card-funded payments without changing your existing workflows.

Who It’s For: Real Business Use Cases

📦 Importers and Product Businesses

“We buy stock from Europe and Asia. With Lessn, we use our AMEX to fund payments, giving us 55 days of float and thousands of points in rewards.”

Why it works: Large invoice values turn into card rewards, and the extended float keeps stock moving without draining operating capital.

🧑💻 Agencies and Offshore Teams

“Our developers are based in Vietnam and the UK. Lessn makes it simple to fund payroll in their currency while earning credit card points.”

Why it works: Monthly payroll for global teams becomes an opportunity to earn rewards while simplifying cross-border contractor payments.

🏢 Property and Construction Businesses

“We regularly send deposits and payments overseas. Lessn lets us do this by card, even when vendors only accept bank transfers—improving our cash flow.”

Why it works: High-value, time-sensitive payments are made efficiently via card, with no supplier onboarding required and cash preserved in the business account.

Why Use Lessn for Global Payments?

Lessn is built for the way modern businesses operate

Modern finance teams need more than just a way to move money. They need visibility, flexibility, and control over how payments are made, tracked, and reconciled.

Lessn brings together the tools businesses already rely on credit cards, bank transfers, accounting platforms, and reporting systems and integrates them into one streamlined experience.

What makes Lessn unique is that it works within your existing supplier workflows.

You don’t need to onboard vendors or ask them to change how they receive funds. Your suppliers continue receiving standard bank transfers, while you gain access to extended float, card rewards, automated reconciliation, and better cash flow planning. It’s built to improve your internal operations without disrupting your external relationships.

Built for Finance and Compliance

Managing international payments means dealing with regulatory, security, and audit requirements. Lessn is designed with these expectations in mind, giving finance teams the confidence and tools they need to maintain control and compliance across every transaction.

Key features include:

End-to-end encryption to protect sensitive payment and cardholder information from submission through to settlement

Real-time audit trails for every cross-border payment, providing complete visibility over who initiated, approved, and finalised each transaction

Role-based permissions that let you assign payment responsibilities across your team, reducing the risk of unauthorised activity

Customisable approval workflows to suit the size and structure of your business, including single or multi-step authorisation

Secure, native integration with accounting platforms like Xero, MYOB, and QuickBooks, ensuring your records are always up to date and accurate

Lessn gives your finance and compliance teams peace of mind, knowing every international payment is secure, traceable, and properly authorised.

Strategic Benefits: International Payments as a Cash Flow Tool

Traditionally, international payments are seen as a cost centre—funds leave the business quickly and offer little return. Lessn changes that mindset by helping you use overseas supplier payments to your advantage.

Here’s how Lessn turns FX payments into a financial strategy:

Maximise card float: Use your business credit card to fund supplier invoices, taking advantage of your interest-free period to keep cash in reserve for longer

Improve short-term liquidity: Delay cash outflow while ensuring your suppliers are paid on time, which helps avoid late fees and preserve business relationships

Earn more from your spend: Convert large overseas expenses into credit card rewards like cashback, frequent flyer points, or travel credits that benefit the business

Increase payment capacity: Split large supplier invoices across multiple cards when needed to make higher-value payments without exceeding individual card limits

Avoid holding excess foreign currency: Remove the need to pre-fund FX accounts or hold currency balances that may sit unused or fluctuate in value

Instead of letting international payments reduce your cash position, Lessn gives you tools to manage them with purpose. Every payment becomes an opportunity to strengthen cash flow, build loyalty rewards, and simplify financial operations.

Frequently Asked Questions

Can I pay any international supplier with a credit card?

Yes, you can. Lessn allows you to fund any overseas supplier payment using your business credit card—even if that supplier doesn’t accept card payments. The process works by routing your card payment through Lessn, which then sends a standard bank transfer to your supplier in their local currency. It’s a simple and secure way to bridge the gap between card-funded payments and traditional bank deposits.

Do I need my supplier to accept card payments?

No. One of Lessn’s core features is that your supplier doesn’t need to accept card payments or change their processes. You pay with your card, and they receive the money via a normal bank transfer, just as they would with any other payment. There’s no onboarding, no merchant setup, and no extra steps for your supplier. It’s seamless for them—and strategic for you.

What FX rates will I get?

Lessn integrates with Monoova to provide access to wholesale foreign exchange (FX) rates. These are typically more competitive than what you’d find through traditional business banking channels. By avoiding inflated margins and hidden fees, you get better value for every international transaction.

Do I still earn AMEX or Visa points?

Yes. When you use a rewards-enabled business credit card to fund international payments through Lessn, you’ll continue earning points, cashback, or other perks as usual. That means your supplier invoices become an opportunity to accumulate valuable benefits, just like your other card-based expenses.

Can I split a large international payment across cards?

Yes, you can. Lessn supports multi-card payments, so if you’re managing high-value invoices, you can divide the amount across two or more credit cards. This helps increase your available spend capacity and gives you the flexibility to manage limits, billing cycles, and rewards strategies more effectively.

How fast are payments settled?

Monoova processes international transfers promptly. Settlement times depend on the destination country and the currency involved but are generally completed on the same or next business day. This ensures your suppliers get paid quickly while you maintain control over the timing and method of funding.

Does Lessn support multiple entities?

Yes. If you operate across multiple ABNs, legal entities, or business divisions, Lessn makes it easy to manage payments across all of them. You can set user roles, separate cards and workflows by entity, and keep reporting streamlined. It’s ideal for finance teams handling diverse or growing organisational structures.

Final Thoughts

Sending international payments doesn’t need to be frustrating, time-consuming, or inflexible. If your business is still relying on wire transfers, battling poor FX rates, or struggling with manual reconciliation, it’s time to rethink your process.

Lessn gives you the power to:

Pay overseas suppliers with a credit card, even when they don’t accept cards

Preserve working capital by using your card’s interest-free period

Earn rewards on international supplier payments—whether it’s AMEX points, cashback, or travel perks

Automate reconciliation directly into your accounting platform

Track and manage international payments in one central, secure dashboard

With Lessn and Monoova working together, you can make international payments for business with more control, visibility, and strategic upside. Every invoice becomes an opportunity to stretch cash flow, simplify reporting, and create long-term value.

Ready to modernise your approach to international supplier payments?

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.