Smarter Payment Tools for Bookkeepers

Apr 22, 2025

Bookkeeping already comes with enough complexity. Managing client payments shouldn’t be another burden. Lessn gives bookkeepers a faster, simpler ...

Bookkeeping already comes with enough complexity. Managing client payments shouldn’t be another burden. Lessn gives bookkeepers a faster, simpler way to run payables, helping you save hours each week while adding more value for your clients.

Whether you’re handling payments for one client or managing multiple across different entities, Lessn helps you automate approvals, eliminate file uploads, and streamline reconciliation all without changing how suppliers get paid.

Instead of jumping between spreadsheets, emails, and banking portals, you can manage everything from a single dashboard.

Why Modern Bookkeepers Need Smarter Payment Tools

Your clients rely on you to do more than just track expenses they count on you to keep operations smooth, ensure suppliers are paid on time, and help maintain healthy cash flow.

But when you’re stuck uploading ABA files, following up on overdue approvals, or manually ticking off payments line by line, it’s easy to get buried in admin instead of focusing on value-add work.

The reality is, traditional payment processes were not built for modern bookkeeping. They’re clunky, error-prone, and make it harder for you to scale your services or offer strategic insight. Every delay whether it’s waiting on a client to log in or dealing with a reconciliation mismatch costs you time and adds friction.

Lessn changes the game for bookkeepers by automating the entire payment journey. With one platform, you can:

Pull invoices straight from Xero or MYOB

Automate supplier payments and approval workflows

Let clients fund payments using their business credit card even if the supplier doesn’t take cards

Sync everything back into the ledger for instant reconciliation

You’ll spend less time managing admin and more time adding real value. Your clients benefit from smoother payments, extended float, and rewards on spend. And best of all, no one has to change how they get paid.

This is the future of payment support for bookkeepers and it starts with Lessn.

Common Payment Pains for Bookkeepers

How Lessn Helps

Lessn gives bookkeepers the power to modernise how they manage payments for clients without needing suppliers to change how they operate. Your clients still pay their bills via standard bank transfers, but behind the scenes, Lessn enables smarter, faster, and more strategic workflows that reduce admin and improve outcomes.

You’re no longer stuck waiting on clients to approve files or manually uploading ABA batches. Lessn makes the payment process smoother by bringing everything invoices, approvals, payments, and reconciliation into one place.

Here’s what you can do with Lessn:

Automate supplier payments and approvals

Set up workflows that pull in invoices, notify clients for quick approval, and automatically release payments on schedule. You control the process while giving clients visibility and input.Let clients pay with credit cards even when suppliers don’t accept them

Lessn lets clients fund payments via their AMEX, Visa, or Mastercard. Suppliers still receive the payment via bank transfer as normal. This unlocks credit card float and points on payments that wouldn’t normally qualify.Earn points and cashback on client business expenses

Turn every eligible payment into a value-add. Whether it’s cashback, Velocity points, or AMEX travel rewards, your clients benefit from spending they were already doing.Reconcile instantly in Xero or MYOB

As soon as a payment is made, Lessn pushes the transaction back to your accounting software and marks it as paid with all references, notes, and details included. You stay on top of the books without spending hours doing it.

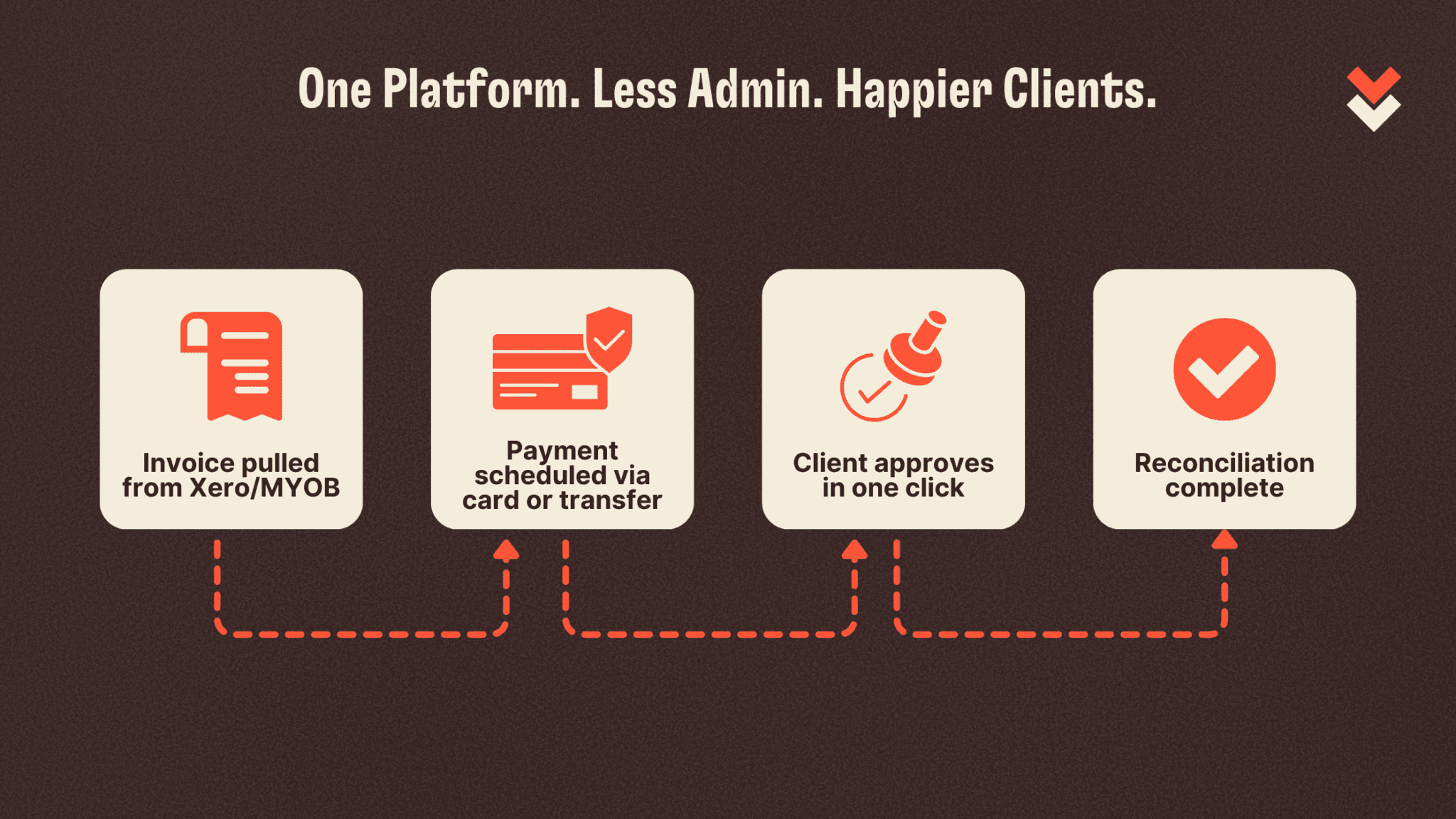

How the Workflow Looks

Here’s what a typical pay run looks like using Lessn:

Sync invoices from Xero or MYOB

No need to manually enter bills. Lessn automatically pulls in outstanding payables from your client’s chart of accounts.Select payment method

Choose between credit card or bank transfer for each bill. You can also let Lessn split a payment across multiple cards if needed.Schedule or split payments

Decide when each bill is paid. Space out large transactions, delay based on cash flow forecasts, or align payment timing with client receivables.Client approval

Clients receive an email or app notification with a pre-built payment batch. One click confirms everything, keeping things compliant but fast.Lessn sends payments and handles remittances

Suppliers receive a standard bank transfer and remittance note. No supplier onboarding or card acceptance required.Transactions are reconciled automatically

Payments are matched to the correct invoices and synced back into your accounting platform — with no manual entry or reconciliation work required.

This workflow eliminates the friction that bookkeepers face every day. No more chasing unpaid bills. No more late-night reconciliations. And no more explaining ABA files or lost payment references. Lessn is built to help you do your best work faster, smarter, and with less admin.

🔍 Real-Life Examples

Scenario 1: Managing a Property Management Client

As a bookkeeper managing payments for a property management company, you’re likely juggling over 100 suppliers each month. That means coordinating payments for contractors, utilities, strata fees, cleaning services, and more often across multiple properties or entities.

With Lessn, you eliminate the manual back and forth. You can create a full batch of supplier payments, send a single approval link to your client, and once they approve, the system takes care of the rest. Payments are sent out via credit card or bank transfer, and all transactions reconcile automatically in Xero or MYOB.

Instead of spending hours chasing invoices, creating ABA files, and manually marking payments as complete, the entire cycle is reduced to a few clicks. What used to take an afternoon now takes minutes giving you time to focus on analysis, reporting, and advising your client on bigger-picture financial decisions.

Scenario 2: Helping a Small Business Improve Cash Flow

One of your clients is a growing retail business with unpredictable cash flow. They’re often tight at the end of the month, especially before major stock deliveries or when rent is due. In the past, they either delayed payments or dipped into savings which disrupted their budget and made reconciliation more difficult.

With Lessn, they now fund key outgoings like rent or supplier bills using their AMEX and Visa business cards. They split large invoices across two cards to manage their limits and stretch payment terms using the interest-free period.

You still manage the books. They still pay vendors via bank transfer. But now you’ve helped them preserve liquidity and unlock points on every eligible transaction. It’s a simple switch that delivers real value.

Bonus Value: Credit Card Rewards

Clients love points, but most suppliers don’t take cards. Lessn fixes that.

With Lessn, your clients can:

Use AMEX, Visa, or Mastercard to fund supplier payments, even if the supplier only accepts bank transfers

Maximise cashback or travel rewards on expenses they already planned to pay

Track spending and reward accruals from a single, user-friendly dashboard

You don’t have to calculate points or manage a rewards system, Lessn handles it. The client sees tangible value in the form of free flights, cashback, or perks. And you get to offer a value-add without adding work to your plate.

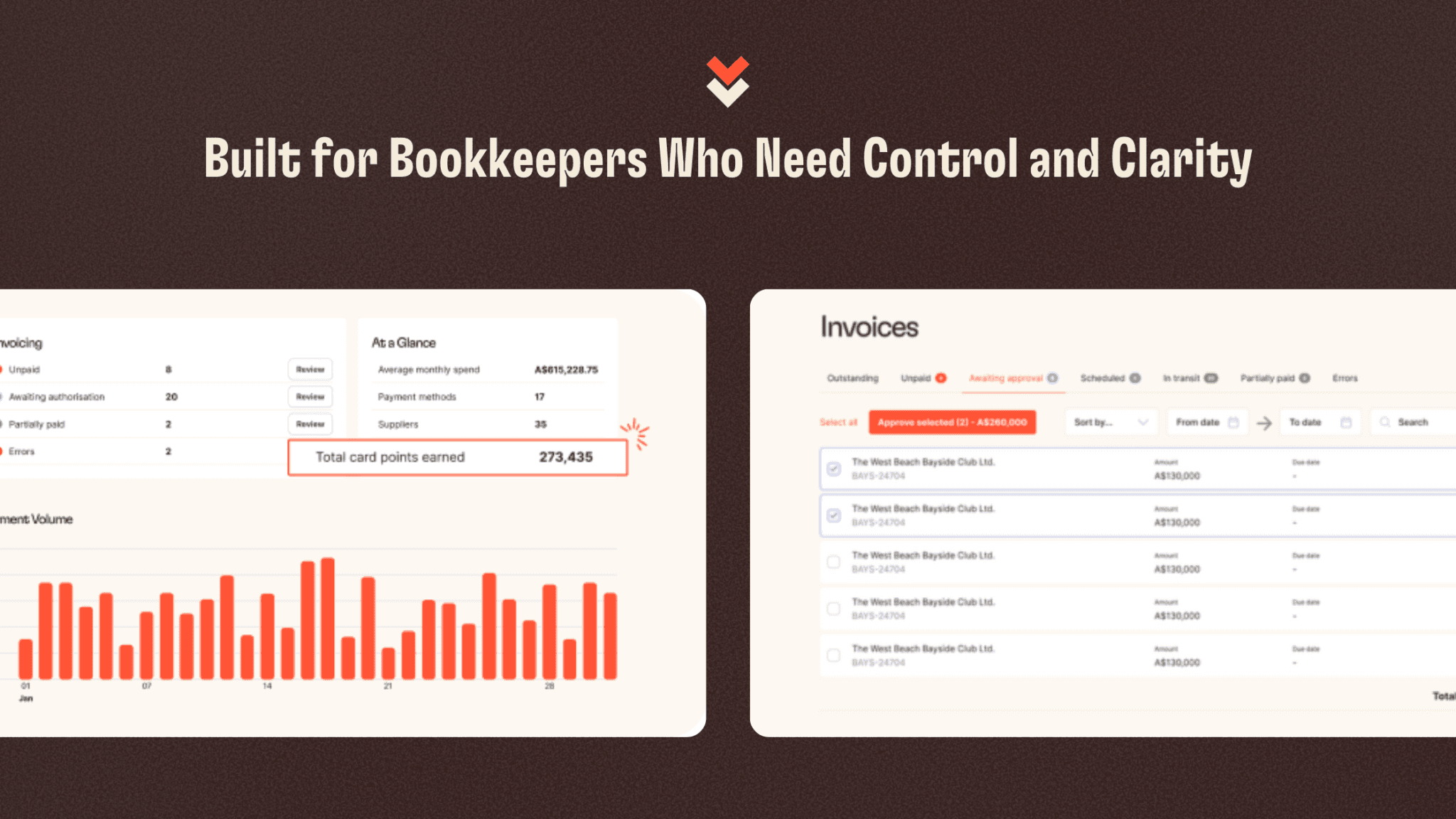

Built for Control & Visibility

Lessn is designed with bookkeepers in mind. You need visibility across clients, control over workflows, and security you can trust.

Here’s how Lessn supports you:

Secure, multi-user access so you and your clients can collaborate without compromising access or visibility

Approval workflows that keep everything compliant but simple no chasing signatures or managing email threads

Real-time payment status tracking, so you always know what’s been sent, what’s pending, and what needs attention

Integration with Xero, and MYOBkeeping your accounting system in sync and your reconciliation clean

Whether you’re managing two clients or twenty, Lessn gives you the infrastructure to scale your bookkeeping practice while saving hours every month.

FAQ: What Bookkeepers Want to Know

Do I still control the payments?

Yes. You can manage and schedule payments on behalf of your client. You can also build in approval workflows to suit your client’s preferences—whether they want to approve everything or just the high-value items.

Do I still control the payments?

Yes. As the bookkeeper, you stay fully in control of the payment process. You can upload or sync invoices, choose the payment method (card or bank transfer), and schedule when payments are made. You can also set up workflows that include your client’s approval before anything is processed, so you’re never flying blind or acting without consent.

Do clients need to change how they receive payments?

No. That’s one of the biggest advantages of using Lessn. Even when your client chooses to fund a payment with a credit card, their supplier still receives the payment via a regular bank transfer in the local currency. There’s no need to ask suppliers to accept cards or sign up for anything new. The payment experience remains exactly the same for them.

Can I manage multiple clients from one login?

Yes. Lessn supports multi-client workflows designed specifically with bookkeepers and partner firms in mind. You’ll have a central dashboard where you can switch between clients, manage approvals, track payment statuses, and monitor outstanding bills — all from one place. Whether you’re managing two businesses or twenty, Lessn makes it easy to stay organised.

Does Lessn replace my accounting software?

Not at all. Lessn works alongside the accounting platforms you already use, including Xero, MYOB, and QuickBooks Online. It pulls invoice and contact data from your accounting system, processes payments through Lessn, then pushes the payment status and reconciliation data back. It’s built to complement your workflow — not disrupt it.

Is Lessn secure and compliant?

Yes. Lessn is built with security and compliance at the core. Every transaction is encrypted, user access is role-based, and there’s a full audit trail for every payment. You can customise approval layers to meet your firm’s policies and rest easy knowing that payments are tracked and stored securely. It’s trusted by finance teams who prioritise governance and accountability.

Can my clients earn rewards on payments through Lessn?

Yes — and it’s a major perk. Lessn allows clients to use their AMEX, Visa, or Mastercard to fund payments even when the supplier doesn’t accept cards. This means clients can earn credit card rewards like points or cashback on bills they’d normally pay via bank transfer. It’s a simple way to add value without adding work.

Start Simplifying Client Payments Today

Managing payments doesn’t have to be a time-consuming, manual process. With Lessn, you can give your clients a faster, more flexible way to pay their suppliers while you stay in control of the process and keep the books tidy.

No more chasing ABA files. No more last-minute approvals. No more hours spent reconciling transactions across multiple systems. Lessn lets you streamline the entire workflow from invoice to payment to reconciliation, freeing up your time and giving your clients a smoother experience.

As a bookkeeper, your value comes from the clarity and control you bring to your clients’ financials. Lessn helps you deliver that value more efficiently. You can manage payments on behalf of your clients, ensure they never miss a due date, and introduce new benefits like card-based rewards or cash flow flexibility all without asking their suppliers to change how they operate.

Whether you’re supporting one client or fifty, Lessn helps you:

Automate supplier payments and approvals with full visibility

Let clients use credit cards even if suppliers only accept bank transfers

Maximise credit card points and float to improve client outcomes

Reconcile payments with one click in Xero, MYOB, or QuickBooks

Centralise payment oversight for all your clients in one easy-to-use dashboard

Ready to modernise your practice and spend less time on payment admin? Lessn is the smarter way to simplify client payments while making your service more valuable than ever.

👉 Book a demo to see Lessn in action.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.