The Best Small Business Payment Solutions for 2025

Apr 16, 2025

In 2025, the way small businesses manage and move money has evolved far beyond paper invoices and manual bank ...

In 2025, the way small businesses manage and move money has evolved far beyond paper invoices and manual bank transfers. Whether you’re paying suppliers, accepting customer payments, or trying to optimise cash flow, the right small business payment solution can give your business an edge.

This guide breaks down the best small business payment solutions for 2025, drawing insights from industry leaders including Airwallex, DSGPay, and Lessn.

We’ll cover what to look for in small business payment solutions, how each platform compares, and how Lessn offers a unique way to turn your payments into a strategic advantage.

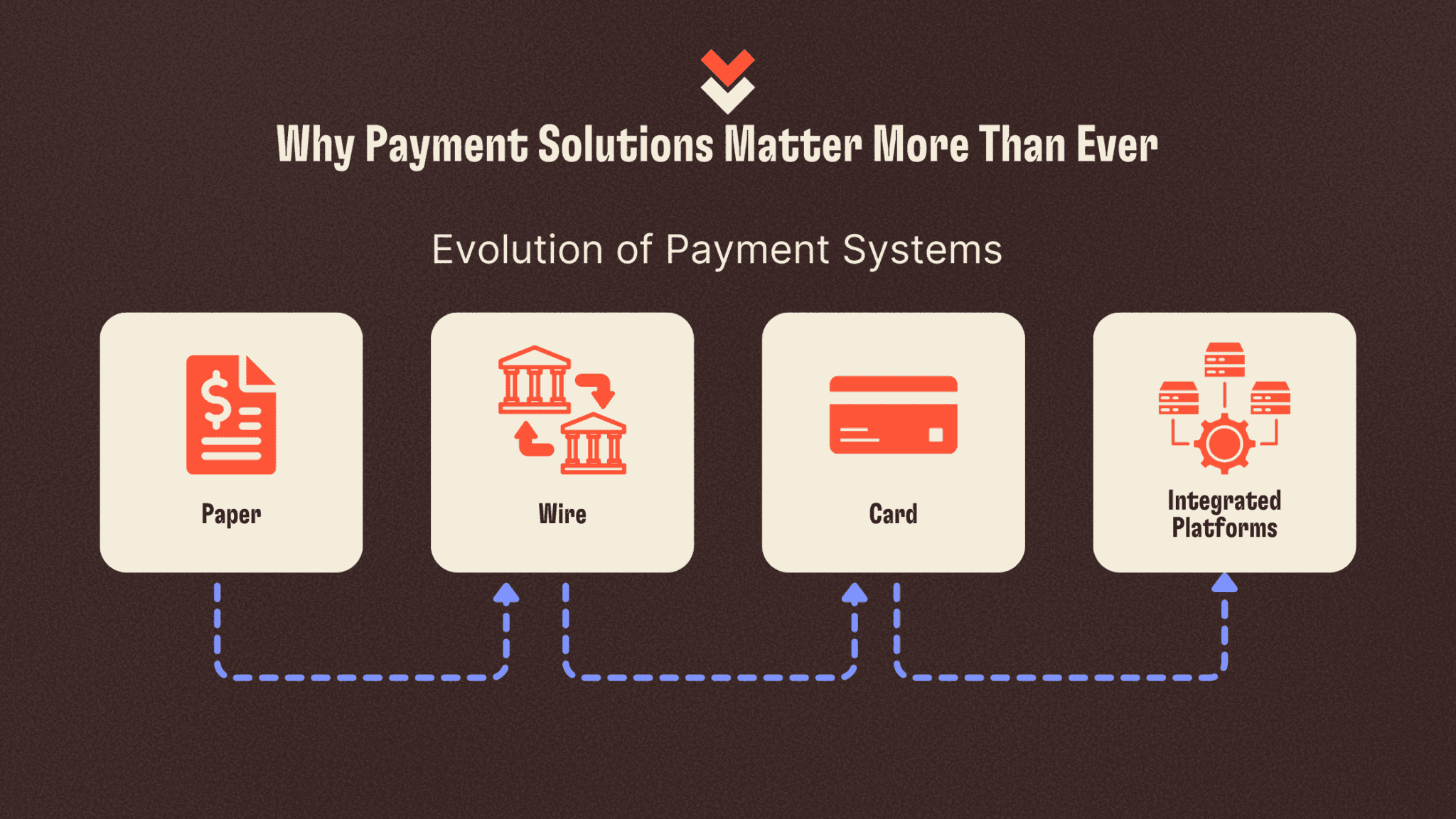

Why Payment Solutions Matter More Than Ever

The role of small business payment solutions has shifted from a simple transaction layer to a strategic tool that impacts nearly every part of a small business’s financial operations. With rising interest rates, volatile cash flow, and global supply chain pressures, how and when you move money can make or break your ability to grow.

More than half of small business owners cite cash flow management as a major challenge. Manual payments and fragmented systems only add to the workload. Today’s business leaders need small business payment solutions that:

Free up time by automating repetitive admin tasks

Extend cash flow using interest-free card float and better payment timing

Offer visibility and control across bills, suppliers, and teams

Help capture value in the form of credit card rewards and early payment discounts

Support growth across borders with multi-currency and international capabilities

In short, a modern small business payment solution should work as hard as you do.

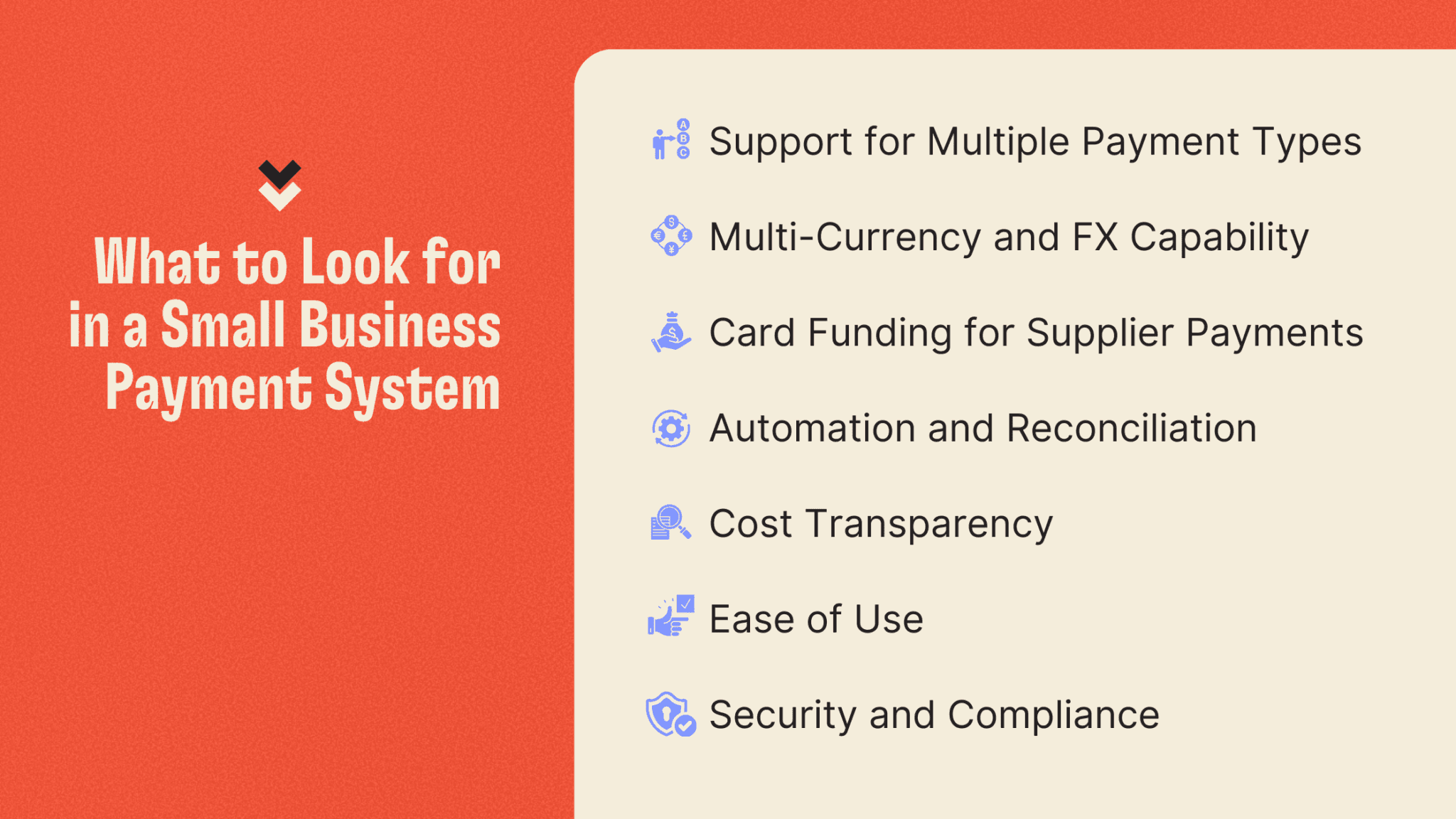

What to Look for in a Small Business Payment System

Choosing the right small business payment solution can make all the difference in managing your money smarter. But with so many options out there, what should you really focus on?

1. Support for Multiple Payment Types

Your ideal platform should let you pay or accept funds via card, bank transfer, direct debit, and even digital wallets. Flexibility is key, especially when your clients and suppliers have different preferences.

2. Multi-Currency and FX Capability

If you work with international suppliers, overseas contractors, or plan to expand globally, look for a tool that lets you hold and convert multiple currencies easily. Even better if it partners with a provider like Monoova to streamline FX.

3. Card Funding for Supplier Payments

This is where Lessn stands out. Being able to pay any business expense with your credit card—while the supplier still gets a regular bank transfer—opens up float, improves working capital, and earns points.

4. Automation and Reconciliation

A great payment solution should integrate with your accounting software and automatically reconcile payments, saving you hours each month.

5. Cost Transparency

Compare transaction fees, FX margins, and hidden costs. The cheapest option upfront isn’t always the most cost-effective long-term if it lacks rewards or float.

6. Ease of Use

Setup and day-to-day management should be intuitive. You shouldn’t need to be a CFO to understand how to run payments. Bonus points for approval workflows and user permissions.

7. Security and Compliance

Choose a payment platform that adheres to the highest security standards. Look for PCI-DSS compliance, tokenised card data, two-factor authentication (2FA), and role-based permissions. Security isn’t just a checkbox—it’s essential for protecting customer trust and ensuring safe, fraud-resistant transactions.

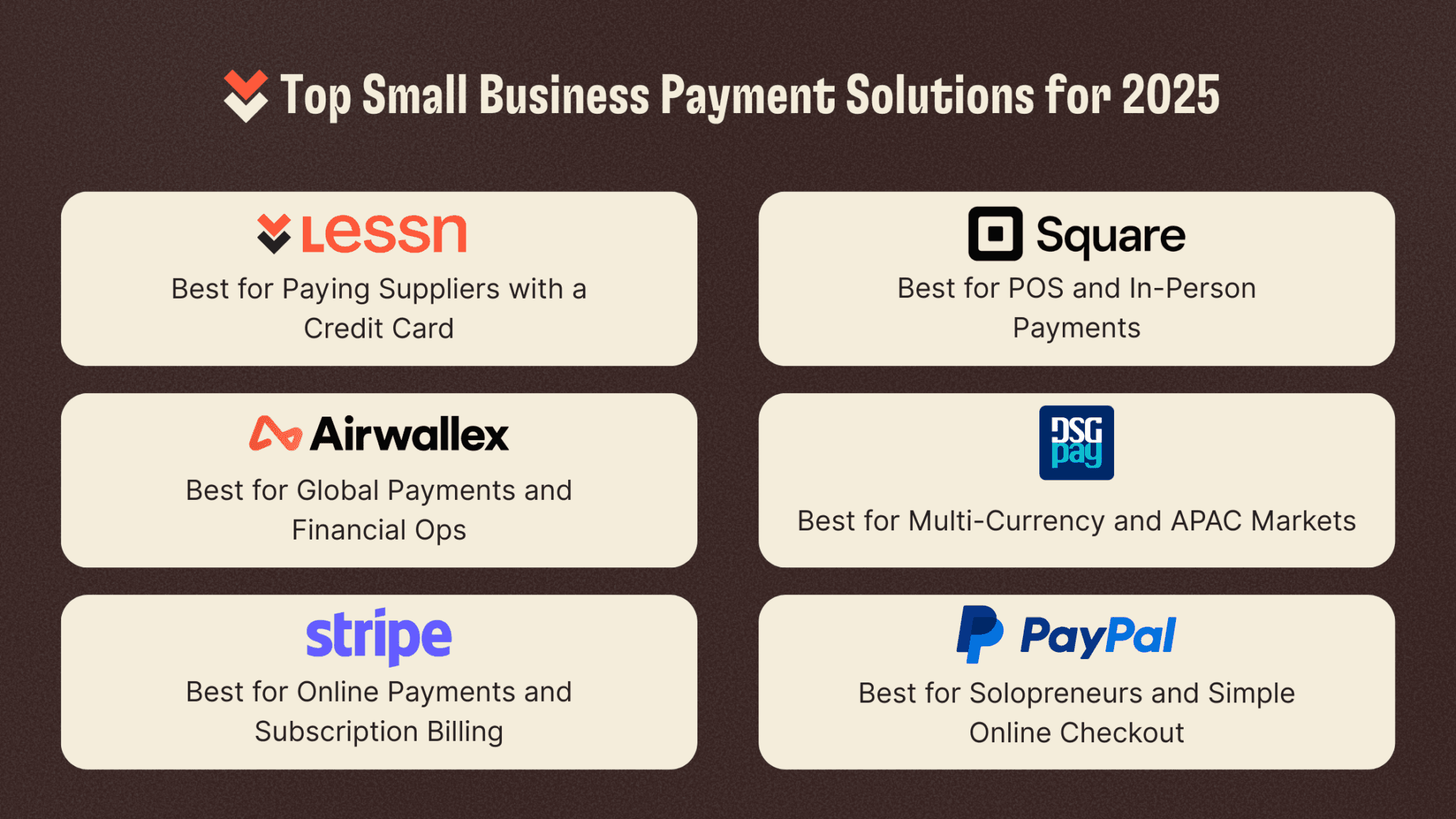

Top Small Business Payment Solutions for 2025

1. Lessn – Best for Paying Suppliers with a Credit Card (Even When They Don’t Accept Cards)

Lessn transforms the way businesses handle outgoing payments. Unlike most platforms that help you collect money, Lessn helps you spend smarter.

It enables you to pay any business expense with a credit card—even if the supplier doesn’t accept cards directly. This unlocks rewards, extends your cash flow, and streamlines reconciliation, all while your suppliers receive a regular bank transfer as if nothing changed.

With support for multi-currency payments via Monoova, Lessn gives you enterprise-level control without enterprise complexity.

Highlights:

Pay any business expense via AMEX/Visa/Mastercard

Supplier receives a standard bank transfer—no onboarding needed

Earn card rewards on payments where you’d normally use cash

Split or schedule payments across accounts/cards

Syncs with Xero, MYOB, and QuickBooks

Make international and multi-currency payments through Lessn’s integration with Monoova

Fund overseas payments via credit card and pay suppliers in their local currency

Access wholesale FX rates, extend cash flow, and earn rewards

Why it’s great in 2025: Lessn gives business owners more control over outflows without the hassle of traditional bank payments or FX complications. It’s one of the few platforms that combines supplier payments, credit card rewards, AP automation, and global payments in one tool.

Airwallex – Best for Global Payments and Financial Ops

Airwallex is a complete financial infrastructure platform. Businesses can open global accounts, issue virtual cards, manage FX, and streamline cross-border payments. It’s especially powerful for businesses operating in multiple markets, as it consolidates foreign currencies and integrates seamlessly with eCommerce and accounting platforms. It’s a strong fit for companies looking to centralise their financial ops with speed, transparency, and scale.

Highlights:

Accept and hold 14+ currencies

Instant cross-border payouts

Integrated with Shopify, Xero, and more

Multi-currency cards and bill pay

Ideal for:

Businesses scaling into international markets, managing distributed teams or suppliers, and needing a single view of cash flow across entities and currencies.

Stripe – Best for Online Payments and Subscription Billing

Stripe is one of the most developer-friendly and customisable payment platforms available. It’s particularly well-suited to businesses with complex online checkout needs, recurring billing, or platform-based services.

With powerful APIs, over 135 supported currencies, and built-in fraud prevention, Stripe is a top choice for scaling SaaS, marketplaces, and eCommerce businesses that need advanced control over payment flows and customer billing experiences.

Features:

Global card support, 135+ currencies

Powerful API and integrations

Built-in fraud tools and reporting

Ideal for:

SaaS companies, tech startups, and digital-first businesses looking for full control over checkout flows, billing, and developer-friendly infrastructure.

Square – Best for POS and In-Person Payments

Square excels at point-of-sale (POS) experiences and is tailored to brick-and-mortar businesses. It offers a full suite of hardware, software, and integrated tools for in-person sales, inventory management, invoicing, and mobile payments.

Its simplicity and lack of monthly fees make it ideal for small business owners in hospitality, personal services, retail, or trades looking for a fast, reliable way to accept payments anywhere.

Benefits:

No monthly fees

All-in-one POS and inventory

Simple onboarding and easy integrations

Ideal for:

Hospitality, retail, personal services, and trades, especially businesses needing a reliable mobile or countertop point-of-sale system.

DSGPay – Best for Multi-Currency and APAC Markets

DSGPay is built for businesses in the Asia-Pacific region that need to manage multiple currencies and streamline cross-border payments.

It’s ideal for SMEs dealing with international suppliers, vendors, or customers. The platform supports 14 currencies, offers competitive FX rates, and enables faster settlement times across 81+ countries.

With features like secure notifications and payment links, DSGPay makes international payment processes more efficient and compliant.

Key Features:

Manage funds in 14 currencies

Faster international transfers to 81+ countries

Mid-market FX rates

Secure notifications and custom payment links

Ideal for:

Exporters, importers, and regionally expanding businesses in Asia-Pacific that need smooth cross-border payment flows and currency flexibility.

PayPal Business – Best for Solopreneurs and Simple Online Checkout

PayPal remains one of the most accessible payment platforms for small businesses, especially for freelancers, consultants, and microbusinesses.

Its global brand recognition and ease of setup allow users to accept payments without needing a full-fledged website. With features like invoicing, payment links, QR codes, and business financing, it’s a go-to for solo operators who need to get paid quickly and securely with minimal admin or technical setup.

Pros:

Trusted brand

Invoice and QR code support

Offers working capital loans

Ideal for:

Freelancers, consultants, and microbusinesses looking for a simple, plug-and-play way to accept payments with minimal setup or overhead.

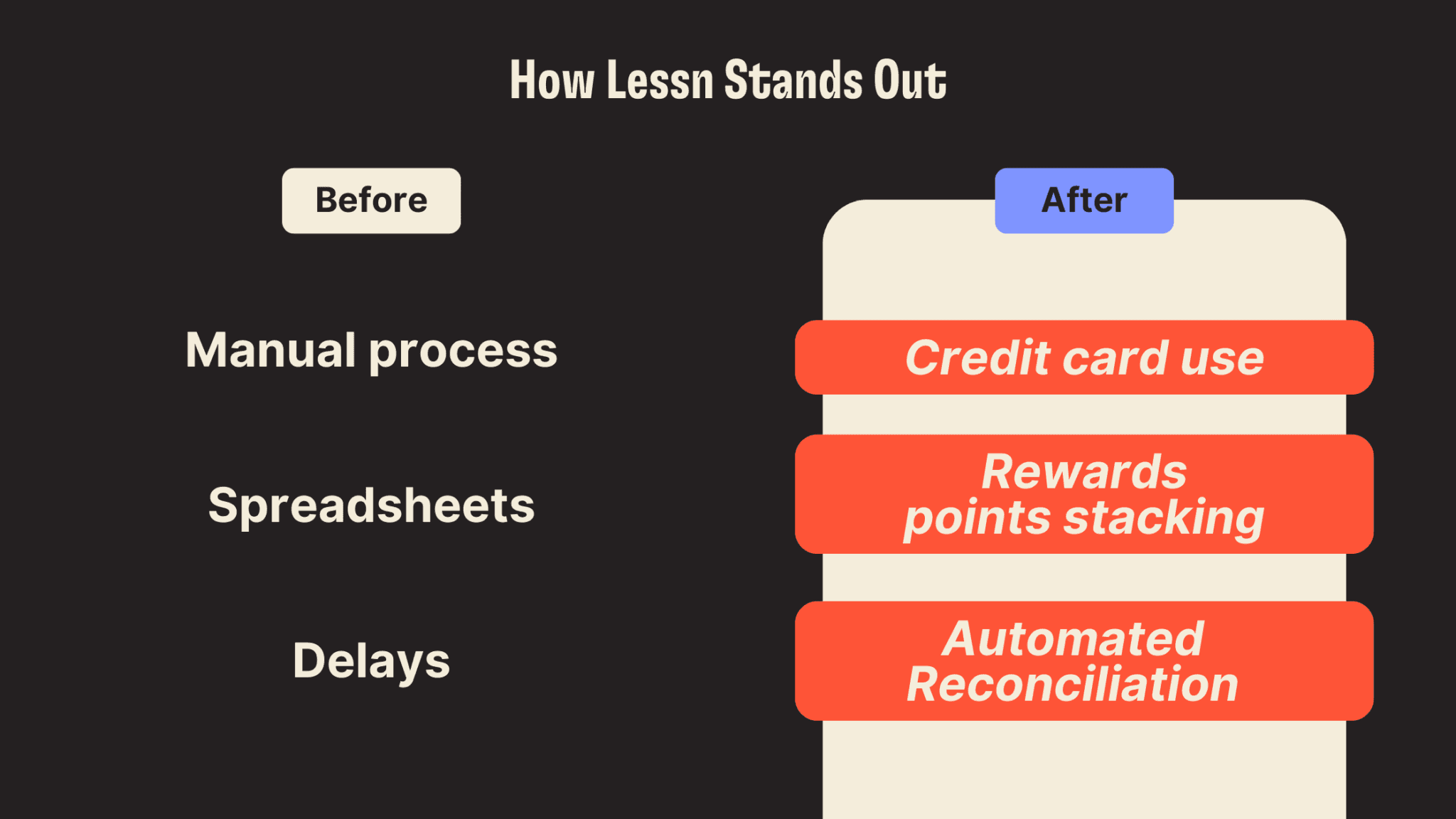

How Lessn Stands Out

Lessn is built for the businesses that want to take control of their outgoing payments. While most platforms are designed for receiving money, Lessn focuses on the outbound layer, where real gains can be made in efficiency, visibility, and working capital.

Lessn is uniquely positioned to support businesses with a range of goals:

Want to earn rewards on every payment? Use your credit card on bills, even if your supplier only accepts bank transfers.

Need to manage large outgoings without cash flow stress? Tap into your credit card’s interest-free period.

Tired of manual admin? Automatically sync your payments and reconciliation with your accounting tools.

Scaling internationally? Pay global suppliers in their currency without worrying about FX markups or delays.

Lessn helps businesses move money with greater purpose by aligning every payment with a financial advantage—whether that’s earning credit card rewards, extending working capital, simplifying reconciliation, or improving cash flow visibility. Each payment becomes an opportunity to drive efficiency, improve cash flow, and return value to the business.

With Lessn, you can:

Use your credit card for any bill, even if your supplier doesn’t take cards

Earn points and cashback while managing your outflows

Extend cash flow with card float (e.g. 55+ days on AMEX)

Automate reconciliation in your accounting platform

Fund international payments in multiple currencies via Monoova, using your credit card and still earn points

With Lessn, you gain control over how payments are funded, timed, and tracked, without disrupting your supplier’s experience.

They still receive standard bank transfers, while you benefit from credit card float, reward points, and streamlined reconciliation. It’s a smarter way to pay that keeps your external relationships unchanged, but delivers internal gains at every step.

Real-World Scenario: How a Business Uses Lessn to Simplify Global Payments

Scenario: An Australian-based design agency regularly contracts a development firm in Vietnam, paying $20,000 USD per month in fees.

Before Lessn:

Each month, the team initiates a wire transfer via their bank.

They pay upfront using cash from the business account.

FX rates vary, with an added 3% international transfer fee.

Payments take 2–3 business days to clear.

Each transaction is manually reconciled in Xero.

After Using Lessn:

They fund the payment via their AMEX Business Card using Lessn.

Lessn processes the payment through Monoova, which pays the supplier in local currency at wholesale FX rates.

The business earns points on their AMEX while preserving cash for 55 days.

Payment auto-syncs to Xero, fully reconciled with the correct invoice.

Result:

$500+ saved per month in FX and transfer fees

5+ hours of manual admin saved

$20,000 worth of card spend converted into AMEX points each month

Smooth, reliable international supplier relationships

Final Thoughts: Choosing the Right Fit

The best small business payment solution for 2025 depends on how your business operates.

Whether you’re handling high volumes of international payments, running a local retail outlet, or looking to improve back-office efficiency, the right platform can give you a serious edge.

Lessn stands out by turning your payments into a strategic advantage. Making payments efficiently, with visibility and control, is what gives Lessn an advantage for small businesses. Lessn enables:

Credit card-funded AP payments, even when suppliers don’t accept cards

Full integration with accounting tools to eliminate manual reconciliation

Float benefits that preserve working capital

Multi-currency capabilities through Monoova that simplify global trade

So whether you’re a sole trader or scaling a multi-entity business, focus on choosing a solution that helps you pay smarter and manage outgoings more effectively.

Ready to Pay Smarter?

Choosing the right small business payment solution plays a meaningful role in improving how your business runs every day.

With Lessn, you don’t have to chase supplier terms, delay bills, or miss out on reward points. You get the tools to fund any invoice with your credit card, automate reconciliation, and optimise your working capital all in one platform that’s built for simplicity.

Whether you’re:

Paying local suppliers or international contractors

Looking to replace manual processes

Wanting to earn points on every expense

Or trying to stretch your cash flow without taking on debt

Lessn gives you the power to do it.

Explore how Lessn can help your business pay smarter and make your money work harder.

👉 Visit lessn.io

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.