What Is Payment Reconciliation and How Can It Be Automated?

Apr 21, 2025

Payment reconciliation is a critical task for any business that manages incoming and outgoing payments. Whether you’re paying suppliers,...

Payment reconciliation is a critical task for any business that manages incoming and outgoing payments. Whether you’re paying suppliers, receiving customer invoices, or reconciling internal transfers, keeping accurate records of what has been paid and received is fundamental to sound financial management.

But for many businesses, reconciliation is still a manual, spreadsheet-driven process. It often involves downloading bank statements, cross-checking transactions line by line, and updating records by hand. This approach is not only slow, it’s also prone to human error, overlooked payments, and misapplied credits. In busy finance teams, it can eat up valuable time that could be better spent on planning, analysis, or strategic work.

When reconciliation errors occur, the consequences can ripple across the business—causing reporting inaccuracies, cash flow miscalculations, and strained supplier relationships.

The good news is, this entire process can be automated. By integrating payment automation tools with your accounting software, you can remove the manual burden, increase accuracy, and gain better control over your financial operations.

In this article, we’ll break down what payment reconciliation really involves, why it matters for growing businesses, and how automation can help you streamline the process, save time, and reduce risk.

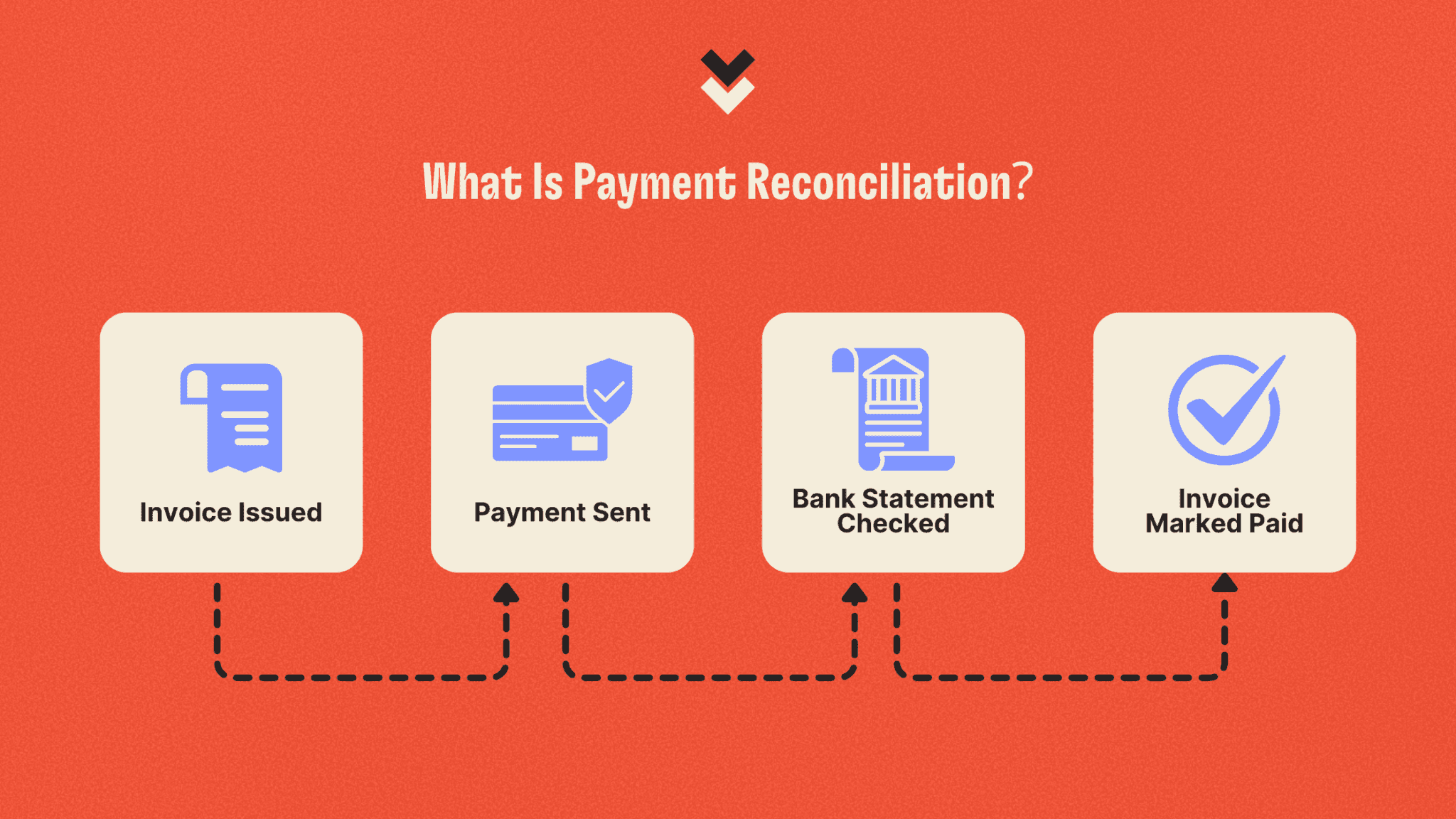

What Is Payment Reconciliation?

Payment reconciliation is the process of comparing your internal financial records, such as invoices, payment batches, or accounts payable reports, with external data sources like bank statements, credit card settlements, or accounting software entries. The goal is to ensure that every payment made or received has been processed accurately, matches the correct amount, and is properly recorded.

This process is crucial for maintaining the integrity of your financial data. It helps businesses catch discrepancies, prevent errors, and maintain up-to-date records that reflect the true state of their cash flow.

In simpler terms, payment reconciliation is how you double-check that the money leaving or entering your accounts actually matches what you expected. It is your financial reality check.

Here’s a basic example of how payment reconciliation works:

Your accounts payable team issues a payment of £2,000 to a supplier for services rendered.

A few days later, you review your business bank statement and confirm that the exact amount was debited.

You return to your accounting software and mark the invoice as “paid,” ensuring the ledger reflects the cleared transaction.

While that may sound straightforward, this process quickly becomes complex when dealing with multiple suppliers, partial payments, foreign currency transactions, refunds, or failed transfers. Without proper reconciliation, businesses risk underpaying, overpaying, or duplicating transactions. Each of these outcomes can damage cash flow, affect supplier relationships, and complicate financial reporting.

When done properly and consistently, payment reconciliation ensures:

Your books are always accurate and audit-ready

Suppliers are paid correctly and on time

Suspicious, duplicate, or failed payments are quickly identified

Your cash flow data is reliable for forecasting and decision-making

In short, payment reconciliation is a financial safeguard. It ensures that every transaction adds up, both literally and strategically. And when automated, it becomes one of the simplest ways to bring more control and accuracy into your finance function.

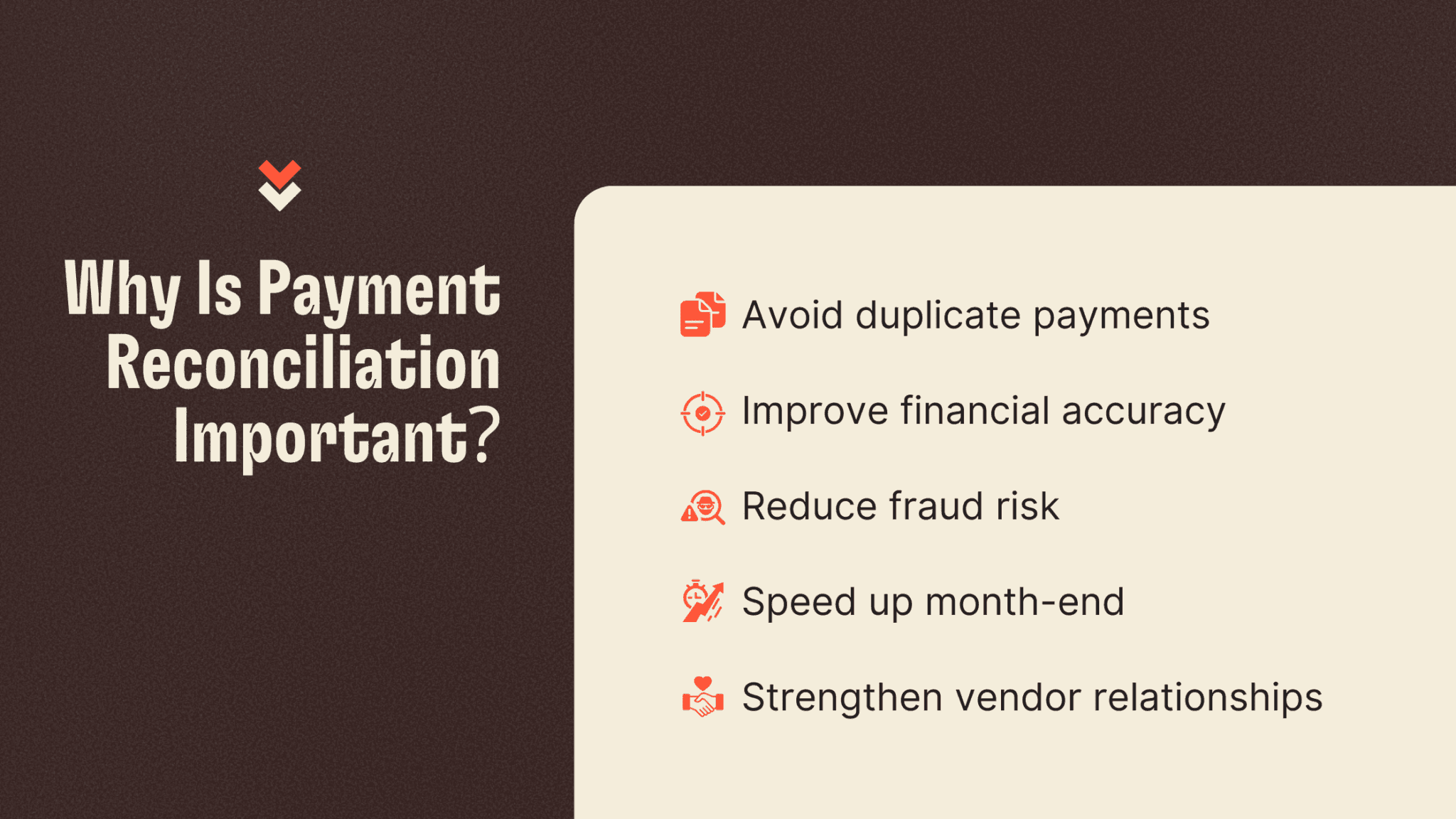

Why Is Payment Reconciliation Important?

Payment reconciliation plays a critical role in maintaining the financial health and operational efficiency of your business. When done consistently and correctly, it acts as a protective layer that prevents errors, improves reporting, and strengthens relationships with your suppliers. Here’s how:

1. Avoids Duplicate or Missed Payments

One of the most common issues in accounts payable is the risk of accidentally paying the same invoice twice or missing it altogether. Reconciliation allows your finance team to cross-check transaction records against your ledger or bank feed to ensure each payment matches an approved invoice. This process helps flag discrepancies early, preventing overpayments, missed bills, or unnecessary late fees.

2. Improves Financial Accuracy

Your financial reports are only as good as the data behind them. When your payments are properly reconciled, your balance sheet, cash flow statements, and profit and loss reports provide a true snapshot of your business’s financial position. This accuracy is essential for decision-making, investor confidence, and regulatory compliance.

3. Reduces Fraud Risk

Reconciliation adds an important layer of protection against internal and external fraud. By reviewing payments regularly and comparing them to approved records, you’re more likely to spot anomalies such as unauthorised transfers, altered payment details, or transactions made outside of established approval processes.

4. Speeds Up the Month-End Close

Month-end can be one of the busiest periods for finance teams. When payments are reconciled in real time or on a rolling basis, it reduces the end-of-month rush. With cleaner records and fewer outstanding items to resolve, reporting becomes faster and less stressful, giving teams more time to focus on insights rather than cleanup.

5. Enhances Supplier Relationships

Late or inaccurate payments can damage supplier trust and cause friction. With proper payment reconciliation in place, you can confirm that each supplier has been paid on time and in full. This creates a more professional experience for your partners, reduces the need for follow-up or clarification, and helps build long-term vendor relationships.

Despite these clear benefits, many businesses still manage payment reconciliationmanually. This leads to unnecessary delays, inconsistent records, and a greater risk of human error. As your business grows, these issues only become more difficult to manage. That’s why now is the right time to consider automating reconciliation and modernising your accounts payable process.

Manual vs. Automated Payment Reconciliation

Manual Reconciliation

Traditionally, finance teams download bank statements, match transactions line by line against invoices or payment exports, and update records by hand. This often involves:

Excel spreadsheets

Printing PDFs or bank reports

Manually updating Xero, MYOB, or ERP systems

Chasing down unclear payments with emails or phone calls

While doable at a small scale, manual reconciliation becomes increasingly inefficient and error-prone as your business grows.

Automated Reconciliation

Automated payment reconciliation uses software to streamline the entire process. Payment data is matched in real time, invoices are marked as paid automatically, and any mismatches are flagged instantly for review.

An automated platform connects directly to your accounting system, imports invoices and payment data, and reconciles payments without manual input.

Benefits include:

Instant matching of bank transactions to bills

Alerts for unmatched or failed payments

Automatic updates in your general ledger

Support for multiple entities and payment methods

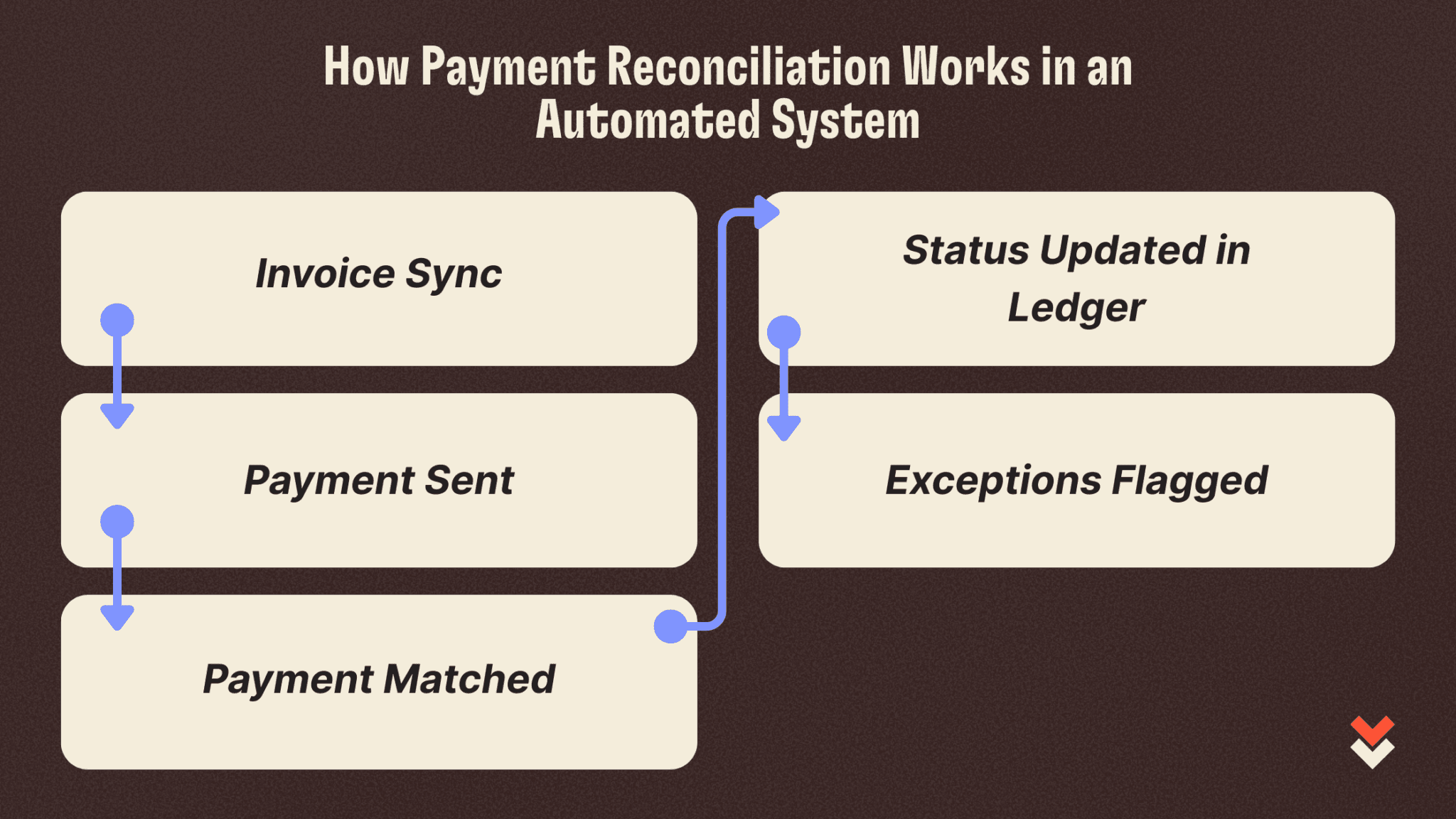

How Payment Reconciliation Works in an Automated System

Here’s what the process typically looks like in a platform like Lessn:

Invoice Data Syncs from Your Accounting Software

Unpaid bills are pulled in automatically from Xero or MYOB.

You Pay the Invoice via Credit Card or Bank Transfer

Payments are processed securely, and the supplier receives funds as a regular bank deposit.

Transaction Is Matched Automatically

The platform recognises the payment and marks the invoice as paid.

The paid status and reference data are pushed back to your accounting ledger.

Exceptions Are Flagged

If a payment fails, is duplicated, or doesn’t match an invoice, it’s flagged for your review.

Reconciliation Reports Are Updated in Real Time

Your finance team gets instant visibility on what’s paid, pending, or needs action.

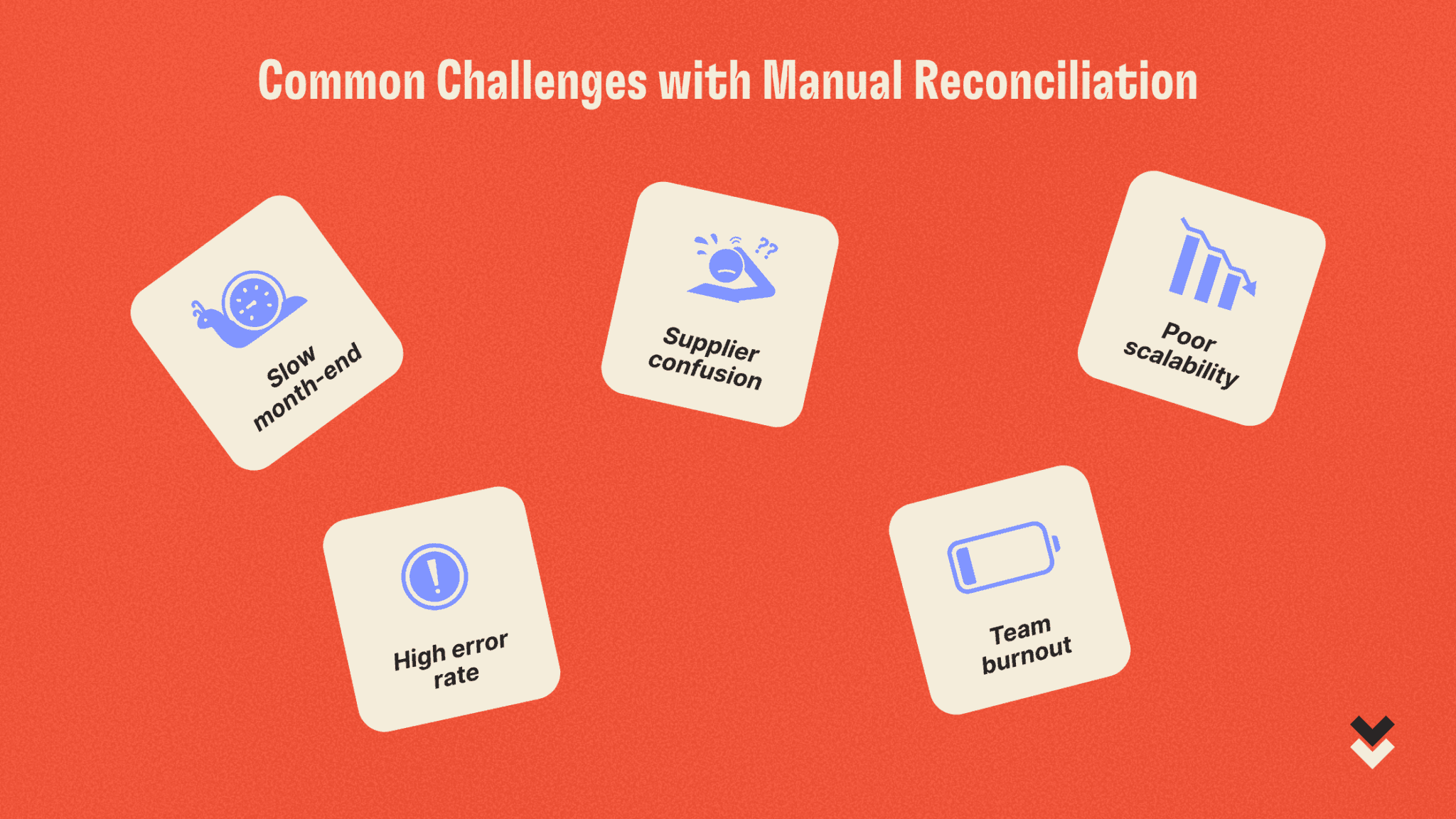

Common Challenges with Manual Reconciliation

Delayed month-end close due to time-consuming matching

High error rates caused by manual entry and oversight

Supplier confusion when remittances or payment references are missing

Team burnout from chasing small mismatches or unexplained transactions

Lack of scalability as transaction volume increases

Automating reconciliation directly addresses these issues—saving time and reducing headaches across the board.

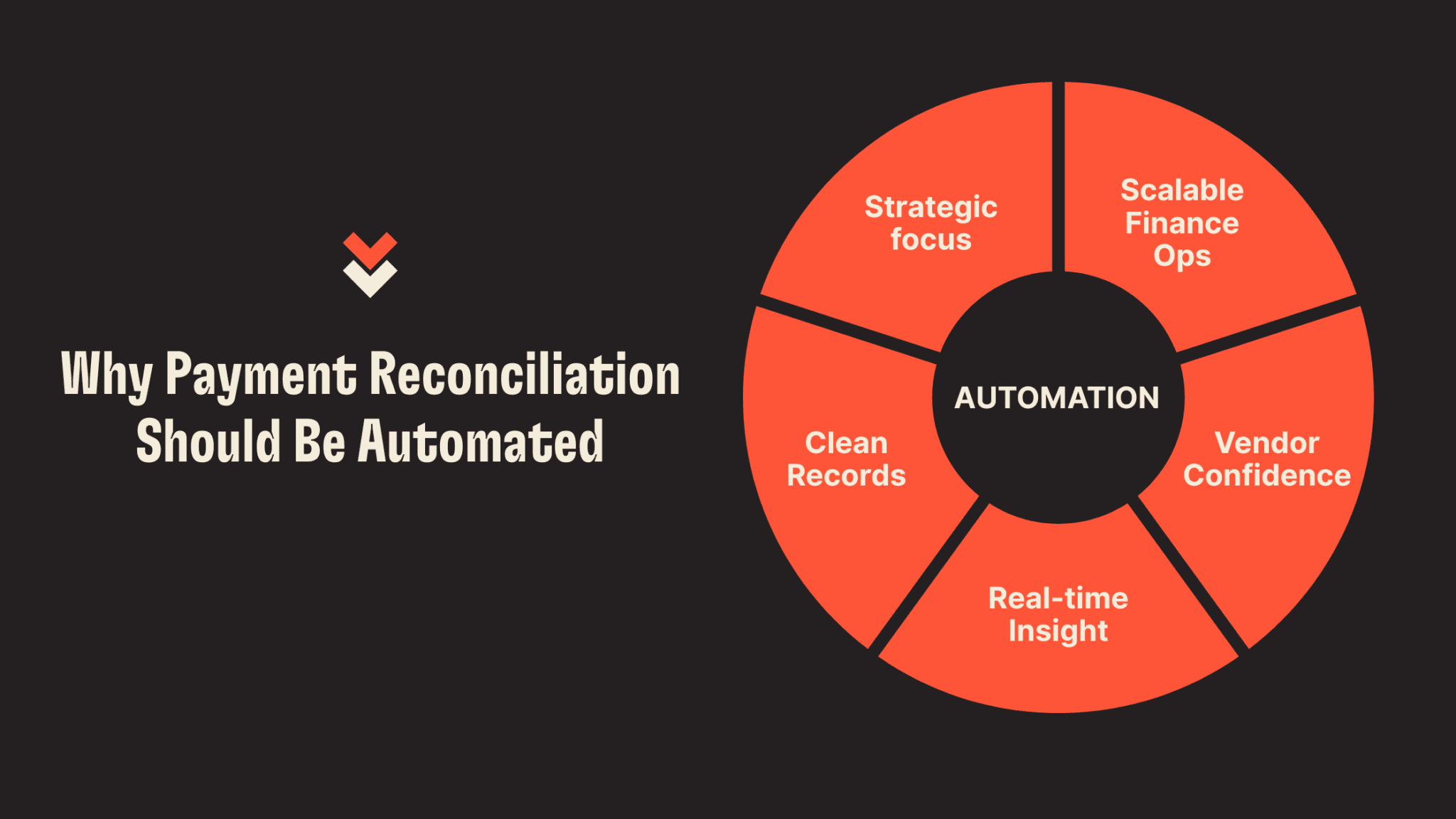

Why Payment Reconciliation Should Be Automated

Automating payment reconciliation isn’t just about saving time. It’s about enabling smarter, faster, and more confident financial decision-making. Here’s what you gain:

More time for strategy: Free your team from low-value admin and allow them to focus on forecasting, budgeting, and planning.

Cleaner books: Ensure your accounts reflect reality, with fewer surprises and smoother audits.

Improved working capital insights: Know where your money is, what’s cleared, and what’s outstanding—at all times.

Better supplier communication: Real-time reconciliation means fewer disputes or follow-ups.

Support for growth: Whether you’re paying five or 5,000 suppliers, automation scales with your business.

How Lessn Helps Automate Payment Reconciliation

Lessn is a payment automation platform that simplifies accounts payable and integrates directly with Xero and MYOB. It’s built for businesses that want to take control of their payments while reducing admin.

With Lessn, you can:

Pay any invoice by card or bank transfer

Reconcile payments instantly in your accounting software

Automate approval workflows and user permissions

Fund international payments and still enjoy full reconciliation

Earn credit card rewards on supplier payments

The reconciliation process is built into the core of the platform, ensuring that every payment, status update, and remittance note is tracked, synced, and closed off with minimal input from your team.

Payment reconciliation may not be the flashiest part of running a business, but it’s one of the most essential. By automating it, you improve accuracy, reduce stress, and put your finance team in a position to drive value, rather than chase spreadsheets.

If you’re still reconciling payments manually or struggling to keep your ledgers in sync, now’s the time to make a change.

Explore how Lessn can help automate your payment reconciliation, simplify your workflow, and give you peace of mind with every transaction.

👉 Learn more at lessn.io

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.