Make global payments and earn credit card rewards with Lessn + Monoova

Fund cross-border payments by card to maximise rewards and preserve cashflow.

Use Lessn to fund your Monoova payments via credit card and enjoy up to 50+ days extended cash flow, earn credit card rewards, and get access to wholesale FX rates with fast, reliable transfers.

How it works

How Lessn & Monoova Work Together

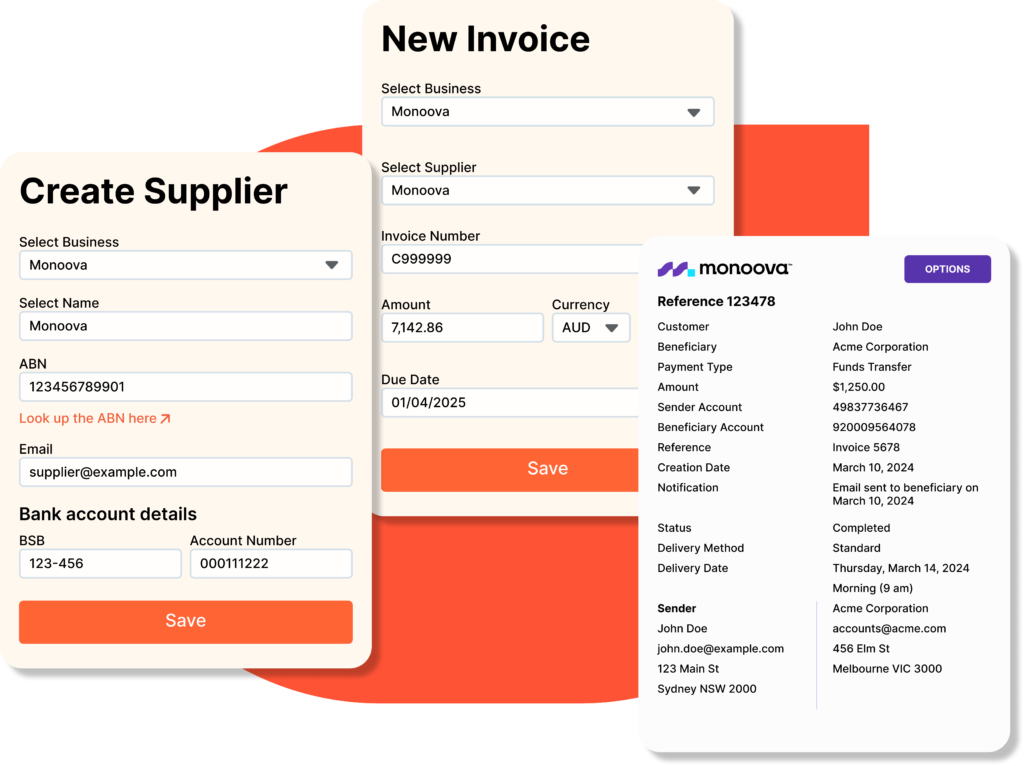

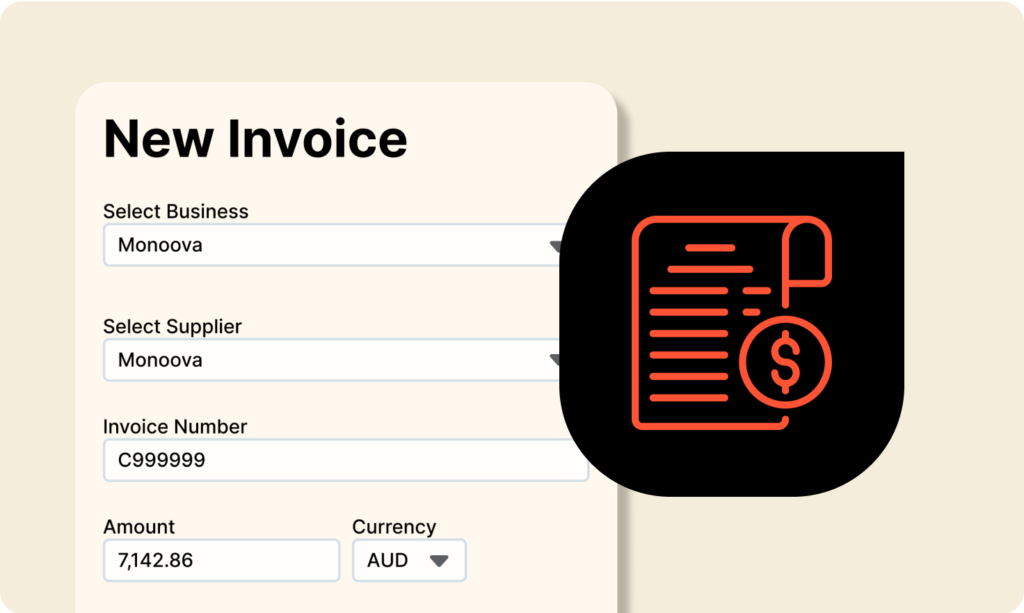

1. Create a payment in Monoova

Set up a transfer to your overseas supplier in their local currency.

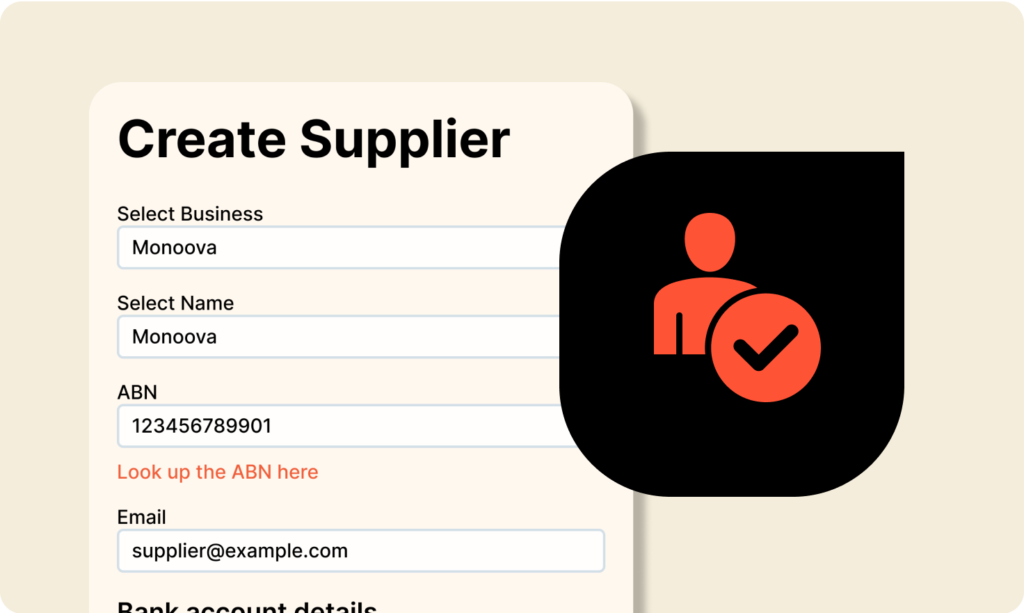

2. Add Monoova as a supplier in Lessn

Use your unique Monoova bank details

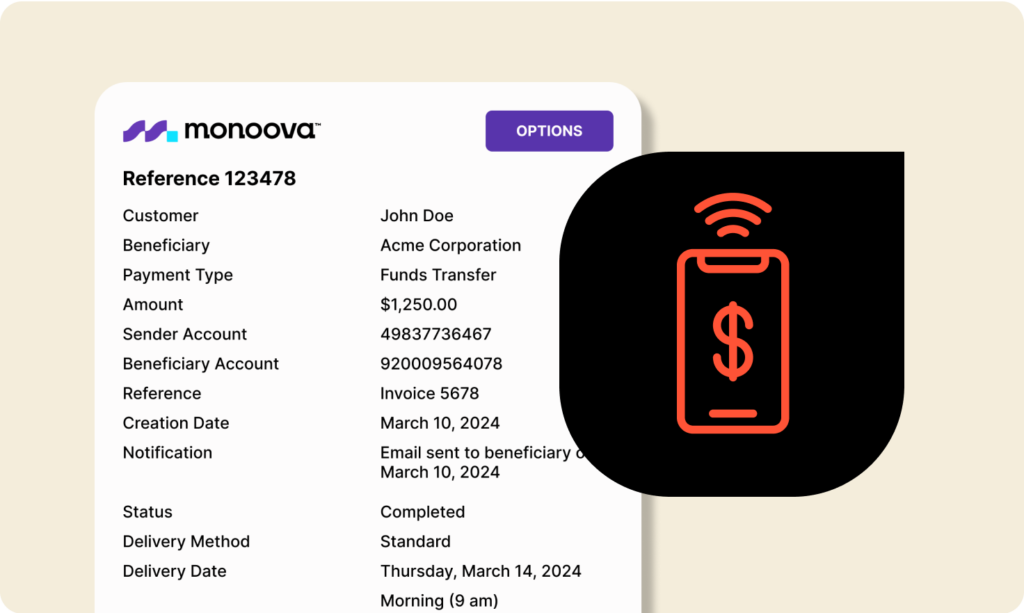

3. Fund the transaction using Lessn

Use Lessn’s one-time payment feature to to Fund the Monoova transaction using your credit card and use the Monoova reference ID for the invoice.

Lessn x Monoova: The Perfect Global Payment Solution

Flexible Funding for Better Cashflow

Use your credit card to pay suppliers, extend repayment terms, and earn rewards—all while keeping payments organised.

- Pay overseas suppliers using your card— no need for upfront cash.

- Extend Cash Flow by using your credit card’s interest-free period to improve working capital.

- Accrue credit card points on international supplier payments.

- Quickly pay any supplier without setup delays.

Cross-Border Payments Made Simple

Send international payments with confidence—fast, compliant, and cost-effective, with real-time funding and support.

- Pay international suppliers in their local currency.

- Competitive exchange rates for better value.

- Accrue credit card points on international supplier payments.

- Digital KYC process and fast tracked account approval

Try it for your next overseas payment

Make your next Monoova payment using Lessn and a credit card. More flexibility. More rewards. Less stress.