Accounts Payable Automation: 75% Faster, 100% Smarter

Apr 4, 2025

Lessn.io’s Accounts Payable Automation streamlines your workflow, eliminates errors, and helps you maximise rewards effortlessly. Book a Demo Managing accounts payable manually...

Lessn.io’s Accounts Payable Automation streamlines your workflow, eliminates errors, and helps you maximise rewards effortlessly.

Managing accounts payable manually is a tedious, time-consuming process that slows down operations and creates financial inefficiencies. Businesses often struggle with tracking invoices, processing approvals, and ensuring payments are made on time. These inefficiencies can lead to cash flow issues, strained supplier relationships, and missed financial opportunities.

Lessn.io eliminates these challenges with an intelligent accounts payable (AP) automation solution that transforms payment processes. Businesses using Lessn.io streamline invoice management, accelerate approval workflows, and optimise supplier payments. Beyond efficiency, the system allows companies to earn credit card rewards on every bill, even when suppliers typically don’t accept credit cards.

Why Businesses Struggle with Accounts Payable

Accounts payable is one of the most critical financial functions in any organisation, affecting cash flow, vendor relationships, and overall operational efficiency. However, many businesses still rely on outdated, manual processes that introduce unnecessary delays and errors.

In many industries, finance teams deal with paper invoices, scattered email approvals, and manual bank transfers, which create bottlenecks in payment workflows. This outdated approach not only increases the risk of late payments and errors but also makes it harder for businesses to take advantage of early payment discounts or cash flow optimisation strategies.

Challenges Across Different Industries

Retail & Hospitality: Businesses handle high transaction volumes and often struggle with tracking invoices from multiple suppliers. Delayed approvals can impact supplier relationships, leading to stock shortages and disrupted service.

Professional Services & Consulting: With project-based expenses, businesses need precise tracking and categorisation of invoices. Late approvals can result in penalties and disrupt service agreements with clients.

Manufacturing & Wholesale: Companies manage payments across large supplier networks, including international transactions requiring foreign exchange considerations. Delayed payments can lead to production slowdowns.

Healthcare & Pharmaceuticals: The healthcare industry deals with strict regulatory requirements and multi-layered supplier relationships. Manual AP processes can lead to compliance risks and costly payment delays.

Construction & Real Estate: Businesses manage multiple vendors and subcontractors. Tracking and approving invoices manually creates unnecessary project delays and cash flow disruptions.

The challenges businesses face in accounts payable are not industry-specific. Regardless of size or sector, the underlying problem remains the same—manual processes slow down operations and create financial inefficiencies.

Why Traditional AP Processes Fail

Without automation, businesses face common issues that can have significant financial and operational consequences.

Manual Invoice Handling & Approval Delays

Processing invoices manually is inefficient, especially when businesses receive hundreds or thousands of invoices per month. Paper invoices can be misplaced, duplicate payments may occur, and finance teams often spend hours manually reviewing documents. The longer it takes to approve an invoice, the higher the risk of missed payments, late fees, and supply chain disruptions.

Missed Cost-Saving Opportunities

Many vendors offer discounts for early payments, but tracking due dates manually is difficult. Without a centralised system, businesses often fail to prioritise payments strategically, losing potential cost savings and spending more than necessary.

Supplier Payment Issues & Disputes

Slow approvals can result in delayed supplier payments, leading to strained relationships and even disruptions in supply. Vendors may impose stricter payment terms or stop offering favourable pricing if late payments become a pattern.

Fraud Risks & Compliance Gaps

Manually handling invoices increases the risk of fraudulent payments and compliance violations. Businesses often lack visibility into their AP workflows, making it harder to detect unauthorised transactions. A lack of automated controls can also make audits and regulatory compliance more challenging.

How Automation Transforms Accounts Payable

By switching to accounts payable automation, businesses eliminate bottlenecks and increase the accuracy, speed, and security of their payment processes.

Automated AP software digitises invoices, routes approvals to the right stakeholders instantly, and schedules payments strategically to improve cash flow. Payments are executed in a way that maximises financial benefits, such as extending cash flow cycles through credit card payments or securing early payment discounts.

Some of the key advantages of AP automation include:

Faster Invoice Processing: Lessn.io automatically captures invoice details and matches them to purchase orders, reducing manual entry errors and speeding up approvals.

Improved Financial Control: With real-time insights, businesses can track payments, monitor outstanding invoices, and optimise cash flow.

Seamless Payment Execution: Businesses can pay suppliers in their preferred method—including credit card—even if the supplier doesn’t accept cards directly.

Enhanced Security & Compliance: Automated workflows reduce fraud risks by enforcing approval controls and maintaining detailed audit trails.

The Future of AP: Cloud-Based Automation

Cloud-based AP software has become the preferred choice for businesses due to its flexibility, security, and ease of integration. Unlike traditional on-premise accounting solutions, which require extensive IT infrastructure and ongoing maintenance, cloud-based platforms offer significant advantages:

Remote Access & Collaboration: Teams can manage accounts payable from anywhere, ensuring uninterrupted workflow even in distributed work environments.

Real-Time Data & Insights: Businesses gain access to live financial reporting, allowing better forecasting and decision-making.

Lower IT Costs & Maintenance: Cloud solutions eliminate the need for businesses to invest in expensive hardware and software updates.

Automated Compliance Updates: Regulatory and security updates happen seamlessly in the cloud, reducing the risk of compliance violations.

Lessn.io provides a fully cloud-based AP solution, offering real-time integration with accounting platforms like Xero and MYOB to ensure a smooth, automated reconciliation process.

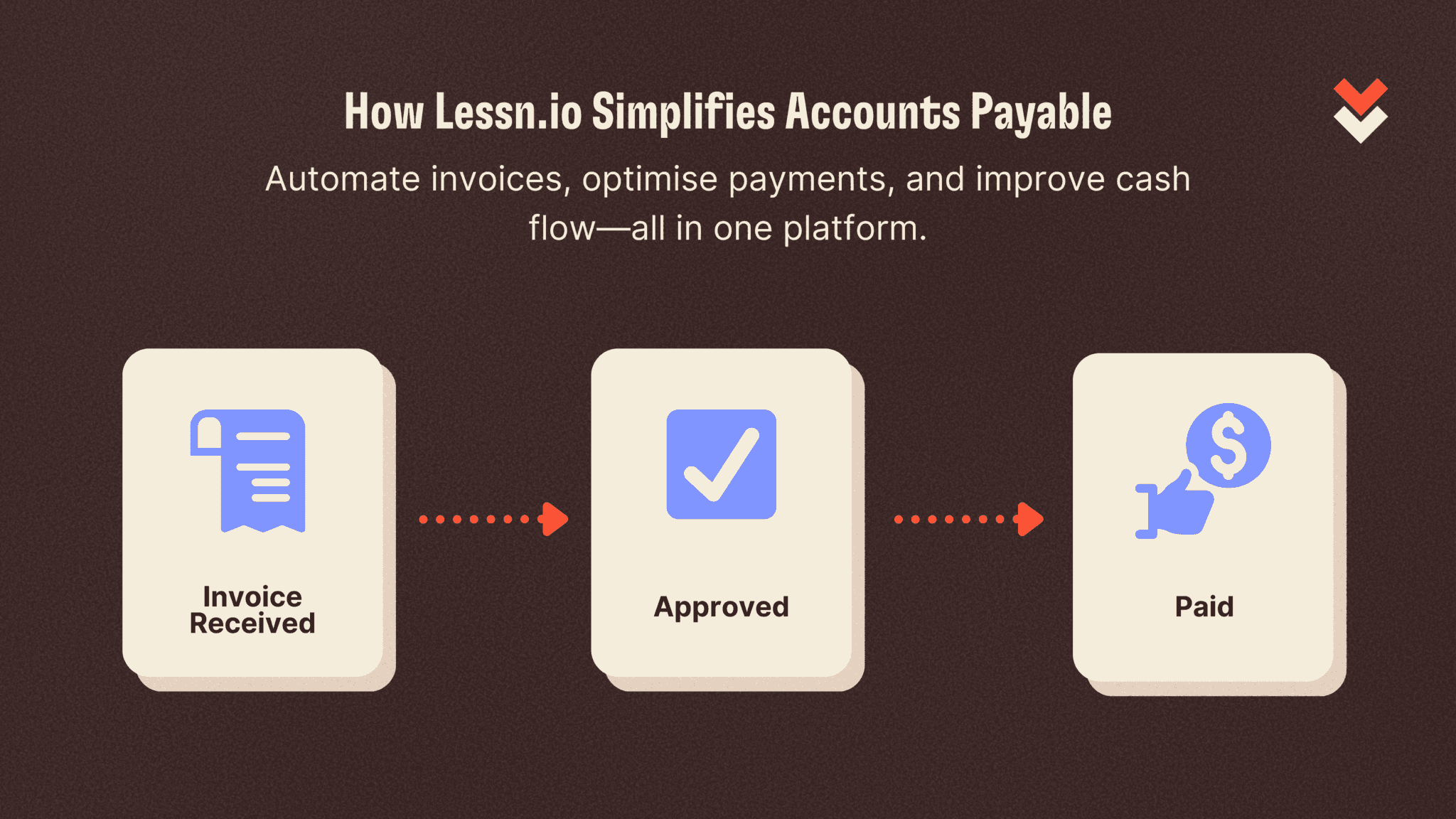

How Lessn.io Simplifies Accounts Payable

Lessn.io is designed to eliminate inefficiencies in invoice management, approval workflows, and supplier payments. Instead of struggling with manual processes, businesses can automate their entire AP workflow.

Automated Invoice Processing

Lessn.io captures and digitises invoices, ensuring that payment details are stored accurately and matched against purchase orders. This eliminates manual data entry and human errors that can cause payment discrepancies.

Optimised Payment Execution

Businesses can pay all expenses via credit card, bank transfer, or BPAY, even if suppliers don’t accept card payments. By converting invoices into card transactions, businesses earn rewards, improve cash flow, and avoid late payments.

Seamless Approval Workflows

Invoices are automatically routed to the right stakeholders based on predefined approval rules. Instead of chasing approvals manually, finance teams can track progress in real-time and reduce processing delays.

Real-Time Cash Flow Monitoring

With a full dashboard view of pending invoices, scheduled payments, and overall spending trends, businesses can optimise financial planning and make data-driven payment decisions.

Case Study: How Bake Bar Transformed Accounts Payable with Lessn.io

Background

Bake Bar, a growing artisan bakery business, faced challenges in managing payments efficiently. With multiple suppliers and recurring expenses, keeping up with invoices manually was becoming unsustainable. Founder and CEO Rafael Aruch wanted a solution that would streamline payments, improve cash flow, and maximise credit card rewards without disrupting supplier relationships.

Challenges Before Using Lessn.io

Bake Bar relied on bank transfers and manual invoice tracking. This approach led to:

Limited payment flexibility, as most suppliers preferred direct bank transfers.

Missed credit card reward opportunities.

A time-consuming reconciliation process.

Cash flow constraints due to immediate payment requirements.

Solution: Automating Payments with Lessn.io

By integrating Lessn.io’s accounts payable automation, Bake Bar was able to:

Pay all supplier invoices via credit card while suppliers still received payments via bank transfer.

Automate invoice approvals and payments, eliminating manual processing delays.

Track spending and cash flow in real time.

Maximise credit card rewards and turn everyday expenses into valuable perks.

Results After Implementing Lessn.io

1. More Reward Points and Business Perks

By paying all bills with a credit card, Bake Bar significantly increased its reward points.

“Using Lessn, I can pay all my bills with a credit card and get more reward points. My points value has skyrocketed and now I’m flying my family to Europe in business class using points.”

– Rafael Aruch, Founder & CEO, Bake Bar

2. Increased Cash Flow Flexibility

Using Lessn.io’s credit card payment capabilities, Bake Bar extended its payment cycle, allowing them to reinvest working capital into growth while ensuring timely supplier payments.

3. Automated Invoice Processing and Approvals

Bake Bar reduced manual payment errors and approval delays, ensuring all invoices were processed on time.

4. Seamless Accounting Integration

With direct integration into Xero, Bake Bar’s finance team eliminated manual reconciliation work.

Conclusion

Lessn.io transformed Bake Bar’s accounts payable process, providing a flexible, automated, and rewarding payment solution. By allowing credit card payments for invoices while keeping suppliers happy with bank transfers, Bake Bar improved cash flow and unlocked valuable financial benefits.

Best Practices for Implementing AP Automation

Establish Approval Workflows Upfront

Define clear rules for invoice approvals to prevent delays and improve transparency.Integrate with Accounting Software

Ensure that your AP automation software syncs with platforms like Xero and MYOB to streamline reconciliation.Use Credit Cards for Financial Flexibility

Convert invoices into credit card transactions to earn rewards and extend cash flow cycles.Monitor Spending with Real-Time Reporting

Use data-driven insights to track spending trends and optimise vendor payments.Regularly Review Supplier Agreements

Negotiating better payment terms with suppliers can improve cash flow and provide more opportunities for cost savings.Set Up Automated Alerts

Ensure invoices don’t slip through the cracks by using automated reminders for due payments.

Frequently Asked Questions

How does Lessn.io automate invoice approvals?

Lessn.io uses predefined approval workflows to route invoices to the right stakeholders automatically. When an invoice is received, the system categorises and matches it with existing purchase orders. It then sends it to the appropriate approver based on custom rules set by the business. These workflows ensure that invoices move through the system quickly, reducing approval delays and improving compliance. Businesses can set multi-tier approvals, escalation processes, and automatic reminders to streamline efficiency.

Can I use Lessn.io to pay suppliers who don’t accept credit cards?

Yes. Lessn.io enables businesses to pay suppliers via credit card, even if the supplier only accepts bank transfers.

The platform processes the payment through a credit card and then transfers funds to the supplier’s bank account on behalf of the business.

This feature allows companies to extend their payment cycles, earn valuable credit card rewards, and maintain strong supplier relationships by ensuring timely payments.

How does Lessn.io improve cash flow?

By converting payments into credit card transactions, businesses can extend their payment cycles and manage working capital more effectively.

Instead of using immediate bank transfers that deplete cash reserves, Lessn.io allows businesses to leverage credit cards, providing additional time to manage expenses before funds are withdrawn.

This approach not only improves liquidity but also offers an opportunity to take advantage of early payment discounts and reward programs, helping businesses optimise financial resources.

What types of businesses benefit the most from AP automation?

Any business that processes a high volume of invoices can benefit from AP automation. Industries like retail, hospitality, healthcare, construction, and manufacturing see the most significant improvements, as they often deal with multiple vendors, recurring payments, and complex approval chains.

Automating AP helps these businesses eliminate inefficiencies, reduce errors, and free up finance teams to focus on strategic initiatives.

Does Lessn.io integrate with accounting platforms?

Yes. Lessn.io integrates with Xero and MYOB, allowing businesses to automate reconciliation.

Once a payment is made, the system syncs transaction data in real time, ensuring accurate bookkeeping and financial reporting without manual intervention.

Why Lessn.io is the Best Choice for AP Teams

Lessn.io is more than just AP automation—it’s a financial optimisation tool that helps businesses improve efficiency, extend cash flow, and earn rewards on every bill. By using Lessn.io, businesses not only reduce manual workload but also unlock financial opportunities that traditional AP processes overlook.

With seamless integrations, real-time tracking, and optimised payment execution, finance teams gain full control over their accounts payable processes without unnecessary complexity. Lessn.io helps businesses scale efficiently by ensuring that financial processes remain smooth, predictable, and cost-effective.

For growing businesses, implementing AP automation isn’t just about convenience—it’s about staying competitive. Faster invoice processing leads to better supplier relationships, increased cash flow flexibility, and improved operational transparency. Lessn.io provides businesses with the tools they need to take their financial management to the next level.

The ability to earn credit card rewards on every transaction further sets Lessn.io apart, allowing businesses to extract more value from everyday payments. Instead of accounts payable being a cost centre, Lessn.io transforms it into a strategic advantage, helping businesses maximise their financial potential.

Book a Demo to see how Lessn.io can transform your AP workflow.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.