The Ultimate Guide to Automated Payment Systems for Australian Businesses

Table of Contents

Managing payments manually is no longer a sustainable approach for growing businesses. As the volume and complexity of transactions increase, relying on spreadsheets, manual bank uploads, or chasing approvals through email chains creates unnecessary risk and slows down your operations. Whether you are collecting customer payments, settling supplier invoices, handling payroll, or managing recurring billing, a smarter approach is needed to keep pace.

Automated payment systems are becoming essential tools for Australian businesses that want to operate more efficiently, reduce errors, and strengthen cash flow management. By automating routine financial tasks, businesses can free up valuable time, improve payment accuracy, and maintain healthier working capital without adding to the administrative burden.

The right system does more than just save time, it builds a more resilient finance function, improves customer satisfaction, and gives you better visibility over your cash flow. As payment technology continues to evolve, businesses that embrace automation gain a competitive advantage, operating with greater speed, flexibility, and control.

In this guide, we will break down what automated payment systems are, how they work, the key options available for Australian businesses, and what to consider when choosing the right system for your needs. We will also introduce Lessn, a modern payment automation platform built specifically for businesses looking to streamline payments, preserve cash flow, and unlock new value through smarter financial workflows.

What Is an Automated Payment System?

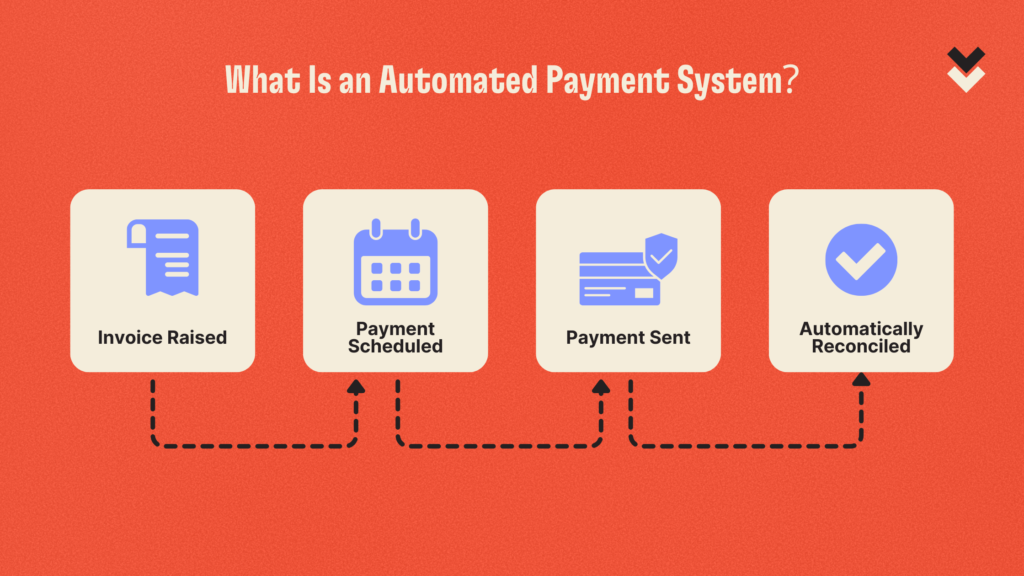

An automated payment system allows businesses to schedule, process, and reconcile financial transactions without needing constant manual input. Instead of manually entering each payment, uploading ABA files, or chasing approvals through emails and spreadsheets, the entire flow can be set up to run automatically based on pre-defined rules, customer agreements, supplier invoices, or system integrations.

Automated payment systems can be used for a wide range of essential business activities, including:

- Customer collections: Automatically collecting payments for subscriptions, ongoing services, or invoice settlements.

- Supplier payments: Scheduling regular or one-off supplier payments to avoid missed deadlines and late fees.

- Payroll: Ensuring employees are paid accurately and on time, without last-minute processing rushes.

- Rent or utilities: Setting up recurring payments for office rent, energy bills, or other operational expenses.

- Tax obligations: Managing BAS, PAYG, or corporate tax payments efficiently, avoiding penalties for late submissions.

For Australian businesses, automation is quickly becoming the new standard. It is no longer just about saving a few hours of admin time each week. It is about building a finance operation that is faster, more accurate, and able to scale as the business grows.

An automated payment system strengthens cash flow by reducing payment errors and missed deadlines, improves the customer experience by ensuring smooth and timely transactions, and enhances operational resilience by reducing reliance on manual processes that are prone to error or bottlenecks.

Choosing the right system can mean the difference between staying reactive and moving into a more strategic, controlled financial position, giving your business a real advantage in an increasingly competitive market.

Key Payment Systems in Australia

Australia has a well-developed payments landscape, with multiple options for automating both incoming and outgoing payments. Here is a look at the major players and technologies:

1. BECS Direct Debit

The Bulk Electronic Clearing System (BECS) enables direct debits from customer bank accounts. It is widely used for recurring payments like memberships, insurance premiums, and subscription billing.

Why choose BECS Direct Debit?

- Ideal for businesses with predictable, recurring revenue

- Lower transaction costs compared to card payments

- Reduces late payments through automatic scheduling

2. Online Payment Platforms

Platforms like GoCardless, Stripe, Airwallex, and PayPal allow businesses to collect online payments easily. They typically support direct debit, credit card, and digital wallet transactions.

Popular features include:

- Seamless integrations with eCommerce platforms like Shopify and WooCommerce

- Invoicing and recurring billing options

- Multi-currency support for international sales

3. Payment Gateways

Payment gateways such as SecurePay, Eway, and ANZ Worldline connect your website or app to banking networks, allowing you to process secure credit card and debit card payments online.

Why use a payment gateway?

- Essential for businesses selling online

- High-security standards with PCI DSS compliance

- Real-time payment authorisation

4. New Payments Platform (NPP)

The New Payments Platform (NPP) is Australia’s fast payments infrastructure. It enables instant account-to-account transfers using services like Osko, PayID, and the emerging PayTo framework.

Key benefits:

- Real-time settlement, available 24/7

- Reduces reliance on slower traditional direct debit cycles

- PayTo offers more control and visibility for both businesses and customers

5. Lessn

Lessn is a smarter payment solution designed for businesses that want to optimise cash flow, automate supplier payments, and unlock the benefits of card funding.

What makes Lessn different?

- Fund any supplier payment using your business credit card, even if the supplier does not accept cards

- Extend cash flow with up to 55+ days of float using AMEX, Visa, or Mastercard

- Automate payment approvals, workflows, and reconciliation back into platforms like Xero and MYOB

- Enable smarter payment timing, splitting large payments across multiple cards if needed

- Preserve relationships with suppliers, who continue receiving payments via standard bank transfers without needing to onboard new systems

Lessn is ideal for businesses managing high volumes of payments, looking to preserve working capital, or wanting to add value through credit card rewards.

Factors to Consider When Choosing an Automated Payment System

Selecting the right automated payment system depends on your business model, cash flow needs, and customer experience goals. Here are critical factors to weigh:

1. Recurring Payments

If you rely heavily on subscriptions, memberships, or regular invoices, prioritise systems that support easy recurring billing. GoCardless and BECS Direct Debit are strong options for automating direct debits.

2. Online vs. In-Person Transactions

- Online businesses should invest in a reliable payment gateway or online platform like Stripe or PayPal.

- In-person businesses, such as retail or hospitality, need integrated Point-of-Sale (POS) solutions like Square or Tyro.

3. Transaction Fees and Costs

Look beyond the headline rates:

- Compare set-up fees, transaction fees, and monthly charges

- Understand currency conversion fees if you sell internationally

- Evaluate chargeback risks and associated costs

Choosing the cheapest option is not always best. Focus on total value, reliability, and support.

4. Integration with Business Systems

The best automated payment systems connect easily with your accounting software (such as Xero, MYOB, or QuickBooks), CRM platforms, and eCommerce sites. Good integrations reduce data entry, speed up reconciliation, and enhance reporting.

5. Security and Compliance

Security is essential. Choose providers that offer:

- PCI DSS compliance for card payments

- Tokenisation and encryption of sensitive data

- Two-factor authentication (2FA) for platform access

If you are handling customer payment details, ensuring compliance with Australian Privacy Principles (APPs) is also vital.

Popular Automated Payment Systems for Australian Businesses

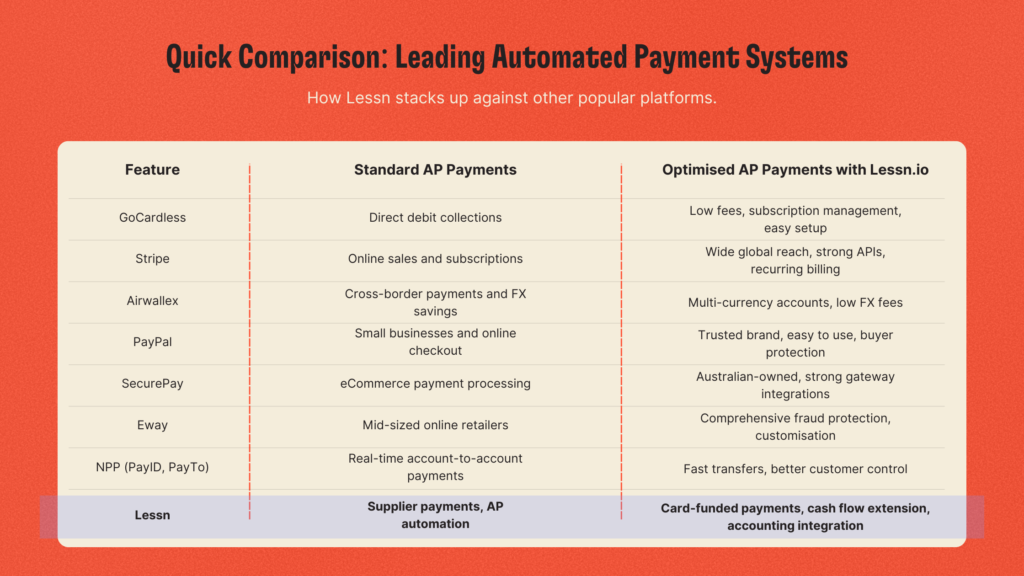

Here is a quick comparison of popular platforms:

Why Lessn Is a Great Platform for Business Owners

Business owners today face more pressure than ever to manage cash flow, streamline admin, and deliver value back to the business. Lessn is built to help them do exactly that.

Here is why Lessn stands out:

- Fund payments with your card: Unlock cash flow flexibility without needing suppliers to accept cards. Preserve your cash for longer while keeping suppliers paid on time.

- Earn rewards on everyday expenses: Turn major operating costs, tax bills, and supplier payments into loyalty points, cashback, or travel perks.

- Automate approvals and reconciliation: Save hours every month by integrating directly with your accounting software, keeping your books clean and accurate with minimal manual work.

- Boost visibility and control: Track every payment, approval, and reconciliation step from one dashboard.

- No supplier disruption: Suppliers continue to receive standard bank transfers without needing to change anything on their end.

For businesses that want better control over outflows, more efficient operations, and a smarter way to manage payments, Lessn offers a true competitive edge.

Why Automating Payments Is Essential for Growing Businesses

Adopting an automated payment system is about creating a finance function that is faster, smarter, and more flexible.

The right solution:

- Streamlines transactions and approvals

- Improves cash flow without needing loans or new debt

- Reduces admin so finance teams can focus on strategy

Platforms like Stripe, GoCardless, and Airwallex provide excellent customer payment solutions.

But when it comes to smarter supplier payments, stronger cash flow, and finance automation, Lessn offers Australian businesses an edge.

If you are ready to take control of payments, unlock card rewards, and simplify your accounts payable workflows, Lessn is the tool to help you do it.