Turning Accounts Payable from a Cost Center into a Profit Center

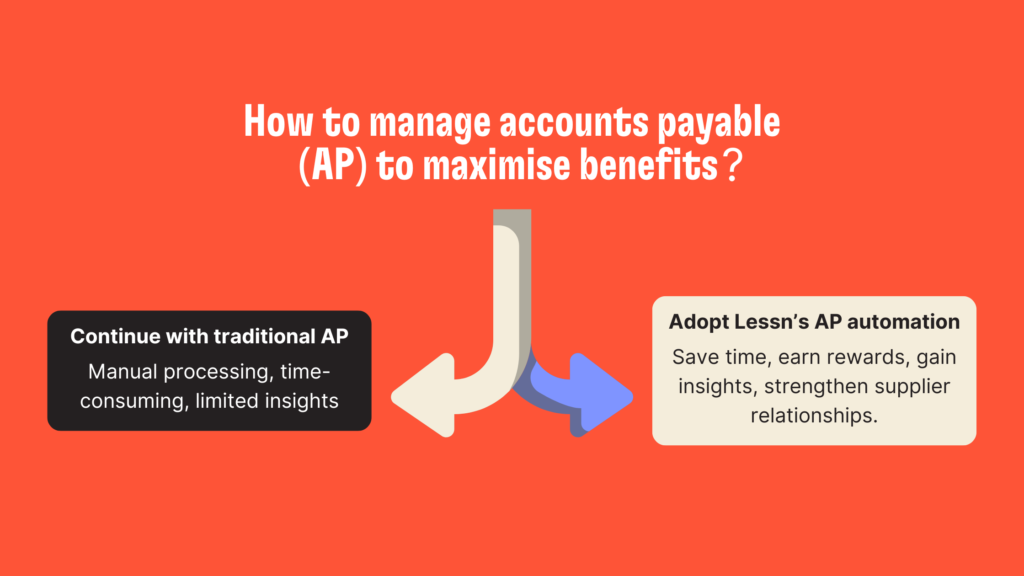

Accounts payable is usually just a cost—you’re sending out payments, tracking invoices, and making sure your suppliers get their money on time. But what if AP could actually help your business grow? With platforms like Lessn, you can flip the script and turn AP into a profit-driving part of your operations.

Let’s dive deeper into turning accounts payable (AP) into something that actually adds value to your business. Instead of just paying bills, with the right strategies and tools, AP can give your company a financial boost. Here’s how Lessn helps businesses like yours do exactly that:

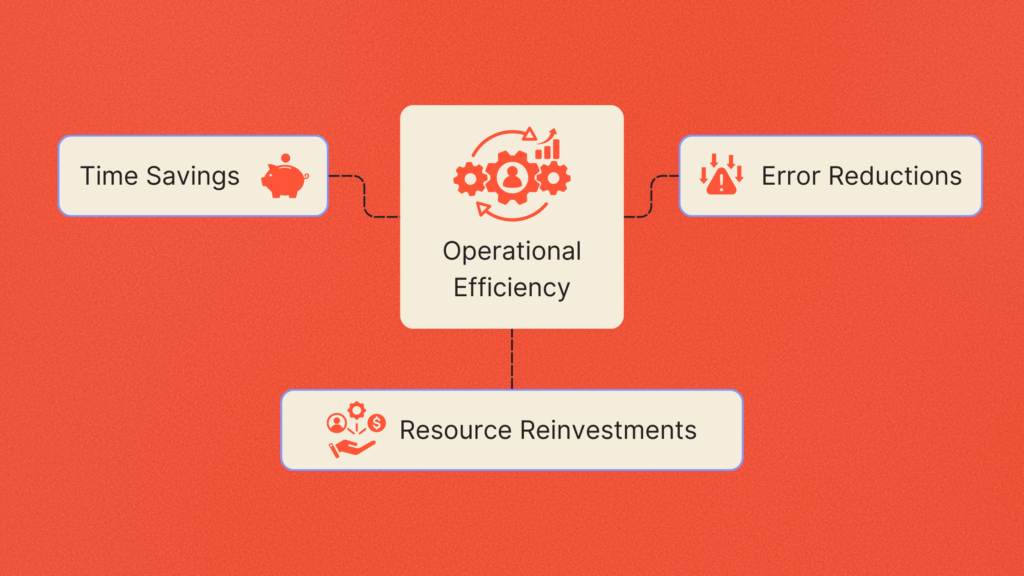

Save Time, Reduce Errors, and Reinvest Resources

Lessn automates your entire AP process, from paying invoices to syncing with your accounting software. What’s the benefit?

Your team spends less time on manual tasks like data entry and chasing approvals, and more time on strategic work. The fewer mistakes and errors, the less money you’ll spend on fixing them. Over time, the saved resources can be redirected into growth-driving areas like marketing or product development. This is how you turn saved costs into profitability.

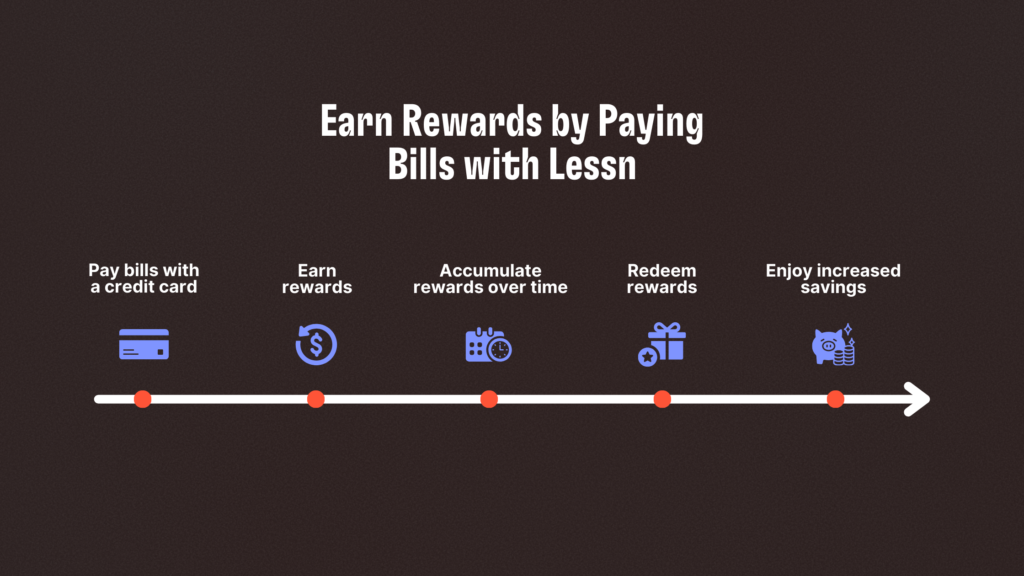

Maximise Rewards for Paying Bills

We all have to pay vendors, but with Lessn, you can do it smarter. By paying bills with your credit card—even when the vendor doesn’t accept cards—you unlock rewards. Think cashback, travel points, or other loyalty perks. This way, you’re turning every payment you make into a chance to earn something back.

It’s a simple change in how you pay, but it adds up. Over the course of a year, those points or cashback rewards can make a significant difference to your bottom line.

Capture Early Payment Discounts

Vendors often offer discounts if you pay early, but it can be tough to keep track of due dates and payment schedules. For example, let’s say you get a 2% discount for paying a $10,000 invoice early—that’s $200 saved, just for being on time. Multiply this across all your suppliers, and it can quickly add up to significant savings.

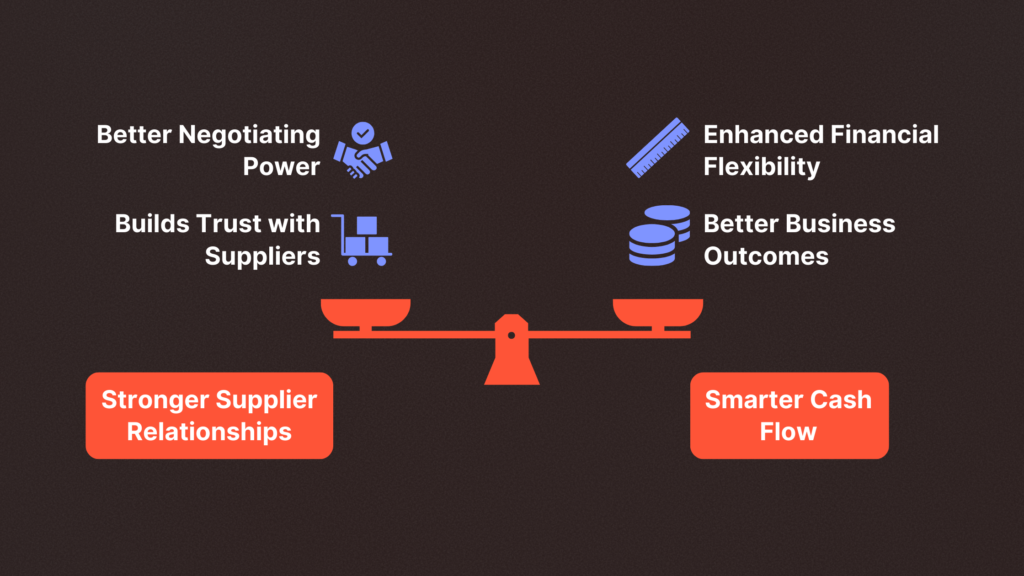

Stronger Supplier Relationships = Better Deals

Paying suppliers on time not only helps you snag early discounts, but it also builds trust. Suppliers value customers who are reliable with payments, which can lead to better terms in the future, like longer payment windows or discounts on bulk orders.

When you have stronger relationships with your suppliers, you have more negotiating power, which can directly impact your profits. Lessn helps you stay on top of all your payments, ensuring you maintain that valuable trust with your partners.

Smarter Cash Flow = Better Business Decisions

One of the key benefits of using Lessn is the improved visibility into your cash flow. You know exactly how much you owe and when payments are coming up. This lets you make smarter financial decisions—like when to delay a payment to free up cash for other investments or when to pay early to secure a discount.

Having this kind of insight helps you stay agile and better manage your company’s finances, turning your AP from a black hole of money into an area that can actually improve your financial flexibility.

In the past, accounts payable was something companies had to deal with—an unavoidable cost of doing business. But with tools like Lessn, it can become an area where you save time, make money, and even strengthen supplier relationships.

By automating payments, earning rewards, and using insights to manage cash flow better, you can flip AP from a cost centre into a profit centre for your business.

Don’t just take our word for it—experience the benefits firsthand. Whether you’re looking to streamline operations, maximise rewards, or build stronger supplier relationships, we’ve got you covered.