Getting Rewards: How to Earn More with Every Business Payment

With every dollar counting more than ever, businesses are rethinking how they handle expenses. Rather than just covering costs, each transaction could add real value to your bottom line. This is where Lessn comes in, offering a fresh approach to business payments that combines ease, efficiency, and financial reward. Imagine turning your expenses into strategic gains, maximising rewards with every payment you make. Here’s how Lessn makes it happen.

1. Rethink Payments: From Cost to Opportunity

For most businesses, payments are a recurring, often time-consuming process that drains resources. But what if those payments could contribute to your growth, helping you earn valuable rewards?

Lessn turns traditional payments into a rewards-earning process by enabling you to use credit cards—even with vendors who don’t usually accept them. This means that expenses you’re already paying can now help you build up points, cashback, or other benefits across popular credit card programs.

It’s more than just paying bills, It’s creating value for your business with each transaction.

Lessn bank and airline rewards programs offer businesses a valuable opportunity to maximise the benefits of their everyday transactions. Book A Demo.

2. Maximise Credit Card Rewards on Every Transaction

Many businesses rely on credit cards to manage cash flow, but what about expenses that traditionally don’t accept cards?

Lessn bridges this gap, letting you use your preferred credit card to pay bills like rent, utilities, or vendor fees, which don’t usually take card payments.

As a result, you’re not only paying off your bills—you’re collecting rewards that can offset future expenses.

Scenario:

A Sydney-based IT firm switched to Lessn for vendor payments and earned over AUD 27,500 in Amex points annually. This offset their travel expenses for client visits, demonstrating how Lessn directly impacts the bottom line.

Key Takeaway: By using Lessn, you can maximise points on essential business payments, potentially turning regular transactions into significant savings.

There are several types of rewards programs that businesses and individuals can benefit from, each offering unique perks to enhance your spending power.

Get More Details About Lessn Rewards Program

3. Enhanced Cash Flow Control with Split & Partial Payments

Cash flow management is crucial for any business, especially when handling large invoices or seasonal fluctuations.

Lessn offers split and partial payment options, giving you the flexibility to manage cash flow in a way that suits your needs.

This means you’re not only building rewards but also maintaining steady financial health without straining your liquidity.

Scenario:

A hospitality company faced cash flow challenges during off-peak months, so they used Lessn’s split payment feature to stagger supplier payments, ensuring consistent cash flow while still earning rewards on each transaction.

Key Benefits:

- Control over large invoices with split payments.

- Flexibility during slow periods, allowing steady cash flow.

- Opportunity to earn rewards on every payment, even when it’s divided into manageable portions.

- Multi-directors earn maximum points on each of their respective reward cards.

Find out more about cash Flow Management and Split Payments: Lessn Features

4. Save Time with Automated Reconciliation

Handling business expenses can be a burden, especially when it involves repetitive, manual reconciliations.

Lessn integrates with accounting software like Xero and MYOB, automating reconciliation and reducing human error.

This automation not only saves time but also ensures accuracy, freeing up your team to focus on strategic initiatives instead of time-consuming administrative tasks.

Example:

A professional services firm saved up to 12 hours a month by using Lessn’s automated reconciliation, streamlining their processes and allowing their team to focus on delivering better client service.

What This Means for You:

With Lessn, you’re not just maximising financial rewards—you’re also optimising your operations, reducing manual work, and empowering your team to work smarter.

Accounting Integration with Xero and MYOB: Lessn Integrations

5. Security & Peace of Mind

According to the 2024 IBM Cost of a Data Breach Report, the average cost of a data breach for Australian businesses has reached a record high of AUD $4.26 million. This represents a 27% increase from 2020, reflecting the growing financial impact of cybersecurity incidents in Australia. The technology and financial sectors, in particular, bore the brunt of these costs, with data breaches averaging AUD $5.81 million and AUD $5.61 million, respectively.

Lessn addresses this concern with top-tier encryption and secure payment processing, providing a strong defence against invoice interception scams. For finance professionals managing high-value transactions, Lessn’s commitment to security is essential.

At Lessn, security isn’t just a feature, It’s a foundational element.

Why This Matters:

Every transaction processed through Lessn is protected by advanced security protocols, allowing you to focus on maximising rewards without compromising on safety.

- Data Breach Costs: Australian Business Security Statistics

- Lessn’s Security Overview: Lessn Security Features

6. Who Can Benefit the Most from Lessn?

Lessn’s payment platform is versatile, empowering various types of businesses:

- Small and Mid-Sized Businesses (SMBs): Perfect for businesses that make frequent vendor payments and want to streamline expenses while earning rewards.

- Finance Teams in Growing Companies: Manage multiple vendor payments with better visibility, control, and cash flow flexibility.

- Accounts Payable Teams in Larger Organizations: Automate repetitive tasks, improve accuracy, and earn rewards on non-traditional credit card expenses.

- Professional Service Firms: From legal to marketing firms, Lessn helps professional service providers gain flexibility with bill payments while building rewards to reinvest in the business.

- Large family owned enterprise firms who want to eradicate the cost of staff and family travel, and unlock supplier early payment discounts by having your card do the work on your terms.

Created for business owners, bookkeepers and accounts payable professionals, Lessn transforms your financial operations.

Schedule a Free demo with one of our team today and understand how transformative Lessn can be for your Organisation — Book A Demo.

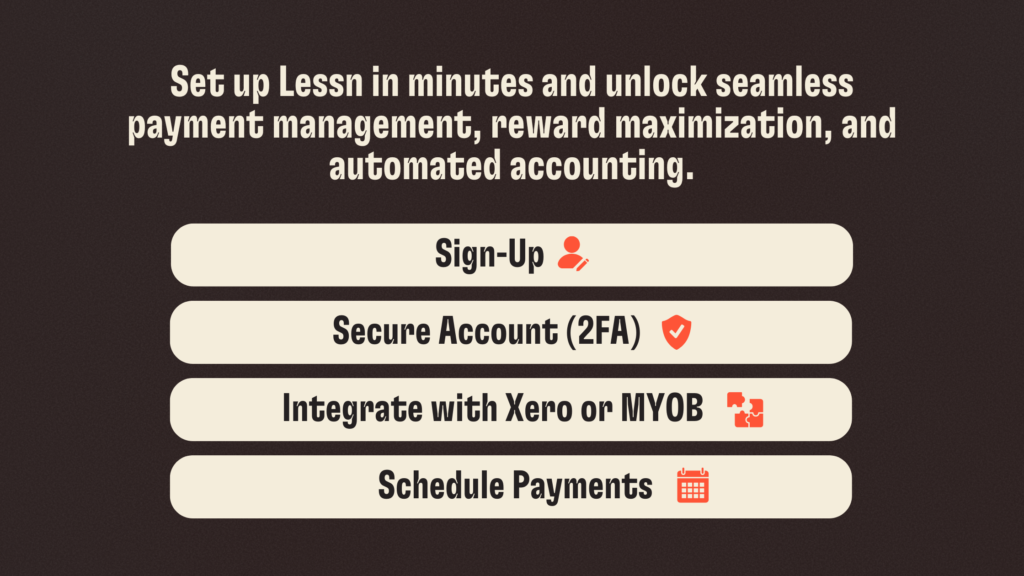

7. Getting Started with Lessn: Your First Steps to Optimised Payments

- Create an Account: Sign up on Lessn’s platform, complete verification, and enable two-factor authentication for added security.

- Integrate with Accounting Software: Connect your Lessn account with Xero or MYOB to automate reconciliation and ensure seamless expense tracking.

- Schedule Payments: Align payments with credit card cycles for maximum rewards and cash flow optimisation.

Best Practices:

- Use split payments to maintain steady cash flow during high-expense periods.

- Regularly track rewards accumulation to ensure you’re maximising benefits.

- Schedule payments around your credit card cycles to maximise point-earning potential.

Say goodbye to the complexities of financial management and welcome a future of streamlined and automated accounting processes.

Experience the difference with Lessn and take the first step towards better managing your finances: Get Started with Lessn.

Make Every Payment Work for You with Lessn

Business payments don’t have to be just costs; they can be investments that return value in the form of rewards, saved time, and optimised cash flow.

Lessn redefines business payments, turning each transaction into an opportunity for growth. Whether you’re a small business owner looking to streamline expenses or a finance professional aiming to optimise rewards, Lessn can help you get the most from every dollar.

Ready to start maximising your rewards?

Create an account to streamline your payments and start earning points today. Create a FREE account.